10x Research Warns Of Bearish Setup For Ethereum

As the crypto market holds its breath, a note from 10x Research reignites the debate. Ethereum is now a good candidate for shorting. According to the firm, betting against ETH could provide effective coverage against the institutional rise of bitcoin. This strategic reading shakes up the hierarchy between the two main assets in the sector.

In brief

- The Ethereum ecosystem shows signs of fatigue, notably in the treasury of ETH-oriented companies.

- Bitcoin benefits from a clear institutional narrative, which accentuates the imbalance with Ethereum.

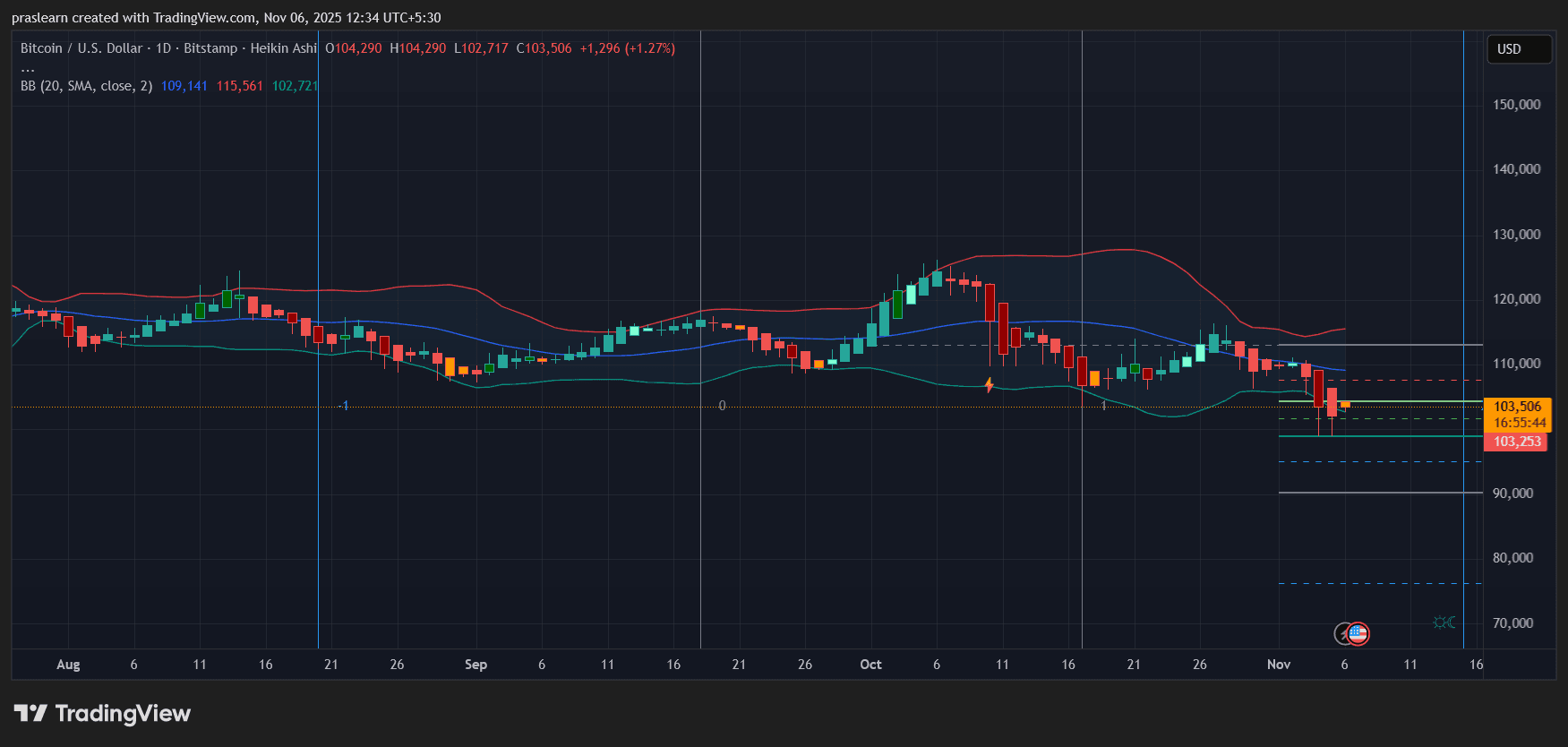

- Technical indicators point towards a bearish trend, with a risk of breaking the $3,000 support.

- A prolonged stagnation or a more pronounced correction of ETH is now conceivable, according to 10x Research’s analysis.

An institutional mechanism at a standstill

In its latest report, the firm 10x Research reveals a worrying shift in the Ethereum ecosystem. While bitcoin continues to absorb most of the institutional flows , Ethereum falls behind, weakened by a treasury mechanism that no longer works.

“While bitcoin continues to attract institutional treasury capital, ETH-oriented companies are starting to run out of ammunition”, claims the firm in a sharp analysis. This loss of momentum calls into question a model that, until now, had largely helped support the ETH price .

Several factual elements illustrate this break :

- The PIPE model losing momentum : companies like BitMine allowed institutional investors to buy ETH at par (cost price), then resell it with a premium on the retail market, feeding a bullish loop on the price. This mechanism is faltering ;

- Lack of transparency on flows : 10x Research highlights the opacity surrounding capital movements in the Ethereum ecosystem, increasing uncertainty for institutional players ;

- Concentration of holdings : according to the data mentioned, 15 companies hold 4.7 million ETH , with BitMine alone holding 3.3 million ETH. This concentration raises the question of potential vulnerability if a disengagement occurs ;

- The imbalance compared to bitcoin : by comparison, BTC benefits from a clear narrative, reinforced by its function as a store of value, which mechanically attracts more institutional capital.

All these factors converge to the same observation: the institutional dynamic that previously supported Ethereum is now running out of steam, which could pave the way for strategic readjustments in the market.

Bearish technical signals that worsen the context

Beyond these weakened institutional dynamics, 10x Research identifies several technical indicators suggesting a marked correction in the asset’s price.

“The weekly stochastic clearly flashes in overbought territory”, warns the report. Analysts also note that a false bullish breakout has formed, similar to the false breakdown observed last March, which could indicate a resumption of the bearish trend if the $3,000 support were to break. In this scenario, a return to $2,700 would be conceivable in the short term.

This technical reading comes in a climate of overall market fragility, notably after the crash of October 10 , which led to the liquidation of $19 billion worth of crypto positions, a historical record. Since then, demand for ETH spot ETFs in the United States has significantly cooled, an indicator of dwindling institutional appetite for Ethereum.

This combination of technical signals and macroeconomic pressure fuels the thesis of a prolonged decline, or at least a worrying stagnation, at a time when bitcoin appears to be consolidating its dominant position.

If institutions begin to permanently turn away from Ethereum, it is the very perception of ETH as a foundational Web3 asset that could be questioned. However, Tom Lee, president of BitMine, continues to anticipate a price of $10,000 for ETH by the end of this year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s new problem: it’s not leverage, it’s long-term holders cashing out

Bitcoin in Trouble? November Could Decide BTC’s Next Big Move

MegaETH announces token sale allocation strategy

Different allocation strategies for existing community members and long-term investors.

ADP employment data exceeds expectations, so why is the market falling instead of rising?