Most people still struggle to understand why blockchain matters — and more importantly, why one blockchain can be better than another. Let’s unpack it simply, using logic, not hype.

⚙️ The Internet Analogy: Why Compatibility Matters

Think of blockchains like computer operating systems.

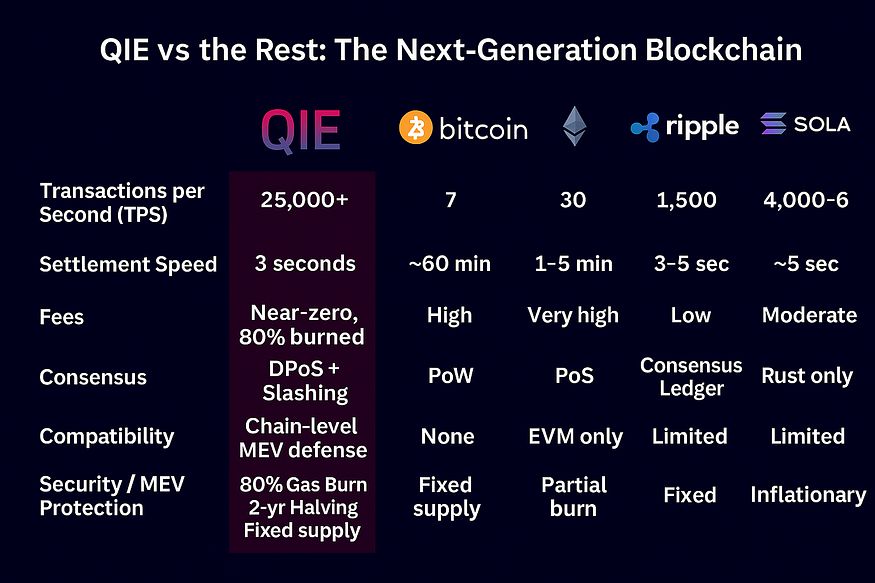

Bitcoin was like the first calculator — great at one thing: moving money. Ethereum came later, like Windows, allowing apps (smart contracts) to run on top. But just like Windows only runs certain programs, Ethereum only speaks one “language”: the EVM (Ethereum Virtual Machine).

QIE, on the other hand, is multilingual.

It’s both EVM-compatible (enabling every Ethereum app to run seamlessly) and Cosmos-compatible (facilitating cross-chain communication with hundreds of other blockchains).

It’s like owning a laptop that runs both Windows and macOS at the same time — no limits, no walls, no translation problems.

🔥 80% Gas Fee Burn: The Opposite of Inflation

In most countries, people experience a decline in purchasing power every year due to central banks printing more money. More money in circulation = each unit is worth less.

Blockchains face the same risk. Many keep adding tokens into circulation endlessly — just like printing money.

QIE does the opposite.

Every time you make a transaction, 80% of the gas fees are burned forever. That means the total supply continues to shrink, not expand. Over time, this creates scarcity — the opposite of inflation.

For users in emerging markets where national currencies lose 10–20% of value yearly, a deflationary crypto like QIE isn’t just innovation — it’s protection. QIE also has a fixed supply of 150 million QIE coins that will ever be created with a halving every 2 years.

⚔️ Slashing: Accountability in a Decentralized World

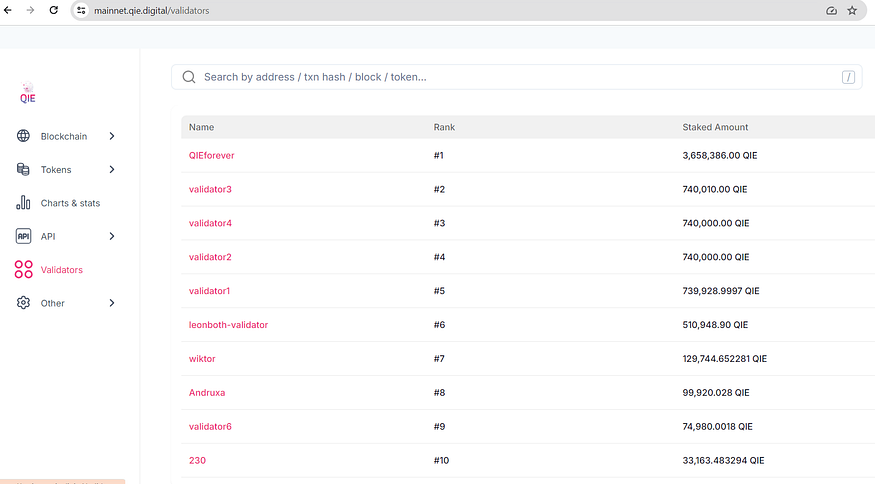

Most blockchains claim to be “secure,” but few hold bad actors accountable. QIE utilizes a Delegated Proof of Stake (DPoS) system with slashing, meaning that validators who cheat, double-sign, or go offline will lose a portion of their staked tokens.

It’s like having a referee in every match — if you break the rules, you pay.

This ensures validators always act honestly, protecting users and investors alike.

🧠 MEV Protection: The Hidden Danger Nobody Talks About

In DeFi, there’s a quiet threat called MEV (Maximal Extractable Value) — where bots and insiders reorder transactions for profit before yours goes through. It’s like someone cutting in line at the supermarket after seeing your shopping list.

Get QIE Blockchain Ecosystem’s stories in your inbox

Most blockchains don’t talk about it.

QIE tackles it at the chain level, embedding MEV protection directly into its consensus — not as an afterthought. That means no front-running, no hidden fees, and no unfair advantage.

🌐 Free Oracles — No Double Crypto Tax

DeFi apps require data from the real world — including prices, weather, sports scores, and stock values. That’s where Oracles like Chainlink come in. But on most networks, you must pay in two different tokens: the network fee and the oracle token fee.

QIE flips that model.

It provides free oracles directly from its infrastructure — no separate token, no dual payment, no friction. Builders can access real-world data without incurring any additional costs.

⚡ Why QIE Is Different

-

25,000 transactions per second

-

3-second settlements

-

EVM + Cosmos compatibility

-

Deflationary design (80% burn + fixed supply)

-

Slashing for validator honesty

-

Chain-level MEV protection

-

Free Oracles for builders

QIE isn’t just another blockchain — it’s the global decentralized operating system the Web3 world needs.

Fast. Secure. Deflationary. Fair.

Everything modern finance should be — but never was.

www.qie.digital