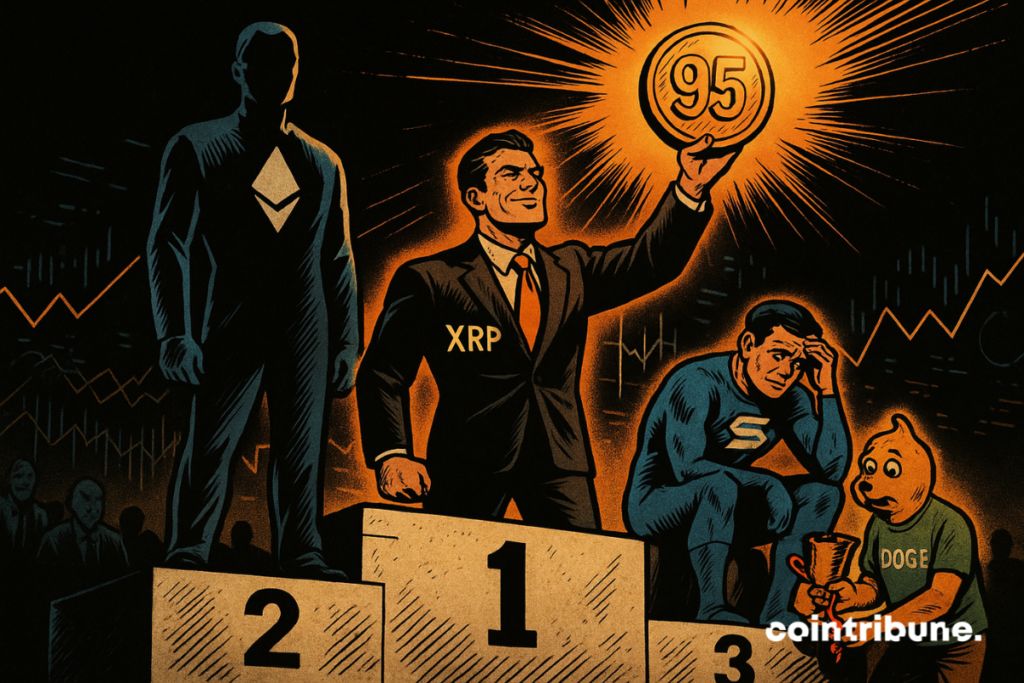

Crypto: Kaiko ranks XRP above Solana and Dogecoin in 2025

The crypto XRP climbs to 2nd place in the Kaiko ranking, alongside Ethereum. Liquidity, institutional adoption, and market depth make the difference. Solana and Dogecoin fall back, XRP stands out. Details below!

In brief

- Crypto XRP reaches 2nd place in the Kaiko ranking thanks to exceptional institutional performance.

- Solana and Dogecoin fall, penalized by lower liquidity and market depth.

Kaiko crowns XRP: a performance on par with crypto leaders

XRP joins Ethereum on the second step of the podium in the Q3 2025 ranking published by Kaiko. Known for its market indicators, the analysis firm awards Ripple’s crypto asset an overall score of 95/100 as well as an AA rating. This score places it just behind Bitcoin, while ahead of all other altcoins.

This jump is explained by a series of maximum performances in strategic areas:

- liquidity;

- market depth;

- availability on exchanges;

- institutional adoption.

XRP also shows a record level on derivative products. This proves its maturity in the crypto market.

That is not all! Kaiko also highlights that XRP shows price stability and exchange infrastructure comparable to those of BTC and ETH. This recognition validates its growing role as a full-fledged institutional asset.

Dogecoin, Solana, and Stellar distanced: reasons for the drop

Often cited among the most followed altcoins, Solana and Dogecoin lose ground in this new hierarchy. Certainly, their presence on crypto platforms remains strong. However, their liquidity, market maturity, and depth indicators do not match those of XRP.

For its part, Stellar holds a B rating. Historically associated with XRP by origin, this digital asset is distanced in almost all categories (except its availability on crypto exchanges).

This repositioning marks a turning point. The Kaiko ranking indeed puts infrastructure quality back at the center of priorities. In other words, speculation is no longer enough. To convince, a crypto asset must demonstrate structural solidity, integration in derivatives markets, and adoption by professional investors.

In any case, XRP gains ground not by announcement effect, but by operational robustness. This signal sent to investors could redistribute institutional flows in the coming months. It remains to be seen if this momentum will hold against a market always eager to reward novelty.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A $500 billion valuation giant is emerging

With a valuation comparable to OpenAI and surpassing SpaceX and ByteDance, Tether has attracted significant attention.

Prediction markets meet Tinder: Can you place bets on Warden's new product by simply swiping left or right?

No need for chart analysis, macro research, or even inputting the amount of funds.

Why does bitcoin only rise when the U.S. government reopens?

The US government shutdown has entered its 36th day, leading to a decline in global financial markets. The shutdown has prevented funds from being released from the Treasury General Account (TGA), draining market liquidity and triggering a liquidity crisis. Interbank lending rates have soared, while default rates on commercial real estate and auto loans have risen, increasing systemic risk. The market is divided over future trends: pessimists believe the liquidity shock will persist, while optimists expect a liquidity release after the shutdown ends. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model is updated.

Jensen Huang predicts: China will surpass the United States in the AI race

Nvidia CEO Jensen Huang stated bluntly that, thanks to advantages in electricity prices and regulation, China will win the AI race. He added that overly cautious and conservative regulation in Western countries such as the UK and the US will "hold them back."