Arthur Hayes Dissects Debt, Buybacks, and Money Printing: The Ultimate Cycle of Dollar Liquidity

If the Federal Reserve's balance sheet increases, it will be positive for US dollar liquidity, ultimately driving up the prices of bitcoin and other cryptocurrencies.

Original Title: Hallelujah

Original Author: Arthur Hayes, BitMEX Co-founder

Original Translation: BitpushNews

Introduction: Political Incentives and the Inevitability of Debt

Praise Satoshi Nakamoto, the existence of time and the law of compound interest, independent of individual identity.

Even for governments, there are only two ways to pay expenses: using savings (taxes) or issuing debt. For governments, savings are equivalent to taxes. It is well known that taxes are unpopular with the public, but spending money is well-liked. Therefore, when distributing benefits to civilians and nobles, politicians prefer to issue debt. Politicians always tend to borrow from the future to ensure re-election in the present, because when the bill comes due, they are likely no longer in office.

If, due to officials' incentive mechanisms, all governments are "hard-coded" to prefer issuing debt over raising taxes to distribute benefits, then the next key question is: how do buyers of US Treasury bonds finance these purchases? Do they use their own savings/equity, or do they finance through borrowing?

Answering these questions, especially in the context of "Pax Americana," is crucial for us to predict the future creation of US dollars. If the marginal buyers of US Treasuries are making purchases through financing, then we can observe who is providing loans to them. Once we know the identities of these debt financiers, we can determine whether they are creating money out of thin air (ex nihilo) to lend, or using their own equity to make loans. If, after answering all these questions, we find that the financiers of Treasuries are creating money in the lending process, then we can draw the following conclusion:

Government-issued debt will increase the money supply.

If this assertion holds, then we can estimate the upper limit of credit that financiers can issue (assuming there is an upper limit).

These questions are important because my argument is: if government borrowing continues to grow as predicted by TBTF Banks, the US Treasury, and the Congressional Budget Office, then the Federal Reserve's balance sheet will also grow. If the Fed's balance sheet grows, that is bullish for US dollar liquidity, which will ultimately push up the price of bitcoin and other cryptocurrencies.

Next, we will answer the questions one by one and evaluate this logical puzzle.

Q&A Section

Will US President Trump finance the deficit through tax cuts?

No. He and the "red camp" Republicans have recently extended the 2017 tax cuts.

Is the US Treasury borrowing money to cover the federal deficit, and will it continue to do so in the future?

Yes.

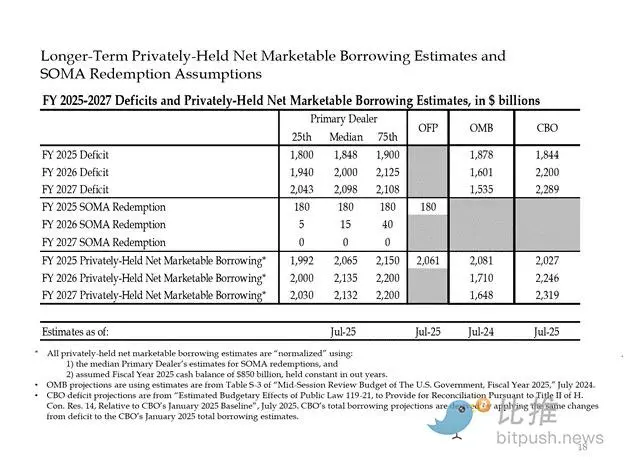

Below are estimates from major bankers and US government agencies. As seen, they predict a deficit of about 2 trillion dollars, financed by 2 trillion dollars in borrowing.

Given that the answers to the first two questions are both "yes," then:

Annual federal deficit = Annual Treasury issuance

Next, we will analyze the main buyers of Treasuries and how they finance their purchases step by step.

The "Trash" That Swallows Debt

Foreign Central Banks

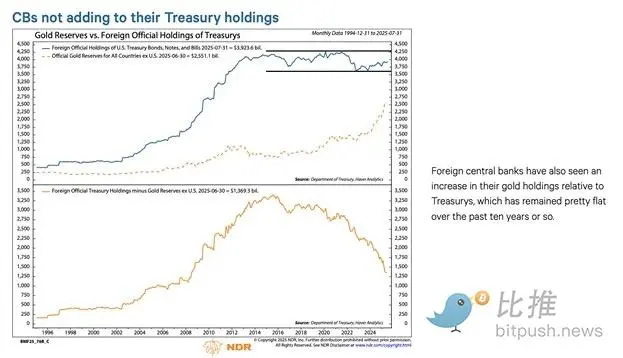

If "Pax Americana" is willing to seize the funds of Russia (a nuclear power and the world's largest commodity exporter), then any foreign holder of US Treasuries cannot be assured of safety. Foreign central bank reserve managers realize the risk of expropriation, and they would rather buy gold than US Treasuries. Therefore, since Russia invaded Ukraine in February 2022, the price of gold has truly soared.

2. US Private Sector

According to the US Bureau of Labor Statistics, the personal savings rate in 2024 is 4.6%. In the same year, the US federal deficit accounts for 6% of GDP. Given that the deficit is larger than the savings rate, the private sector cannot be the marginal buyer of Treasuries.

3. Commercial Banks

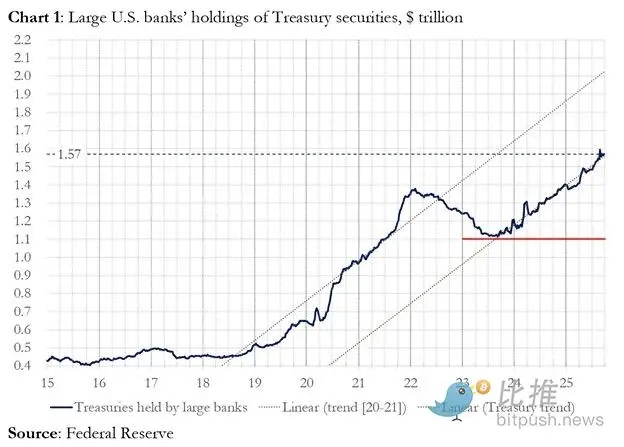

Are the four major currency center commercial banks buying large amounts of Treasuries? The answer is no.

In fiscal year 2025, these four major currency center banks purchased about 300 billion dollars worth of Treasuries. In the same fiscal year, the Treasury issued 1.992 trillion dollars in Treasuries. While these buyers are undoubtedly important, they are not the ultimate marginal buyers.

4. Relative Value (RV) Hedge Funds

RV funds are the marginal buyers of Treasuries, as acknowledged in a recent Federal Reserve document.

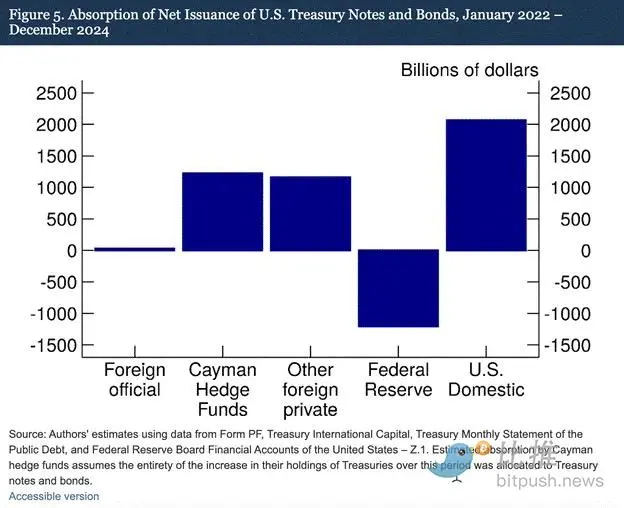

Our findings indicate that Cayman Islands hedge funds are increasingly becoming the marginal foreign buyers of US Treasuries and bonds. As shown in Figure 5, from January 2022 to December 2024—a period during which the Fed reduced its balance sheet by allowing maturing Treasuries to roll off its portfolio—Cayman Islands hedge funds made net purchases of 1.2 trillion dollars in Treasuries. Assuming these purchases were all Treasuries and bonds, they absorbed 37% of the net issuance, almost equal to the total purchases of all other foreign investors combined.

RV fund trading pattern:

- · Buy spot Treasuries

- · Sell corresponding Treasury futures contracts

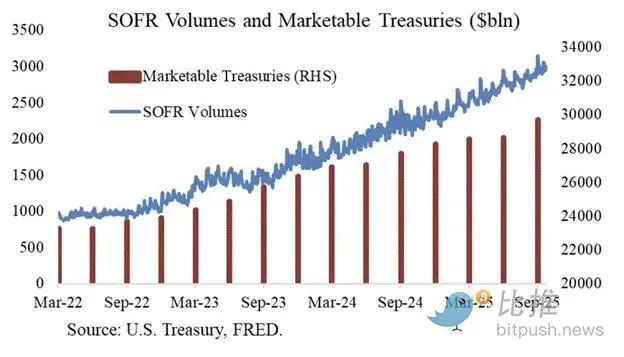

Thanks to Joseph Wang for the chart. SOFR trading volume is a proxy for the scale of RV fund participation in the Treasury market. As you can see, the growth in debt burden corresponds to the growth in SOFR trading volume. This indicates that RV funds are the marginal buyers of Treasuries.

RV funds engage in this trade to earn the tiny spread between the two instruments. Since this spread is very small (measured in basis points; 1 basis point = 0.01%), the only way to make money is to finance the purchase of Treasuries.

This leads us to the most important part of this article: understanding the Fed's next move—how do RV funds finance their Treasury purchases?

Part Four: Repo Market, Stealth QE, and Dollar Creation

RV funds finance their Treasury purchases through repurchase agreements (repo). In a seamless transaction, RV funds use the purchased Treasury securities as collateral, borrow overnight cash, and then use the borrowed cash to settle the Treasury purchase. If cash is abundant, repo rates will trade at or just below the Fed's upper bound for the federal funds rate. Why?

How the Fed Manipulates Short-Term Rates

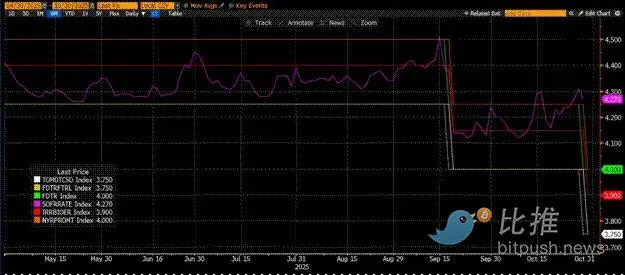

The Fed has two policy rates: the upper bound of the federal funds rate (Upper Fed Funds) and the lower bound (Lower Fed Funds); currently 4.00% and 3.75%, respectively. To force the actual short-term rate (SOFR, the Secured Overnight Financing Rate) to stay within this range, the Fed uses the following tools (ordered from lowest to highest rate):

- · Overnight Reverse Repo Facility (RRP): Money Market Funds (MMF) and commercial banks deposit cash here overnight and earn interest paid by the Fed. Reward rate: federal funds rate lower bound.

- · Interest on Reserve Balances (IORB): Commercial banks earn interest on excess reserves held at the Fed. Reward rate: between the upper and lower bounds.

- · Standing Repo Facility (SRF): When cash is tight, allows commercial banks and other financial institutions to pledge eligible securities (mainly Treasuries) and obtain cash from the Fed. Essentially, the Fed prints money in exchange for collateral. Reward rate: federal funds rate upper bound.

The relationship among the three:

Federal funds rate lower bound = RRP < IORB < SRF = Federal funds rate upper bound

SOFR (Secured Overnight Financing Rate) is the Fed's target rate, representing a composite of various repo transactions. If SOFR trades above the upper bound of the federal funds rate, it means cash is tight in the system, which will cause big problems. Once cash is tight, SOFR will soar, and the highly leveraged fiat financial system will stop functioning. This is because if marginal liquidity buyers and sellers cannot roll over their liabilities at a predictable federal funds rate, they will suffer huge losses and stop providing liquidity to the system. No one will buy Treasuries because they cannot get cheap leverage, causing the US government to be unable to finance itself at an affordable cost.

Exit of Marginal Cash Providers

What causes SOFR to trade above the upper bound? We need to look at the marginal cash providers in the repo market: Money Market Funds (MMF) and commercial banks.

- · Exit of Money Market Funds (MMF): MMFs aim to earn short-term interest with minimal credit risk. Previously, MMFs would withdraw funds from the RRP and invest in the repo market because RRP < SOFR. But now, due to the attractive yields on short-term T-bills, MMFs are pulling funds from the RRP and lending to the US government. RRP balances have dropped to zero, and MMFs have basically exited as cash providers in the repo market.

- · Commercial bank constraints: Banks are willing to provide reserves to the repo market because IORB < SOFR. However, banks' ability to provide cash depends on whether their reserves are sufficient. Since the Fed began quantitative tightening (QT) in early 2022, banks' reserves have dropped by trillions of dollars. Once balance sheet capacity shrinks, banks are forced to charge higher rates to provide cash.

Since 2022, both MMFs and banks—the two marginal cash providers—have had less cash to supply to the repo market. At some point, neither is willing or able to provide cash at rates below or equal to the federal funds rate upper bound.

Meanwhile, demand for cash is rising. This is because former President Biden and now Trump continue to spend heavily, requiring more Treasury issuance. The marginal buyers of Treasuries, RV funds, must finance these purchases in the repo market. If they cannot obtain daily funding at or just below the federal funds rate upper bound, they will stop buying Treasuries, and the US government will not be able to finance itself at affordable rates.

Activation of SRF and Stealth Quantitative Easing (Stealth QE)

Because a similar situation occurred in 2019, the Fed established the SRF (Standing Repo Facility). As long as acceptable collateral is provided, the Fed can provide unlimited cash at the SRF rate (i.e., the federal funds rate upper bound). Therefore, RV funds can be confident that no matter how tight cash is, they can always obtain funding at worst at the federal funds rate upper bound.

If the SRF balance is above zero, we know the Fed is using printed money to cash the checks written by politicians.

Treasury issuance = Increase in US dollar supply

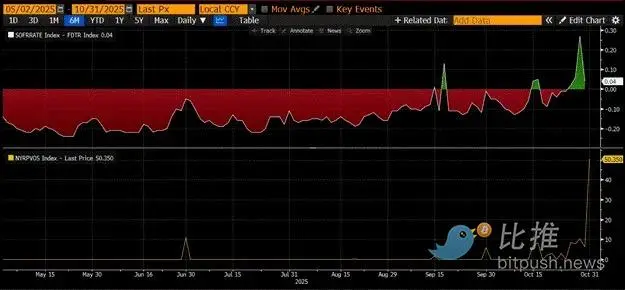

The chart above (top panel) shows the difference between (SOFR – federal funds rate upper bound). When this difference approaches zero or is positive, cash is tight. During these periods, the SRF (bottom panel, in billions of dollars) is used to a non-trivial extent. Using the SRF allows borrowers to avoid paying higher, less manipulated SOFR rates.

Stealth Quantitative Easing (Stealth QE): The Fed has two ways to ensure there is enough cash in the system: the first is to create bank reserves by buying bank securities, i.e., Quantitative Easing (QE). The second is to freely lend to the repo market via the SRF.

QE is now a "dirty word," widely associated by the public with money printing and inflation. To avoid being blamed for causing inflation, the Fed will strive to claim its policy is not QE. This means the SRF will become the main channel for printed money to flow into the global financial system, rather than creating more bank reserves through QE.

This can only buy some time. But eventually, the exponential expansion of Treasury issuance will force repeated use of the SRF. Remember, Treasury Secretary Buffalo Bill Bessent not only needs to issue 2 trillion dollars annually to fund the government, but also needs to issue trillions more to roll over maturing debt.

Stealth QE is about to begin. Although I don't know the exact timing, if current money market conditions persist and Treasuries pile up, the SRF balance as the lender of last resort must grow. As the SRF balance grows, the global supply of fiat US dollars also expands. This phenomenon will reignite the bitcoin bull market.

Part Five: Current Market Stagnation and Opportunity

Before stealth QE begins, we must control capital. The market is expected to remain volatile, especially before the US government shutdown ends.

Currently, the Treasury is borrowing money through debt auctions (negative for US dollar liquidity), but has not yet spent the money (positive for US dollar liquidity). The Treasury General Account (TGA) balance is about 150 billion dollars above the 850 billion dollar target, and this extra liquidity will only be released into the market after the government reopens. This liquidity siphon effect is one of the reasons for the current weakness in the crypto market.

Given that the four-year anniversary of bitcoin's 2021 all-time high is approaching, many will mistakenly interpret this period of market weakness and fatigue as the top and sell their holdings. Of course, that's assuming they weren't "deaded" in the altcoin crash a few weeks ago.

But this is a mistake. The logic of the US dollar money market does not lie. This corner of the market is shrouded in obscure terminology, but once you translate these terms into "printing money" or "destroying money," it's easy to know how to grasp the trend.

Original link

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The "mini nonfarm payrolls" rebound beyond expectations, is the US job market recovering?

US ADP employment in October saw the largest increase since July, with previous figures also revised upward. However, experts caution that the absence of nonfarm payroll data means this figure should be interpreted cautiously.

Microsoft Strikes $9.7B Deal With IREN as AI Demand Surges

XRP ETF: Nate Geraci predicts a launch within two weeks

Sequans Sells 970 Bitcoins, Unsettling the Markets