Don't panic, the market's true main line is still liquidity

Original Author: @RaoulGMI

Translation: Peggy, BlockBeats

Editor's Note: When the market is in panic, liquidity tightens, and asset rotation stagnates, a bullish view often seems out of place. This article presents a contrarian perspective: if global liquidity remains the key macro variable driving everything, then the restart of the debt refinancing cycle may trigger the next round of a "liquidity flood." This is a game of time and patience—a starting point for growth may emerge after the "pain."

The following is the original text:

The Market's Main Plot

I know almost no one wants to hear a bullish view right now.

The market is in panic, and everyone is blaming each other. But the road to Valhalla is not far.

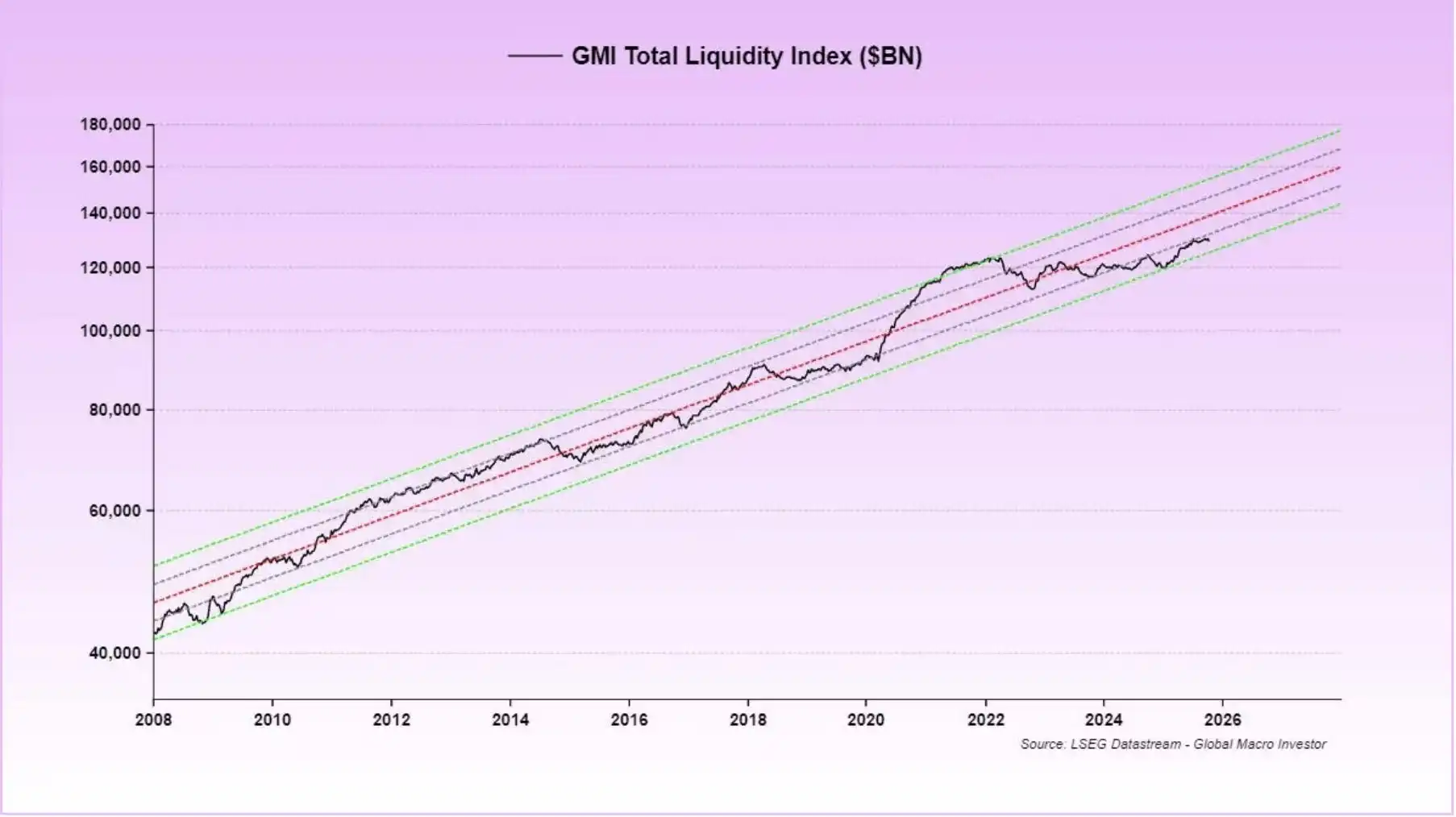

If global liquidity is the most decisive macro factor right now, then it is the only thing we should focus on.

Remember! The true main plot of the market now is the $100 trillion debt rollover. Everything else is a subplot. The game for the next 12 months revolves around this point.

Currently, due to the government shutdown, the Treasury General Account (TGA) is rapidly accumulating cash with nowhere to spend it, causing a sharp liquidity squeeze. This cannot be offset by reverse repos (as that portion of liquidity has already dried up), and quantitative tightening (QT) is further draining liquidity.

This has directly hit the market, especially the most liquidity-sensitive crypto assets.

The performance of traditional asset management institutions this year is generally lagging behind benchmarks, marking the worst performance in recent years. Now they have to passively "buy the dip," which paradoxically makes tech stocks more stable than crypto assets. Inflows from 401K funds have also provided some support.

However, if this liquidity dry-up persists longer, the stock market will also find it hard to escape a downturn.

However, once the government shutdown ends, the U.S. Treasury will disburse $250-350 billion within a few months, and quantitative tightening will stop, nominally expanding the balance sheet again.

With the return of liquidity, the dollar may weaken again.

The tariff negotiations will also come to an end, gradually reducing policy uncertainty.

At the same time, the continuous issuance of treasuries will inject more liquidity into the market through banks, money market funds, and even the stablecoin system.

Next, the interest rate will continue to be lowered. The economic slowdown caused by the shutdown will be used as a reason for the rate cut—but this does not mean an economic recession.

On the regulatory front, the SLR (Supplementary Leverage Ratio) adjustment will release more bank balance sheet space, supporting credit expansion.

The "CLARITY Act" is also expected to pass, providing a much-needed regulatory framework for banks, asset management firms, and businesses to adopt encrypted assets on a large scale.

Meanwhile, the "Big Beautiful Bill" will further boost the economy, setting the stage for strong growth leading up to the 2026 midterm elections.

The entire system is restructuring towards one goal: a robust economy and thriving market in 2026.

Meanwhile, China will continue to expand its balance sheet, Japan will work to support the yen and introduce fiscal stimulus.

With interest rates falling and tariff uncertainty dissipating, U.S. manufacturing activity (ISM index) will also rebound.

So, the key now is to weather this "Window of Pain."

At the other end of it is a "Liquidity Flood."

Always remember that old rule: Don't mess it up.

Be patient, endure the volatility.

Such pullbacks are not uncommon in a bull market, and their purpose is to test your conviction.

If you have the capacity, take advantage of the dip.

TD;DR (Too Delighted; Didn't Rejoice)

When this number (liquidity index) rises, all other numbers will rise with it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

As treasury companies start selling coins, has the DAT boom reached a turning point?

From getting rich by holding coins to selling coins to repair watches, the capital market is no longer unconditionally rewarding the narrative of simply holding tokens.

Bitcoin Falls Below the 100,000 Mark: Turning Point Between Bull and Bear Markets?

Liquidity is the key factor influencing the current performance of the crypto market.

The "mini nonfarm payrolls" rebound beyond expectations, is the US job market recovering?

US ADP employment in October saw the largest increase since July, with previous figures also revised upward. However, experts caution that the absence of nonfarm payroll data means this figure should be interpreted cautiously.

Microsoft Strikes $9.7B Deal With IREN as AI Demand Surges