- Bitcoin struggles below key EMAs, signaling sellers maintain control across major timeframes.

- High futures open interest shows cautious trader optimism despite bearish market pressure.

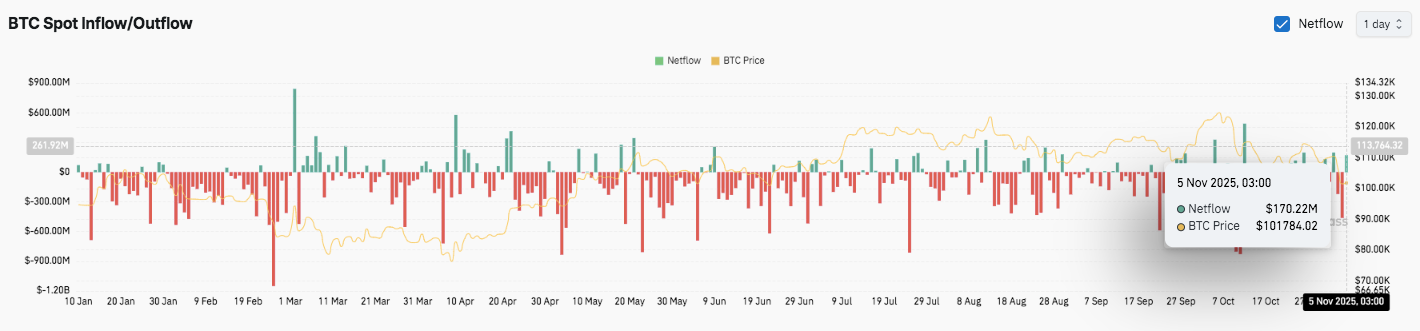

- Recent $170M inflows suggest early accumulation after October’s sharp BTC correction.

Bitcoin (BTC) is trading near $101,839 after retreating from the $102,000 level, reflecting persistent bearish sentiment in the market. Despite occasional rebounds, the broader structure shows sellers maintaining control across major timeframes. The asset’s 4-hour chart reveals continued weakness below key moving averages, signaling limited momentum for recovery.

Market Structure Shows Continued Pressure

Bitcoin remains under the 20, 50, 100, and 200-exponential moving averages, confirming a prevailing downtrend. The Supertrend indicator reinforces this bias, showing that recent recovery attempts have failed near resistance zones. The price now trades just above the critical $101,000–$100,000 support band, a region where buyers historically stepped in to defend against deeper declines.

BTC Price Dynamics (Source: TradingView)

BTC Price Dynamics (Source: TradingView)

Additionally, traders are closely watching the Fibonacci retracement zones drawn from the $126,383 high to the $103,634 low. The 38.2% level near $110,324 represents the first significant resistance, followed by the 50% retracement at $115,008 aligned with the 100-EMA.

These overlapping resistances create a technical ceiling that must be cleared for bullish momentum to reemerge. Further upside barriers appear around $117,692 and $121,514.

Derivatives Market Reflects Risk Appetite

Bitcoin’s futures open interest has remained notably high despite recent volatility. As of November 5, 2025, the metric stood at $67.36 billion, while the spot price hovered near $101,428.

Source: Coinglass

Source: Coinglass

This persistence suggests that traders maintain substantial exposure, signaling cautious optimism in the derivatives market. The steady rise in open interest since September indicates sustained participation from both retail and institutional investors.

However, elevated leverage levels raise concerns about potential liquidation cascades. Any sharp downturn below the $100,000 psychological floor could trigger aggressive long liquidations, amplifying volatility. Consequently, maintaining price stability above this zone remains essential for short-term sentiment recovery.

Inflows Signal Renewed Accumulation

Source: Coinglass

Source: Coinglass

Recent inflow data indicates early signs of investor re-engagement. Around November 5, exchanges recorded approximately $170 million in net inflows after several weeks of dominant outflows.

This pattern hints at possible bargain accumulation following the sharp correction from October highs. Persistent outflows earlier in the quarter suggested caution, as traders moved assets off exchanges amid uncertainty.

Technical Outlook for Bitcoin Price

Key levels remain tightly defined as Bitcoin trades near $101,800. Upside resistance sits at $105,000, $107,800, and $110,324, with a breakout potentially extending toward $115,008 and $117,692. These resistance levels align with the 100-EMA and Fibonacci retracements, forming a significant supply cluster.

On the downside, support rests at $101,000 and the psychological $100,000 level, followed by deeper cushions near $98,000 and $96,500. The 4-hour chart shows price movement below all major EMAs, signaling persistent bearish pressure. The Supertrend indicator continues to flash a sell signal, emphasizing a market still dominated by short positions.

The overall structure suggests Bitcoin is consolidating within a tightening range after a steep correction. A decisive break above $107,800 would mark the first sign of a trend reversal, while losing $100,000 could accelerate downside momentum.

Will Bitcoin Reclaim Momentum?

Bitcoin’s price trajectory hinges on whether bulls can defend the $100,000 support and push above the $107,000–$110,000 resistance cluster. Sustained inflows and strong open interest above $67 billion hint at investor confidence, but high leverage makes the market vulnerable to volatility.

If buying pressure strengthens near the current zone, Bitcoin could recover toward $115,000 and possibly $121,000 in the coming sessions. However, failure to hold $100,000 may open the door to further losses toward $96,500. For now, BTC remains in a pivotal phase stability above key support levels will determine whether a new leg higher can develop.