XRP Profits Fall To November 2024 Low But New Investors Attempt To Revive Price

XRP’s profitability has sunk to a yearly low, yet growing participation from new investors may help stabilize prices and set the stage for a potential rebound if key support holds.

XRP continues to struggle under growing bearish pressure, as its price action remains subdued following a prolonged downtrend. The altcoin has fallen 10% in recent days, with traders showing caution amid broader market volatility.

Yet, despite the weakness, new investors appear to be stepping in, signaling potential optimism ahead.

XRP Investors Show Mixed Signals

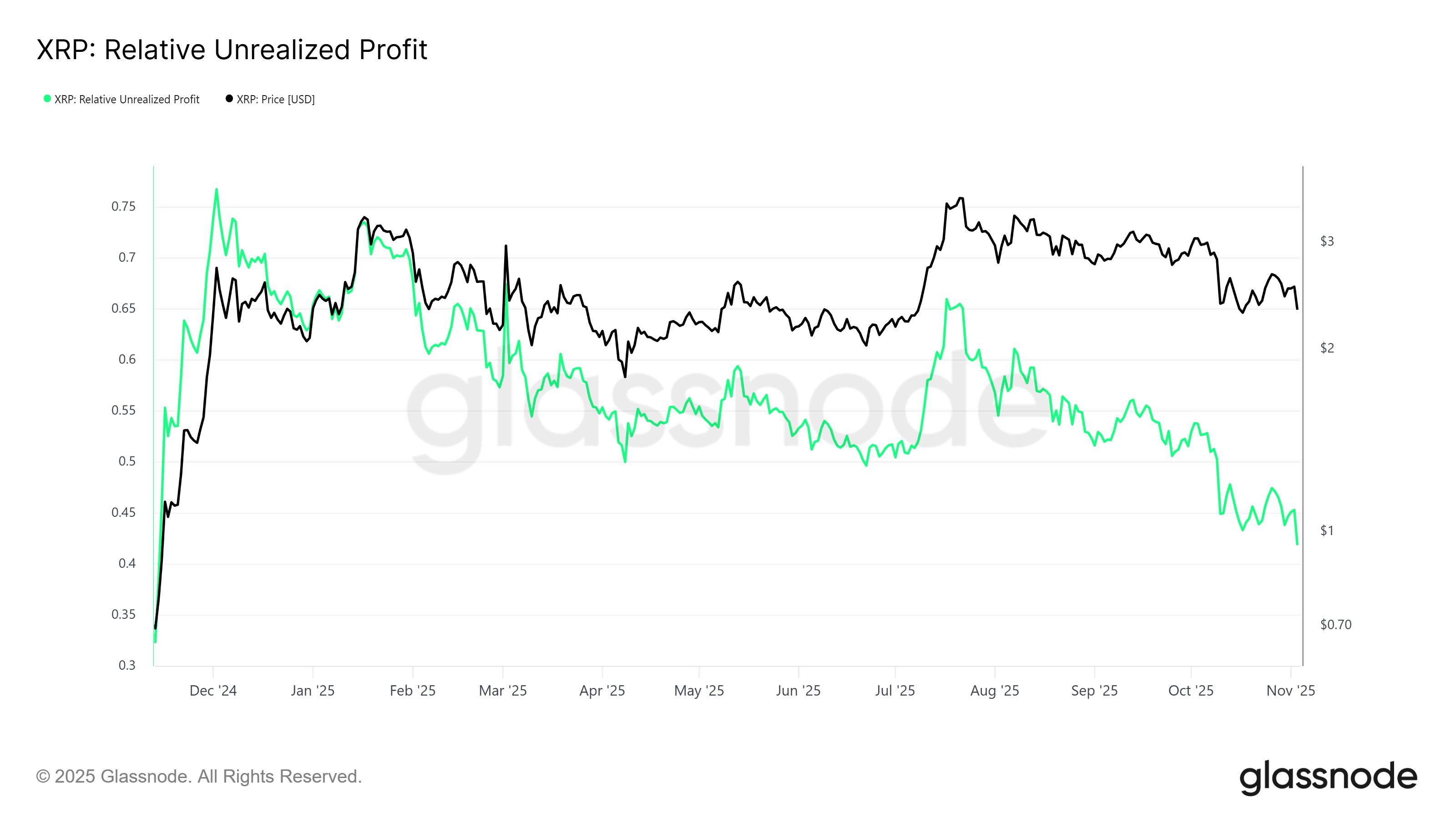

Unrealized profits for XRP holders have dropped to a 12-month low, reflecting a worrying trend across the asset’s investor base. Unrealized profits refer to paper gains based on the asset’s purchase price rather than actual sales. The decline suggests that most investors are now holding XRP either at a loss or with minimal gains.

This indicator’s sharp drop often sparks panic selling, particularly when confidence in the market weakens. If long-term holders begin liquidating positions to avoid deeper losses, XRP could face added downward pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Unrealized Profit. Source:

Glassnode

XRP Unrealized Profit. Source:

Glassnode

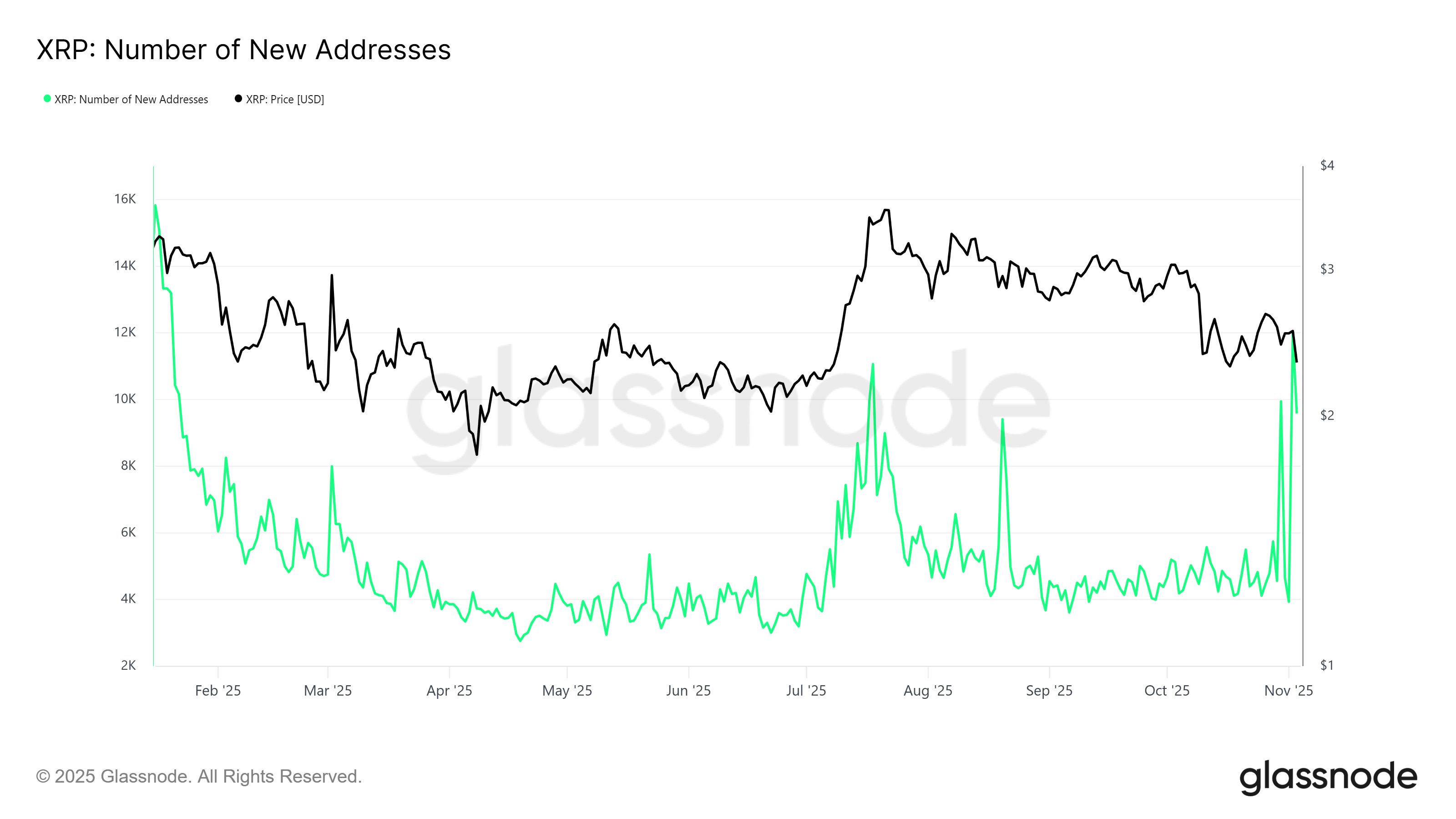

Amid the bearish outlook, an interesting trend is emerging — a surge in new addresses accumulating XRP. The lower price appears to be attracting new investors who see current levels as an opportunity to enter the market before a potential recovery. These fresh inflows could help stabilize selling pressure in the near term.

New investors, reaching 12,000 at their peak, also inject liquidity into the ecosystem, creating demand that may offset profit-taking from older holders. Historically, periods of low profitability followed by an influx of new participants have often preceded rebounds in XRP’s price.

XRP New Addresses. Source:

Glassnode

XRP New Addresses. Source:

Glassnode

XRP Price Could Bounce Back

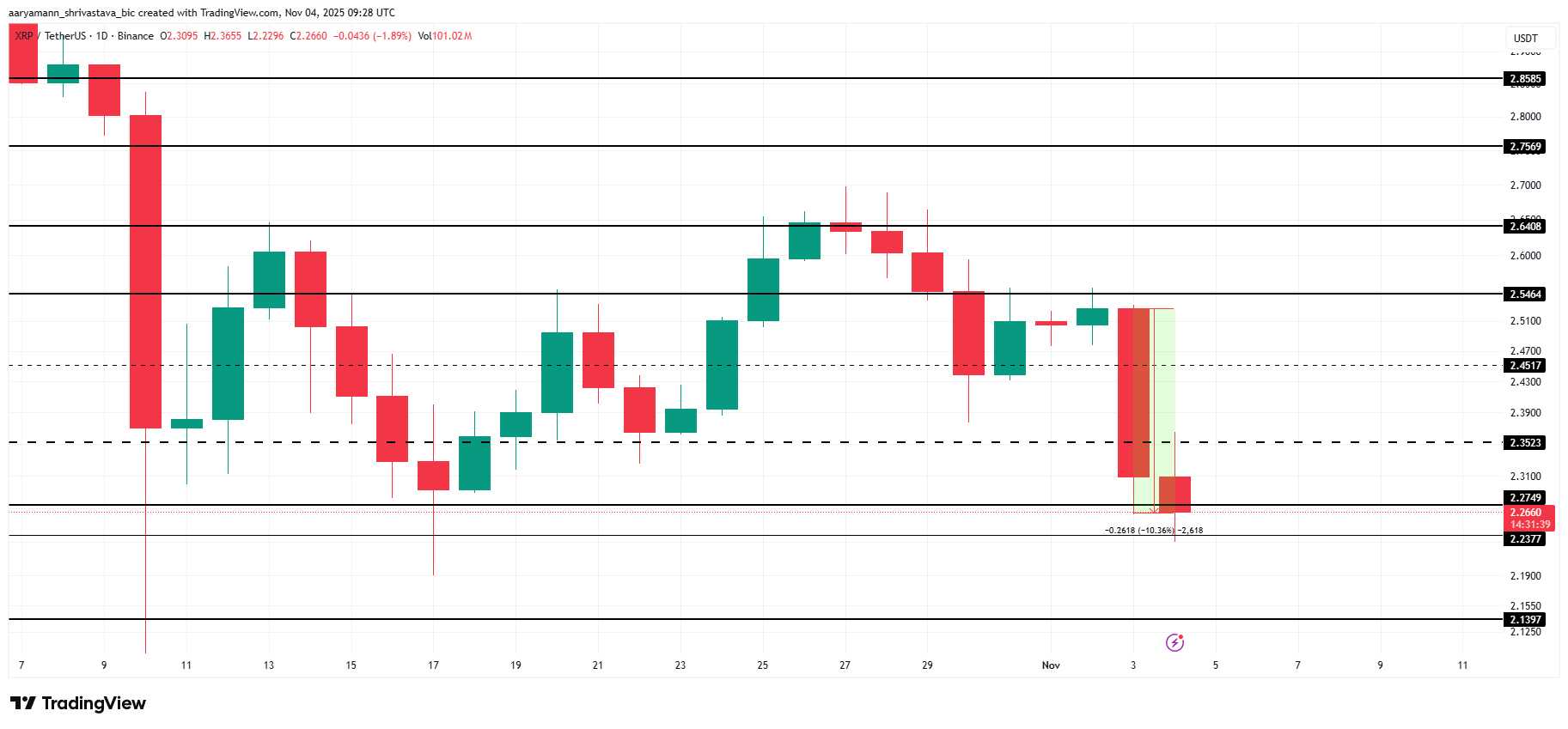

At the time of writing, XRP trades at $2.26, down 10% over the past 24 hours. The altcoin continues to face resistance amid broader bearish market sentiment. However, strong support remains near the $2.27 mark, offering hope for a potential recovery.

If XRP maintains this key support level, it may move sideways in the short term, with possible rebounds to $2.35 or $2.45 as buyers regain confidence. This consolidation could set the stage for a stronger move upward later in November.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if selling pressure intensifies, XRP could fall below $2.27, slipping through $2.23 and hitting $2.13. Such a drop would invalidate the bullish scenario and confirm a deeper corrective phase.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Galaxy Research Report: What Is Driving the Surge in Zcash, the Doomsday Vehicle?

Regardless of whether ZEC's strong price momentum can be sustained, this market rotation has already succeeded in forcing the market to reassess the value of privacy.

Soros predicts an AI bubble: We live in a self-fulfilling market

When the market starts to "speak": an earnings report experiment and a trillion-dollar AI prophecy.

Soros predicts an AI bubble: We live in a self-fulfilling market

The article uses Brian Armstrong's behavior during the Coinbase earnings call to vividly illustrate George Soros' "reflexivity theory," which posits that market prices can influence the actual value of assets. The article further explores how financial markets actively shape reality, using examples such as the corporate conglomerate boom, the 2008 financial crisis, and the current artificial intelligence bubble to explain the workings of feedback loops and their potential risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

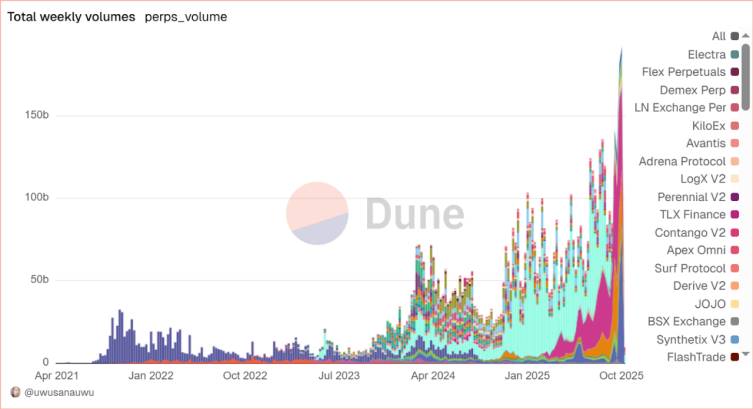

In-depth Research Report on Perp DEX: Comprehensive Upgrade from Technological Breakthroughs to Ecosystem Competition

The Perp DEX sector has successfully passed the technology validation period and entered a new phase of ecosystem and model competition.