Bitcoin Breakdown Begins — On-Chain Signals Say “Brace for $104K”

Bitcoin's price weakness increases the odds of a $104K retest, Glassnode reports. Top buyers are capitulating after the price failed to reclaim their average cost basis since July.

Bitcoin’s price showed renewed weakness, dipping nearly 4% on Monday. According to a detailed on-chain analysis, this raises the possibility of a test of the crucial $104,000 support level.

On-chain data platform Glassnode posted the analysis on X on Tuesday, observing a persistent failure in upward momentum. The firm pointed out, “Since July, BTC has consistently failed to reclaim the cost basis of the top buyers’ supply.”

Key Support and Resistance Levels

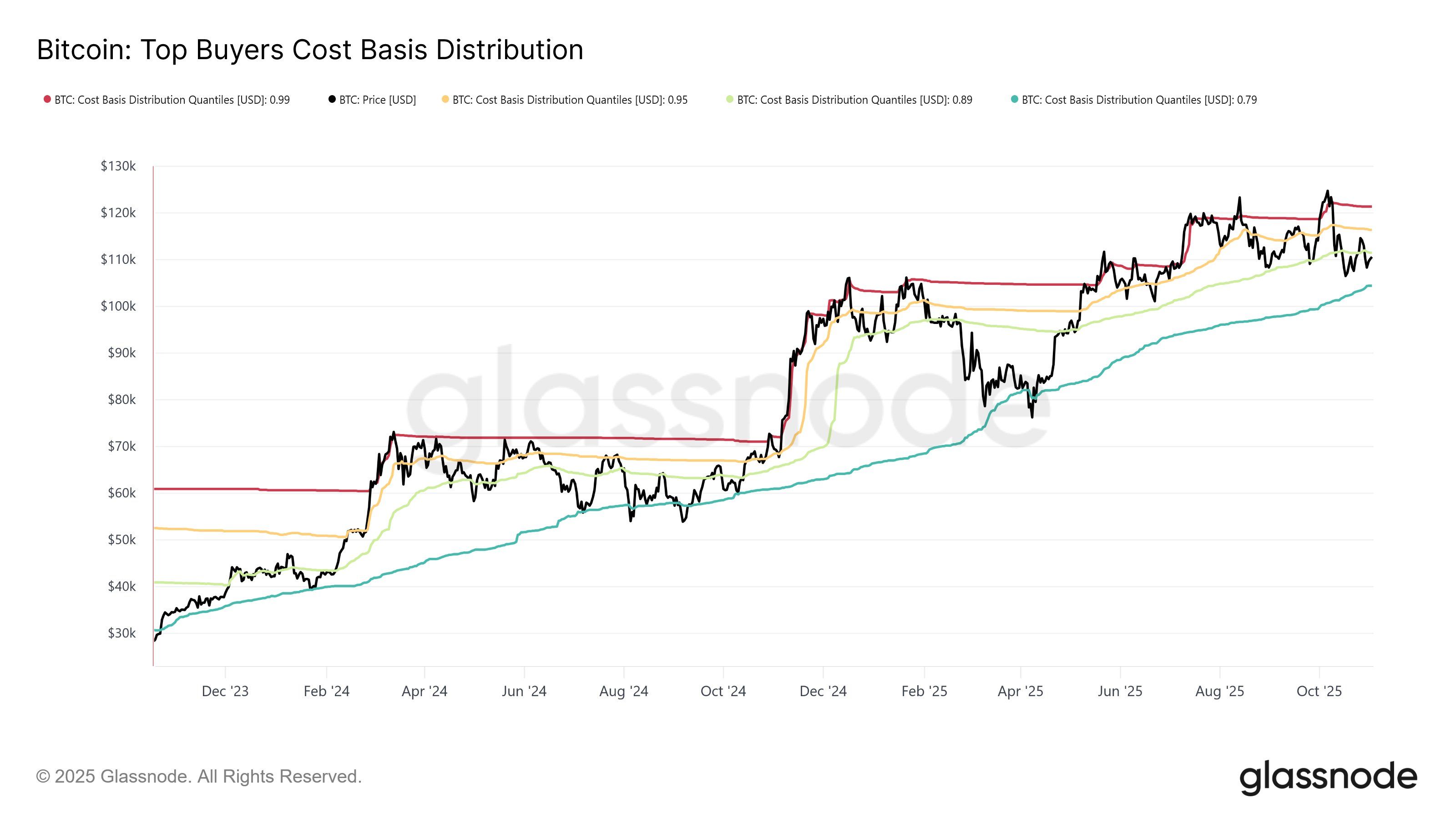

The analysis utilizes the “Top Buyers Cost Basis Distribution” metric. This metric maps Bitcoin’s price against the average acquisition price (Cost Basis) for different cohorts of the market’s most recent and highest-price purchasers.

Top Buyers Cost Basis Distribution. Source: Glassnode

Top Buyers Cost Basis Distribution. Source: Glassnode

The metric defines several key cost basis quantiles:

- 0.99 Quantile (Red): This represents the average purchase price of the most recent, highest-priced buyers. It is considered the cost basis for the latest entrants.

- 0.95 Quantile (Yellow): The average cost basis for the top 5% of recent buyers.

- 0.89 Quantile (Green): The average cost basis for the top 11% of recent buyers.

- 0.79 Quantile (Mint): The average cost basis for the top 21% of recent buyers, often viewed as the general ‘recent buyer average cost.’

These lines act as significant support and resistance levels. When the price falls below a line, the corresponding buyer group enters an Unrealized Loss state, increasing the potential for sell pressure and capitulation.

Momentum Shifts Post-October Crash

Glassnode noted that the price movement confirms a gradual decrease in upward momentum since July. The BTC price hit a new all-time high on August 14. Following this, the market successfully held the green line (0.89 Quantile) as support for nearly two months during the ensuing correction.

However, a deeper correction that pierced the green line followed the rally to a subsequent all-time high in early October. The 0.89 Quantile, now near $111,000, has flipped from support to resistance. This shift was confirmed when Bitcoin failed to hold the level after a small surge to $110,800 on Monday, 0:00 UTC.

This structural weakening leads to a bearish projection. Glassnode warned, “This increases the odds of a retest of the 0.8-quantile cost basis (~$104K) as top buyers capitulate, transferring coins to stronger hands.”

Around 09:30 UTC, Bitcoin briefly dipped below the $104,000 level before recovering, signaling yet another test of key support.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

As treasury companies start selling coins, has the DAT boom reached a turning point?

From getting rich by holding coins to selling coins to repair watches, the capital market is no longer unconditionally rewarding the narrative of simply holding tokens.

Bitcoin Falls Below the 100,000 Mark: Turning Point Between Bull and Bear Markets?

Liquidity is the key factor influencing the current performance of the crypto market.

The "mini nonfarm payrolls" rebound beyond expectations, is the US job market recovering?

US ADP employment in October saw the largest increase since July, with previous figures also revised upward. However, experts caution that the absence of nonfarm payroll data means this figure should be interpreted cautiously.

Microsoft Strikes $9.7B Deal With IREN as AI Demand Surges