Bitget Addresses Altcoin Liquidity Shortage by Offering Interest-Free Loans

- Bitget launches zero-interest loans for altcoin market makers to boost liquidity in smaller digital assets, effective November 2025–January 2026. - Qualified institutions can borrow up to 2M USDT with 50% reduced trading-volume requirements, targeting professional firms and new clients. - The program addresses fragmented altcoin markets by lowering entry barriers, enabling efficient capital deployment for stable, accessible trading conditions. - Aligning with performance-linked financing trends, Bitget e

Bitget, recognized as the leading Universal Exchange (UEX) worldwide, has introduced an Institutional Financing Program that provides interest-free loans to altcoin market makers, with the goal of boosting liquidity for up-and-coming digital assets. Announced on November 4, 2025, this program enables eligible institutional participants to access up to 2 million USDT without interest, provided they achieve just half of the typical trading volume required by Bitget’s regular financing scheme. Running until January 31, 2026, the initiative is designed for established market-making companies and new institutional clients, making it easier to participate and enhancing capital utilization to help stabilize smaller and less liquid markets.

This initiative tackles a significant issue in the crypto sector: inconsistent market depth and unpredictable spreads in altcoin trading. In contrast to major cryptocurrencies like BTC and ETH, tokens with smaller market capitalizations often face liquidity shortages, posing challenges for market makers. By lowering the trading volume requirement to 50% of the standard threshold, Bitget gives firms the opportunity to obtain zero-interest funding, which the platform believes will contribute to more reliable and accessible altcoin markets.

Bitget CEO Gracy Chen highlighted the vital role of liquidity in smaller-cap tokens for the overall health of the crypto market. “By making it easier for professional market makers to join, we’re giving them the flexibility to manage capital effectively and, in turn, making altcoin trading more stable and accessible for everyone,” she explained. This approach reflects a wider industry movement away from fixed fee structures toward performance-based financing models tailored for liquidity providers.

This development is part of Bitget’s broader efforts to grow its UEX ecosystem, which brings together cryptocurrencies, tokenized equities, and on-chain assets within a single platform. The exchange has also rolled out zero-commission trading for U.S. stock tokens during earnings periods, further strengthening its position as a link between traditional finance and digital assets. With a user base exceeding 120 million across more than 150 countries, Bitget’s initiatives are focused on making global asset access easier and driving innovation in liquidity management.

By prioritizing altcoin liquidity, the program highlights the increasing interest from institutions in specialized crypto markets. Through incentives for trading in smaller-cap tokens, Bitget aims to establish more balanced liquidity, which is essential for the evolution of the crypto industry. This strategy is consistent with the exchange’s global outreach, including partnerships such as its official crypto collaborations with LALIGA and MotoGP™, showcasing its commitment to worldwide influence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

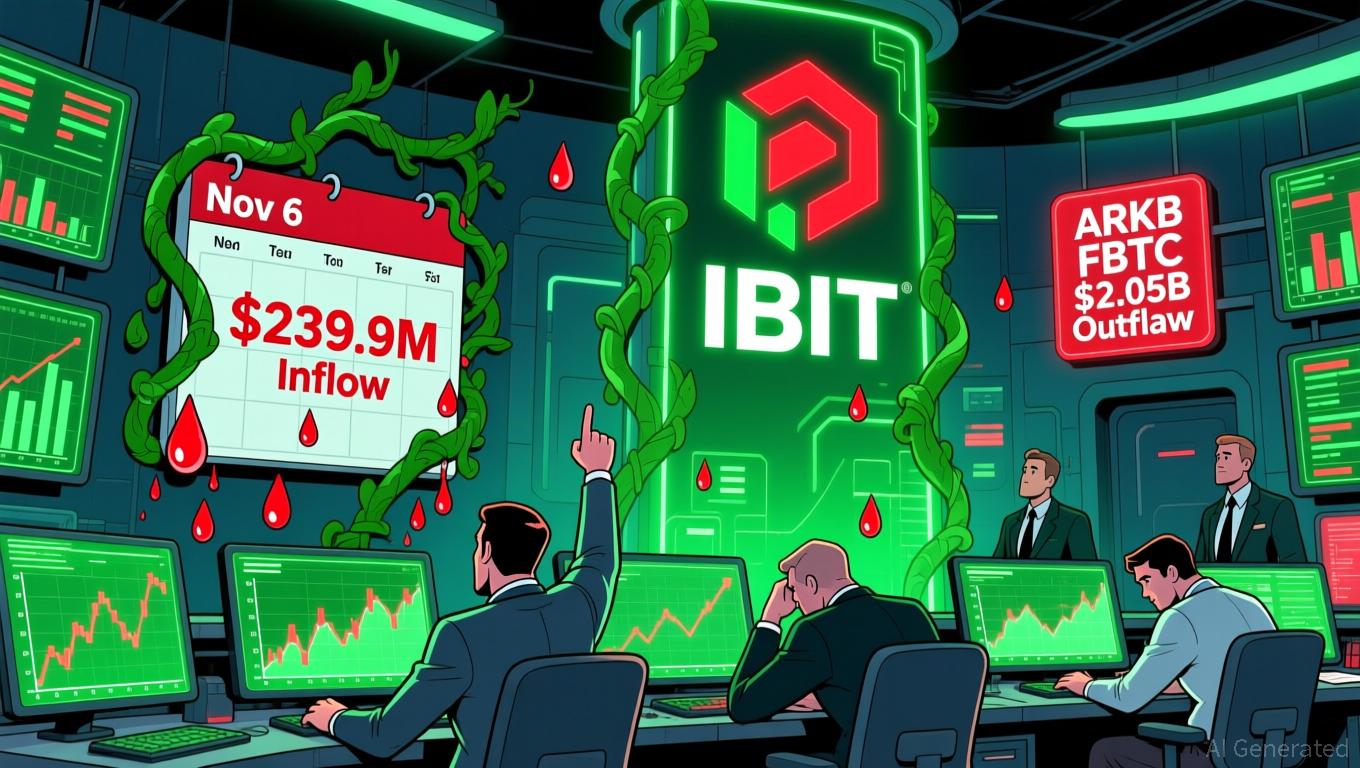

Bitcoin Updates: Investor Optimism Grows as Bitcoin ETFs End Outflow Trend

- U.S. spot Bitcoin ETFs ended a six-day outflow streak with $239.9M net inflows on Nov 6, led by BlackRock's IBIT ($112.4M) and Fidelity's FBTC ($61.6M). - Bitcoin's price rebounded to $103,000 from below $99,000 as improved liquidity and reduced macro volatility drove inflows, though risks persist without sustained buying pressure. - Ethereum ETFs saw smaller $12.5M inflows while Grayscale's ETHE continued outflows, highlighting diverging investor preferences between BTC and ETH. - Solana ETFs emerged as

Bitcoin News Update: Bitcoin Drops Under $100K Amid Diverging Analyst Opinions on Market Direction

- Bitcoin dropped below $100,000 on Nov. 7, driven by macroeconomic risks and $2B+ ETF outflows amid U.S.-China tensions and Fed inaction. - Analysts highlight $113,000 as critical resistance and $100,000 as key support, with breakdowns risking $88,000 liquidation levels. - Institutional views diverge: Ark Invest cut targets to $120,000 while JPMorgan raised fair value to $170,000 amid shifting adoption narratives. - Market eyes December's "Santa Rally" potential but recovery hinges on Bitcoin holding abov

Bitget Connects Speculation and Risk Control through STABLEUSDT Futures

- Bitget launched STABLEUSDT pre-market futures with 25x leverage, offering 24/7 trading since Nov 6, 2025. - The contract features 4-hour funding settlements and 0.00001 tick size to enable flexible positioning. - As the world's largest UEX, Bitget aims to boost market depth for emerging tokens through strategic liquidity initiatives. - Partnerships with LALIGA/MotoGP and a $2M loan program highlight its mission to democratize crypto access. - Risk warnings emphasize volatility concerns for leveraged prod

Token Unlock Releases and Large Holder Sell-Offs Drive Ethena's 80% Value Decline

- Ethena's ENA token dropped 80% to $0.31 amid massive unlocks and whale selling, with 45.4% of tokens released in November. - Robinhood listing and Binance's USDe buyback program offer limited support as 6.8B tokens circulate and 5.99B remain locked until 2026. - USDe's $8.9B TVL and multi-chain expansion highlight potential, but technical indicators signal a possible 37% further price decline. - Analysts warn ongoing unlocks, whale activity, and crypto market volatility could prolong ENA's bearish trend