From Altruism to Exploitation: Has True Cryptocurrency Long Been Dead?

Once, it was something so pure, liberating, and hopeful.

Original Article Title: the real crypto died long ago

Original Article Author: hitesh.eth

Original Article Translator: DeepFlow Tech

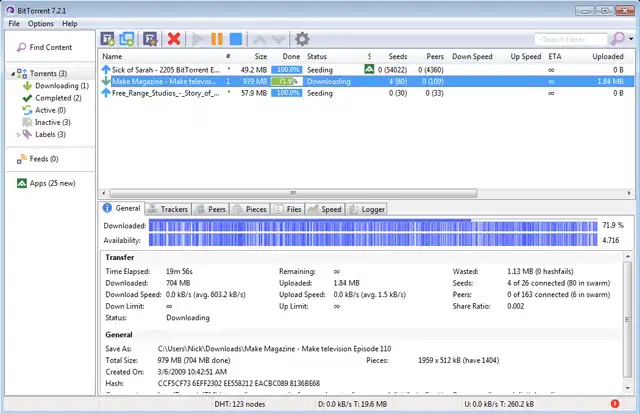

Since the birth of cryptocurrency, it has always been based on altruism. Early adopters of any cryptocurrency-based products were not motivated by pursuit of wealth. In fact, they were willing to contribute resources to early encrypted networks like BitTorrent to help a large community.

Back in those days, when OTT (over-the-top media services) were not yet popular, watching a high-quality movie online was a challenging task, almost a global issue. We had to wait for several months until it aired on television to see those movies that weren't feasible to watch at the theater every weekend.

The film culture has been continuously growing and expanding, which I believe is the only culture that consistently attracts more and more people. Those drawn to the film culture often stay in it for a long time, and cryptocurrency played a catalytic role in this process. It made the global community more inclusive through the internet, transforming the film culture into a more diverse and welcoming space.

Many individuals shared movie files through their computer systems, utilizing seeds and peers for sharing, and we downloaded them from their systems peer-to-peer (p2p). It was like magic. It was free, entirely driven by a shared love for movies.

This resistance against centralized systems and processes, empowering people by returning power to them, is the core spirit of those who consciously or unconsciously participated in early encrypted products.

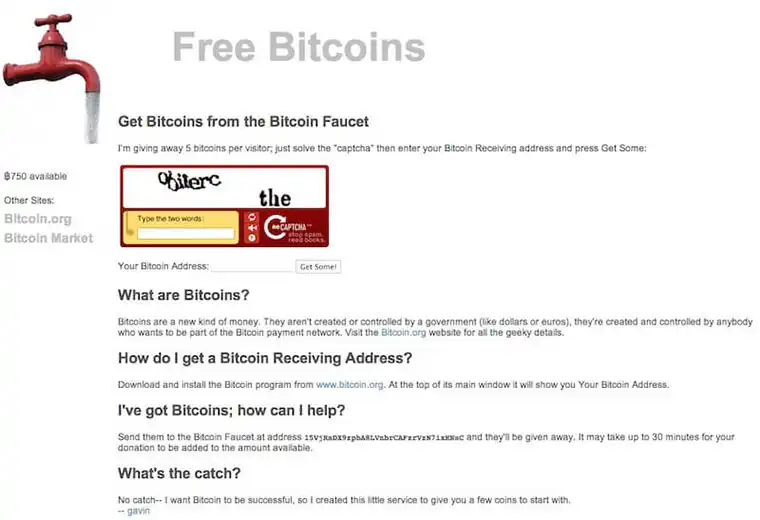

Subsequently, Bitcoin emerged, marking a significant milestone in the crypto space. In Bitcoin's early days, those who joined the network were not concerned about its price. They focused on building the network, educating more people, and driving early adoption. They even altruistically gifted Bitcoin through forums, offline meetings, events, and mailing lists.

During 2009 and 2010, thousands of Bitcoins were given away for free, when Bitcoin actually had no market value. However, with the emergence of exchanges, Bitcoin became tradable and gradually acquired market value. This changed everything. The spirit of altruism took a back seat as fear and greed quietly crept in, gradually polluting the network's consciousness.

Events such as Mt. Gox, Bitconnect, OneCoin, and others have become typical examples. These malicious actors have squeezed millions of bitcoins from ordinary people who held dreams and hopes. We always thought of ourselves as early adopters of the game. In reality, we were not, my brother.

In fact, we arrived too late, even later than those who, in a remote corner, driving a taxi with a big smile on their faces, lost 10 bitcoins due to the Bitconnect scam. These people are the real early adopters. They believed in Bitcoin, but never truly understood its significance.

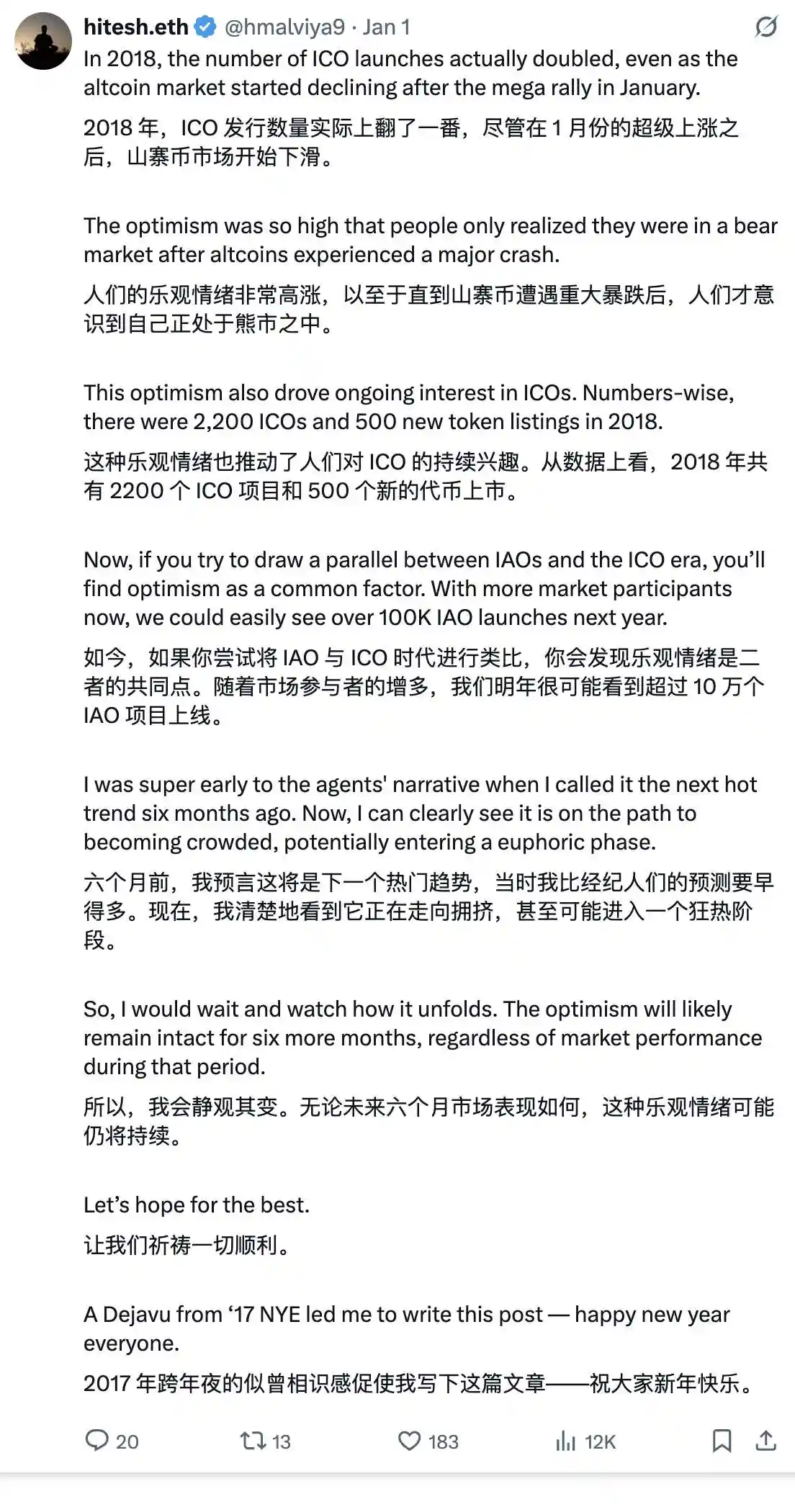

Perhaps, everything changed after money became intertwined with cryptocurrency. Those who decided to build the crypto market after 2012 made "profiting from information asymmetry" their new agenda. They achieved great success in the market. However, most tokens never got proper listing, and almost all tokens eventually disappeared within three years.

But when these projects were hot, people thought they would change the world. Everyone believed in these ideas, without realizing that the infrastructure was far from ready. Some genuinely concerned individuals kept warning others, but no one was willing to listen. All they saw in their eyes were others making money, success stories shared online, and that was enough to make them believe that cryptocurrency would change their lives. They believed and thus lost. And the bad actors succeeded once again. Some even successfully disguised themselves as "good guys" and are still operating at higher levels today.

The New Face of Crypto

Crypto tokens have become commitment data strings with limited supply, controlled by project teams. The project teams strategically release the token supply slowly into the market, using part of the distribution to create artificial demand, then designing incentive mechanisms to attract early adopters, associating their identity and reputation with the tokens.

These incentives are not just economic but also psychological triggers aimed at triggering belief, tribalism, and Fear Of Missing Out (FOMO). The real product is not the token but an illusion. The narrative built around these data strings is not only false but also carefully emotionally manipulated. The target has always been those in the survival cycle, the reactive mind, those millions of people seeking meaning and craving faith.

Once you tap into this kind of thinking, you don't even need evidence, just a story, a symbol of what seems like a "last chance." The human mind, conditioned by decades of scarcity, shame, or missed opportunities, will eagerly grab onto these narratives with both hands. And the individuals behind these data strings know this all too well. What they are selling is not a product, but hope—a hope cloaked in digital, trend, and community terms. They skillfully exploit information asymmetry because hope is the easiest drug to sell and the hardest to quit.

What we are witnessing is not something new; it's just faster now. The concentration of wealth has always relied on this asymmetry. A few know the rules of the game, while the majority cling tightly to their dreams. But in the world of tokens, the speed at which beliefs spread far exceeds the speed of reflection. Victims don't even have time to pause and think because the next promise has already emerged—shiny, trendy, full of potential, and just credible enough to seem like the hope of redemption.

The Extractor's Truth

We have reached a point where we feel deceived but cannot accept this fact. For new market participants who have just entered, hope is still visible; but for veterans who have experienced two to three market cycles, they can't even digest the current market structure. It's something they can't truly accept. They can't keep up with the changing narrative, can't track the rapid operation of catalysts, and can't act swiftly because they are still stuck in the market concepts they once thought were simpler.

However, upon deeper reflection, the market has never been about being "simple" or "complex"; it's all about scale. In the past, an "extractor" faced a hundred thousand users, but now, an "extractor" only needs to face a hundred users.

The probability of being extracted has become extremely high. Even in the extractor's world, there is competition, so they cannot focus their attention on one thing for too long to avoid exposure. They constantly throw out new narratives to excite participants.

People hover between winning and losing, some stay, some leave, but extraction never stops; instead, it continues to scale up. Even within the extraction cycle, there will always be a window for you to exit with gains, depending on your discipline, risk management, and the lessons learned from the past. Some clever individuals exit at the right time to continuously profit, while others fall into "exit liquidity." This cycle will continue because the extractors know they have only just scratched the surface of human greed.

As mainstream adoption increases, more people will be trapped in it. And when this happens, the government will intervene in the name of regulation to "save" us, ultimately diverting the extracted funds into their own hands through taxation.

Reflection

When you realize all of this and start to ponder, comparing it to the original intention of altruism, you may find yourself in tears, seeing everything we have done to cryptocurrency.

Once, it was such a pure, liberating, and hopeful thing, showing us the possibility of an alternative system.

It was supposed to give power back to us.

And now, we seem to have power, but it is a power lost.

We followed the ideals of altruism, yet we handed over our peace of mind and money to the market, while some scammer lurks in the corner, laughing at our foolishness.

A dream turned into an illusion, the illusion then transformed into exploitation, and perhaps this is the true story of cryptocurrency.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Central Bank Issues Historic Penalty: Adhering to Crypto Regulations Is Now Essential

- Ireland's Central Bank fined Coinbase Europe €21.5M for AML/CFT failures, marking its first crypto enforcement action. - Systemic flaws allowed 30M unmonitored transactions (€176B) due to software errors and governance gaps. - Regulators emphasized crypto compliance urgency, citing MiCA regulations and law enforcement collaboration risks. - Coinbase acknowledged technical errors but faced reduced penalties via early settlement under regulatory programs. - Case highlights EU's intensified crypto oversight

Fed's Balancing Act: Navigating Inflation and Employment in the 2025 Interest Rate Challenge

- The Fed debates 2025 rate cuts to balance 3% inflation control with a cooling labor market, as policymakers like Jefferson advocate a slow easing approach. - Mixed signals persist: U.S.-China trade deal eased volatility but left businesses cautious, while Matson's 12.8% China service decline highlights lingering tensions. - Market expects 25-basis-point December cut, but Powell warns uncertainty remains, compounded by government shutdown limiting key data access. - Rate-cut expectations boosted municipal

Bitcoin News Update: Institutions Pour In Funds Despite Bitcoin Downturn: ETFs Draw $240M During Market Turbulence

- Bitcoin ETFs saw $240M net inflows on Nov 6, ending a six-day outflow streak led by BlackRock's IBIT and Fidelity's FBTC. - Despite Bitcoin's 9% weekly price drop to $100,768, institutional confidence grew in regulated, low-fee ETF products amid market volatility. - Altcoin ETFs gained traction while total crypto ETPs faced $246.6M outflows, highlighting diverging investor priorities. - Analysts attribute Bitcoin's decline to internal dynamics, not ETFs, as on-chain data shows easing sell-pressure and st

Hyperliquid's 2025 Boom: Blockchain-Based Liquidity and Shifting Retail Trading Trends

- Hyperliquid's TVL surged to $5B in Q3 2025, capturing 73% of decentralized perpetual trading volume via on-chain liquidity and retail demand. - Technological innovations like HyperEVM and strategic partnerships drove $15B open interest, outpacing centralized rivals' combined liquidity. - Retail traders executed extreme leverage (20x BTC/XRP shorts) and $47B weekly volumes, highlighting both platform appeal and liquidation risks. - Institutional interest (21Shares ETF application) and deflationary tokenom