Ethereum News Today: Ethereum's 3-Day Drop: Will the Next Move Be Upward or Signal a Downtrend?

On October 30, Ethereum's value dropped by 4.86% to $3,757.13, reaching its lowest 5 p.m. ET price since October 11, 2025, when it was at $3,700.42, as reported by a

Even with the recent price swings, experts highlight that Ethereum's MVRV (Market Value to Realized Value) ratio stands at 1.50, a level that has historically signaled market stabilization before major price shifts. The MVRV ratio compares the market capitalization of all ETH to its realized capitalization, which is the sum of the last transaction prices of all coins. When the ratio is above 1, most coins are valued above their purchase price; below 1 means the opposite. A reading near 1.5 is often interpreted as a neutral point, suggesting neither strong optimism nor pessimism in the market and possibly indicating conditions for a breakout, the report stated.

Ethereum's monthly returns have also worsened, with a 10.39% decline since the beginning of October. This positions the asset for its weakest monthly performance since March 2025, when it dropped 18.10%. Nevertheless, Ethereum is still up 12.33% for the year, despite being 24.18% below its record intraday high of $4,955.23 reached on August 24, 2025, according to Morningstar. Over the past 52 weeks, the token has seen significant movement, rising 49.20% from its October 31, 2024, price of $2,518.23 and standing 165.19% above its 52-week low of $1,387.85 recorded on April 9, 2025.

Intraday price swings have become more pronounced as well, with Ethereum touching a low of $3,680.41—the lowest since October 17, 2025. The 6.81% drop within the day was the sharpest since October 14, 2025, when the token fell by 9.09%, the report mentioned. Market participants are now watching closely to see if the MVRV ratio's neutral position will persist or if upcoming price movements will trigger a decisive shift toward either a bullish or bearish trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

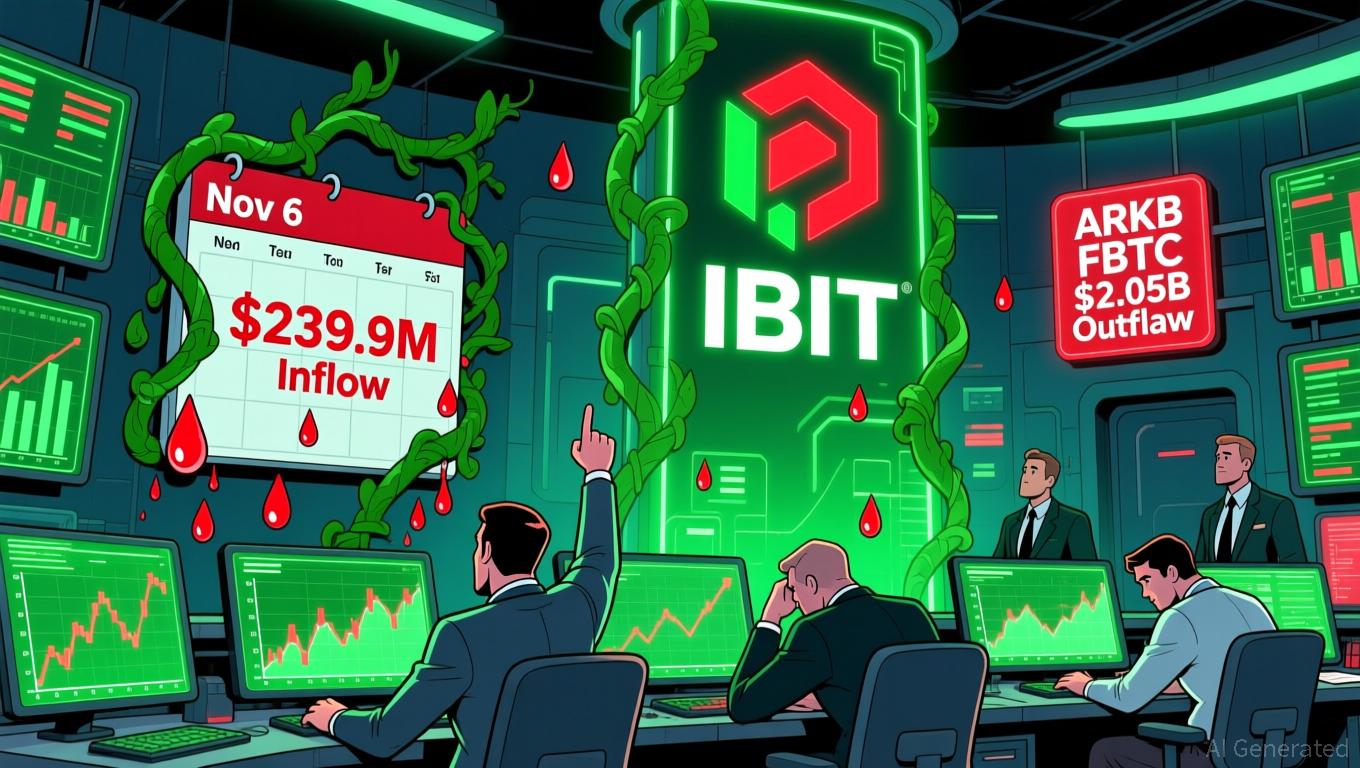

Bitcoin Updates: Investor Optimism Grows as Bitcoin ETFs End Outflow Trend

- U.S. spot Bitcoin ETFs ended a six-day outflow streak with $239.9M net inflows on Nov 6, led by BlackRock's IBIT ($112.4M) and Fidelity's FBTC ($61.6M). - Bitcoin's price rebounded to $103,000 from below $99,000 as improved liquidity and reduced macro volatility drove inflows, though risks persist without sustained buying pressure. - Ethereum ETFs saw smaller $12.5M inflows while Grayscale's ETHE continued outflows, highlighting diverging investor preferences between BTC and ETH. - Solana ETFs emerged as

Bitcoin News Update: Bitcoin Drops Under $100K Amid Diverging Analyst Opinions on Market Direction

- Bitcoin dropped below $100,000 on Nov. 7, driven by macroeconomic risks and $2B+ ETF outflows amid U.S.-China tensions and Fed inaction. - Analysts highlight $113,000 as critical resistance and $100,000 as key support, with breakdowns risking $88,000 liquidation levels. - Institutional views diverge: Ark Invest cut targets to $120,000 while JPMorgan raised fair value to $170,000 amid shifting adoption narratives. - Market eyes December's "Santa Rally" potential but recovery hinges on Bitcoin holding abov

Bitget Connects Speculation and Risk Control through STABLEUSDT Futures

- Bitget launched STABLEUSDT pre-market futures with 25x leverage, offering 24/7 trading since Nov 6, 2025. - The contract features 4-hour funding settlements and 0.00001 tick size to enable flexible positioning. - As the world's largest UEX, Bitget aims to boost market depth for emerging tokens through strategic liquidity initiatives. - Partnerships with LALIGA/MotoGP and a $2M loan program highlight its mission to democratize crypto access. - Risk warnings emphasize volatility concerns for leveraged prod

Token Unlock Releases and Large Holder Sell-Offs Drive Ethena's 80% Value Decline

- Ethena's ENA token dropped 80% to $0.31 amid massive unlocks and whale selling, with 45.4% of tokens released in November. - Robinhood listing and Binance's USDe buyback program offer limited support as 6.8B tokens circulate and 5.99B remain locked until 2026. - USDe's $8.9B TVL and multi-chain expansion highlight potential, but technical indicators signal a possible 37% further price decline. - Analysts warn ongoing unlocks, whale activity, and crypto market volatility could prolong ENA's bearish trend