Balancer Hit by $110 Million Exploit in Latest DeFi Security Breach

Balancer has fallen victim to a major $110 million exploit sparking new questions about DeFi security as attackers drain assets from key liquidity pools.

Decentralized exchange and liquidity protocol Balancer has reportedly fallen victim to a major security breach, with losses exceeding $110 million in digital assets. On-chain data indicates that the attack remains ongoing.

This exploit highlights ongoing vulnerabilities in DeFi infrastructure, despite increasing regulatory scrutiny and enhanced security efforts across the sector.

Balancer Exploit Drains Over $110 Million as Attack Continues

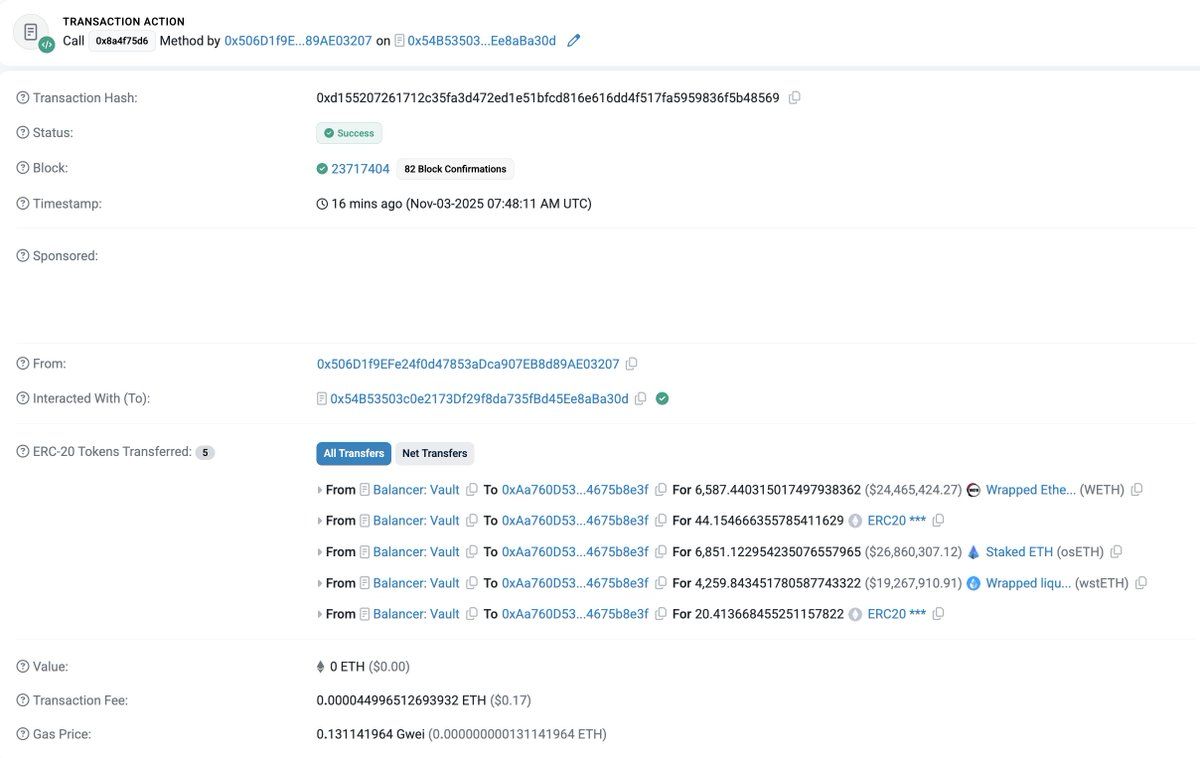

According to data shared by Lookonchain on X (formerly Twitter), the attackers transferred roughly 6,587 WETH, worth around $24.46 million, 6,851 osETH, valued at nearly $26.86 million, and 4,260 wstETH, worth approximately $19.27 million, from Balancer to a new wallet.

Hackers Transferring Assets From Balancer. Source:

Hackers Transferring Assets From Balancer. Source:

The attack hasn’t stopped yet. Lookonchain reports that losses from the Balancer exploit have already exceeded $110 million.

“Absolutely insane — the total stolen funds from the Balancer exploit have now surged to $116.6 million,” Lookonchain added.

This isn’t the first time the network has faced such an incident. In 2023, bad actors managed to steal around crypto assets from the protocol. The Balancer team has not yet issued an official statement regarding the incident.

This is a developing story.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hong Kong and Brazil Forge Blockchain Agreement, Transforming International Trade Finance

- Hong Kong and Brazil conduct blockchain-powered cross-border trade settlement via Chainlink, reducing risks. - The pilot, involving Banco Inter and regulators, tests DvP/PvP models to automate transactions. - Analysts highlight potential $15 price target for LINK as adoption grows, boosting institutional interest. - Hong Kong's Fintech 2030 strategy and regulatory moves aim to position it as a digital asset hub. - The success may expand to more institutions, enhancing blockchain's role in global trade fi

Hyperliquid News Today: Abraxas Capital's $760M Short Position Points to an Uncertain Path Ahead for HYPE

- Hyperliquid's HYPE token faces potential 50% price drop due to bearish indicators like growing short positions and competition. - Abraxas Capital's $760M short positions on BTC/ETH and individual traders' aggressive shorting amplify downward pressure risks. - Pump.fun's $1.42M 24-hour revenue surge threatens Hyperliquid's dominance in DeFi derivatives market. - $1B fundraise raises valuation concerns as critics question HYPE's $305M reserves vs 12.6M circulating tokens. - Forrester's AI investment foreca

Cardano News Update: ADA's $0.60 Support at Risk as Large Holders Intensify Bearish Momentum

- Cardano (ADA) fell below $0.58 amid whale sell-offs and weak trader sentiment, signaling broader bearish momentum. - Whale activity drove 100M+ ADA offloads, pushing price below 200-day EMA and triggering 10-15% correction risks. - Technical indicators (RSI=32, ADX=43.21) and declining active addresses (24,280) confirm downward pressure. - Founder Charles Hoskinson blamed community inaction for DeFi struggles, worsening near-term uncertainty. - Short positions dominate (2.8:1 ratio) with key support at $

Bitcoin Updates Today: Slower Bitcoin Accumulation Drives Broader System Integration Efforts

- Coinbase's Q3 2025 BTC purchase (2,772 BTC) and $1.9B revenue surge highlight institutional growth amid Trump-era regulatory support. - Broader slowdown in institutional BTC buying, ETF outflows, and geopolitical risks temper bullish momentum despite CEO's commitment. - MicroStrategy's Saylor predicts $150k Bitcoin by year-end, citing SEC tokenized securities progress, but faces stock declines mirroring BTC's dip. - Miners pivot to AI infrastructure, diversifying revenue as Bernstein upgrades valuations