Cardano News Update: Diverse Industry Trends Drive ADA Closer to $2 Goal

- Cardano (ADA) aims for $2 by 2030, driven by cross-sector trends in biotech, retail, and energy. - Adagene's Phase 2 trial of muzastotug shows promise in colorectal cancer treatment with low adverse events. - Denny's Corp forecasts 4.6% revenue growth, while 3D Systems faces 17.6% decline, highlighting sector volatility. - Urano Energy's uranium acquisition reflects renewed interest in domestic energy production amid crypto market maturation. - Divergent performances of Astera Labs and ADTRAN underscore

Speculation remains high in the cryptocurrency space regarding Cardano (ADA) potentially hitting the $2 mark by 2030, fueled by its expanding user base and ongoing technological progress. Although the current news does

Within the biotech sector,

Elsewhere, established sectors are demonstrating their ability to adapt. Denny's Corp (DENN) is forecasted to see a 4.6% rise in revenue, reaching $116.9 million for the quarter ending September 30, 2025, according to

Turning to the energy industry, Urano Energy’s purchase of uranium project assets from enCore Energy Corp. points to renewed enthusiasm for domestic uranium output, as reported by

Astera Labs Inc. (ALAB) and ADTRAN Holdings Inc. (ADTN) present contrasting stories. Astera Labs is projected to achieve an 82.6% jump in revenue to $206.5 million, with profits of 39 cents per share, according to

Although the news does not directly discuss Cardano’s price outlook, it reflects wider economic and technological developments that influence investor choices. As the digital asset market evolves, innovation across sectors and the performance of traditional equities are likely to play a part in shaping ADA’s journey toward the $2 milestone by 2030.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

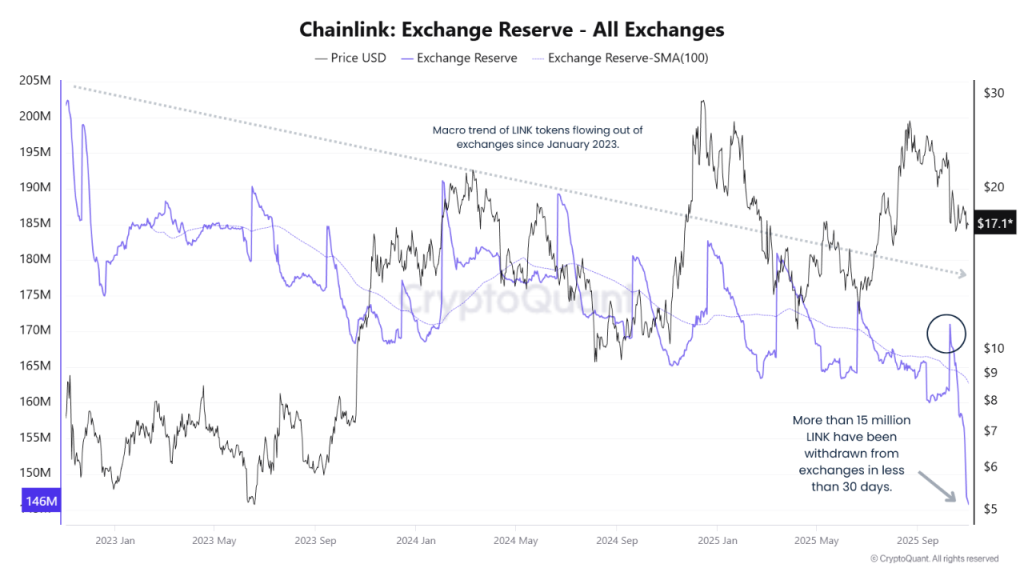

Chainlink Price Prediction 2025: Rising Institutional Adoption Eyes $100 Target

DeFi Faces Confidence Challenges: External Mismanagement Reveals Deep-Rooted Vulnerabilities

- Stream Finance halts deposits/withdrawals after $93M loss from third-party mismanagement, triggering XUSD depegging and systemic risks. - Perkins Coie investigates, highlighting DeFi governance flaws as XUSD’s 58% 24-hour drop impacts $280M in linked loans. - Industry warns of trust fragility; incident coincides with Balancer’s $116M hack, amplifying crypto sector scrutiny. - Stream’s crisis underscores risks in DeFi’s reliance on external managers amid broader economic pressures and regulatory tightenin

Solana Latest Updates: Bitcoin Falters, Solana Shows Uncertainty While MoonBull's Tokenomics Spark November Rally

- Bitcoin fell below $116,000 in late October amid cautious positioning before the Fed meeting, with on-chain metrics showing stable miner holdings. - Solana dropped 6% after Jump Crypto swapped $205M SOL for BTC, highlighting altcoin volatility despite $100B+ market cap support from ETF approvals. - MoonBull ($MOBU) surged 163% in presale with 95% APY staking, leveraging deflationary tokenomics and meme-driven adoption to outpace BNB/AVAX in 2030 ROI forecasts. - Institutional crypto infrastructure deals

Tokenized Treasuries Reach $8.7 Billion as Authorities and Competing RWA Platforms Draw Near

- Tokenized U.S. Treasuries surpassed $8.73B AUM, driven by institutional demand and yield seekers, with BlackRock and Securitize leading the market. - Regulatory scrutiny intensifies as CFTC and Hong Kong tighten oversight, while RWA rivals like tokenized gyms and education assets challenge treasury dominance. - Liquidity constraints and redemption restrictions persist, but ISO 20022 blockchain integration signals progress toward bridging TradFi and digital finance. - Market growth faces hurdles including