Solana ETFs capture nearly $200 million in 4 days

The crypto world has just crossed a new milestone with the launch of Solana ETFs by Bitwise and Grayscale. In only four days, these financial products attracted nearly 200 million dollars, revealing a growing appetite for SOL. Analysis of a phenomenon that could redefine the market.

In brief

- Solana ETFs attracted nearly 200 million dollars in just four days, a record for a crypto ETF launch.

- Despite the massive inflow to Solana ETFs, the SOL price shows a 1.5% drop over 24 hours.

- The analysis of SOL’s outlook raises questions: could Solana ETFs stimulate a future rise in SOL?

Successful launch of Solana ETFs: a historic first

On October 28, 2025, Bitwise made history by launching the first ETF providing direct exposure to Solana ! An event that immediately captivated the crypto community. Grayscale quickly followed with its own ETF, confirming the enthusiasm around this digital asset.

This dual launch illustrates a clear trend. Financial institutions are beginning to recognize the potential of SOL, long considered a serious alternative to Ethereum. For investors, these ETFs represent an opportunity to access Solana without directly holding crypto. A major step for institutional adoption.

Solana ETF: nearly $200 million inflow in 4 days

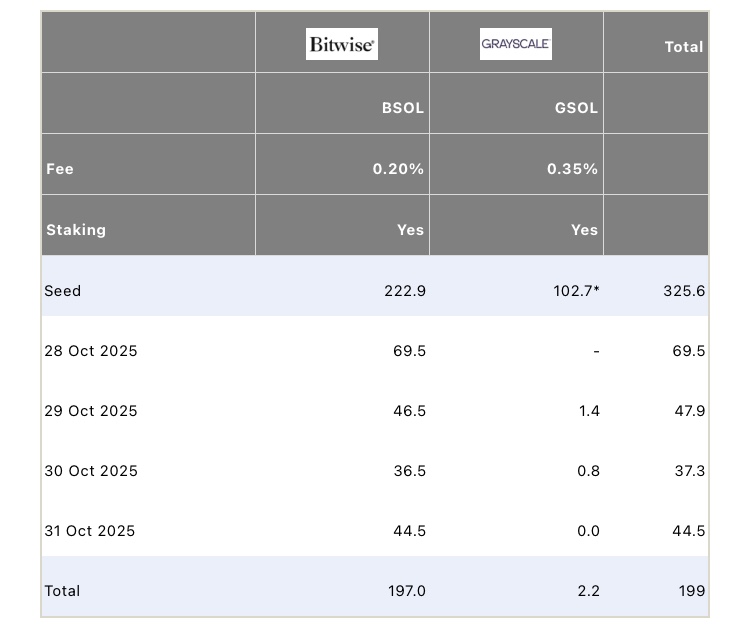

The data speaks for itself. The Bitwise Solana ETF (BSOL) recorded $69.5 million in inflows on its first day! Followed by $46.5 million, $36.5 million, and $44.6 million on the following days. In four days, BSOL accumulated $197 million.

The Grayscale Solana ETF (GSOL) attracted $2.2 million during the same period, with inflows of $1.4 million and $0.8 million on October 29 and 30. Together, these two ETFs reached $199.2 million, a record for products linked to SOL. These figures demonstrate immediate and massive investor confidence.

The Solana ETFs BSOL and GSOL reached $199.2 million in 4 days

The Solana ETFs BSOL and GSOL reached $199.2 million in 4 days

SOL: a mixed reaction despite the massive ETF inflow

Despite the enthusiasm around the Solana ETFs and the $199.2 million inflows recorded in just four days , SOL shows a slight decrease of 1.5% over the last 24 hours. At $185.73, Solana seems to react cautiously, despite the prevailing optimism around financial products linked to this crypto.

This situation raises questions: why doesn’t SOL immediately benefit from this massive inflow? Several factors may explain this trend:

- On one hand, crypto markets are often subject to high volatility, where expectations and profit-taking can influence prices in the short term;

- On the other hand, institutional investors might adopt a gradual approach, waiting to see how these ETFs perform before investing massively.

It remains to be seen whether this drop is temporary or a sign of a more lasting crypto trend.

Solana ETFs have marked a turning point, attracting hundreds of millions of dollars in just a few days. Solana (SOL) could it become the next star of crypto? One thing is certain, the ecosystem has never been so dynamic.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Goldman Sachs predicts that the "U.S. government shutdown" will end within two weeks, making a Federal Reserve rate cut in December "more justified"?

Goldman Sachs predicts that the government shutdown is "most likely to end around the second week of November," but also warns that key economic data will be delayed.

I traded perpetual contracts for a month: from dreaming of getting rich overnight to a sobering reality.

Find a group of people who are doing the same thing as you, preferably those who are smarter than you.

Solana Consolidates Above $177 Support as Market Watches $200 Breakout Level

BTC Dominance Faces 60% Barrier Before Next Halving Cycle