Crypto: Key Senate Negotiations Underway Despite the Shutdown

Despite the paralysis of the federal government, Republican lawmakers are staying the course on their ambitious crypto schedule. Several key senators say they want to pass a landmark digital assets law before the end of the year. But will this promise hold against the budget deadlock blocking Washington?

In brief

- Republican senators plan to pass a law on the crypto market structure by the end of 2025, despite the shutdown.

- John Boozman is negotiating a bipartisan bill with Democrats; an agreement could be announced in a few weeks.

- The CLARITY Act passed in July in the House serves as the basis for the Senate’s Responsible Financial Innovation Act.

- Brian Armstrong of Coinbase confirmed that the Senate has agreed on 90% of crypto-related points.

The US Senate Accelerates on Cryptos Despite Budget Chaos

Several Republican senators refuse to let the budget deadlock slow down their regulatory ambitions.

John Boozman, who chairs the Senate Agriculture Committee, is intensifying negotiations with his Democratic counterparts to present a bipartisan bill “very soon.” His goal remains unchanged: to have this legislation passed before 2026.

This determination is explained by a relentless political reality . As Senator Thom Tillis points out, the window of opportunity will only remain open until February 2026 at the latest.

After this deadline, the midterm elections will turn Congress into an electoral arena where any consensus will become nearly impossible. Lawmakers know: it is now or never.

The Senate Banking Committee has also begun promising bipartisan discussions. Sources close to the matter mention a possible announcement of an agreement within a few weeks.

This momentum strongly contrasts with the administrative paralysis affecting other sectors, where thousands of federal employees have been on forced leave since early October.

The initial schedule called for review by the Agriculture Committee at the end of September and by the Banking Committee at the end of October. While the first deadline was not met, Republicans are staying the course.

Cynthia Lummis, Senator from Wyoming and a leading figure in the crypto matter, remains convinced that President Trump will be able to sign the bill before 2026.

Brian Armstrong Revives the Legislative Machine

The visit of Coinbase’s CEO to Washington last week marked a turning point. Brian Armstrong met with several lawmakers and delivered an encouraging assessment: the Senate has found common ground on about 90% of the crypto-related issues. This unexpected convergence gives new momentum to the legislative process.

The Responsible Financial Innovation Act, sponsored by Republicans in the Senate, directly builds on the CLARITY Act passed by the House in July. This legislative strategy aims to create a coherent framework for the digital assets market structure. Party leaders had promised to build on the foundations laid by their House colleagues, a promise they seem determined to keep.

The momentum remains fragile. The shutdown complicates everything, especially the SEC’s decisions on crypto ETFs. The agency is still operating with reduced staff and had to delay the review of several files, although the Litecoin (LTC) and Hedera (HBAR) ETFs have since been launched on the NYSE. As for Michael Selig, appointed by Donald Trump to lead the CFTC, he has not yet been confirmed by the Senate, with his hearing still pending.

Despite these obstacles, the crypto industry remains hopeful. The roundtable announced for October 22nd did take place, bringing together leaders from Kraken, Coinbase, Ripple, and Circle to maintain dialogue between lawmakers and industry players. This mobilization illustrates the strategic importance of these bills for an ecosystem that has been demanding a clear regulatory framework for years.

The US Congress is playing its credibility on the field of crypto regulation. If Republicans manage to keep their commitments despite the surrounding chaos, the United States could finally offer its digital asset industry the long-awaited legal clarity. Otherwise, we will have to wait until 2027, risking other jurisdictions gaining a decisive lead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin starts $100K ‘capitulation’ as BTC price metric sees big volatility

Ripple Unlocking 1 Billion XRP Worth $2.5 Billion on November 1st

Ethereum’s Fusaka Upgrade Coming, Despite Price Struggles

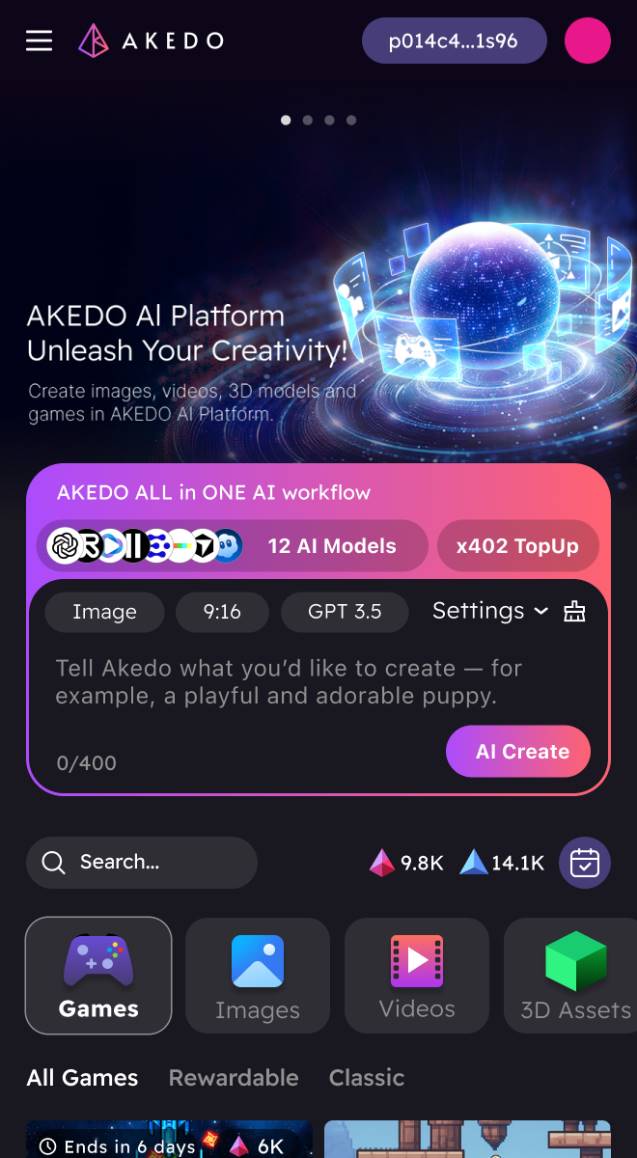

From Tool to Economic Organism: AKEDO and the x402 Protocol Ignite a Productivity Revolution

This marks the formation of the foundational infrastructure for the Agentic Economy: AI now has the ability to make payments, creators have access to an ecosystem for automatic settlements, and platforms become the stage for collaboration among all parties.