Bitcoin briefly dropped to $106,000, is it really game over?

After the Federal Reserve implemented interest rate cuts, the market's short-term sentiment reversed, but macroeconomic data still supports a medium-term easing outlook.

After the Federal Reserve's rate cut was implemented, market sentiment reversed in the short term, but macro data still supports medium-term easing.

Written by: ChandlerZ, Foresight News

In the early hours of October 30, the Federal Reserve announced its latest interest rate decision, cutting rates by 25 basis points as expected, lowering the federal funds rate range to 3.75% – 4.00%, and announcing the cessation of balance sheet reduction starting December 1. Upon the release of the news, the market reaction was muted: the S&P 500 and Nasdaq 100 edged up slightly, while gold and bitcoin briefly narrowed their losses. However, minutes later, Federal Reserve Chair Powell stated at a press conference that whether to continue cutting rates in December was "not a foregone conclusion," and there were clear divisions within the committee.

This statement quickly changed market sentiment. The four major asset classes—U.S. stocks, gold, bitcoin, and U.S. Treasuries—all fell simultaneously, while the dollar rose alone.

This sentiment continued to spread on the 31st. Bitcoin plunged from around $111,500 to $106,000, with Ethereum falling even further, dropping below $3,700 at its lowest, and SOL falling below $180. According to CoinAnk data, the total liquidations across the network in the past 24 hours reached $1.035 billion, with long positions liquidated for $923 million and short positions for $111 million. Of these, bitcoin liquidations amounted to $416 million and Ethereum liquidations to $193 million.

On the other hand, by the close of the U.S. stock market, all three major U.S. stock indices had fallen, with the Nasdaq leading the decline. Crypto-related stocks also saw widespread losses: Coinbase (COIN) fell by 5.77%, Circle (CRCL) by 6.85%, Strategy (MSTR) by 7.55%, Bitmine (BMNR) by 10.47%, SharpLink Gaming (SBET) by 6.17%, and American Bitcoin (ABTC) by 6.02%, among others.

After the excitement at the beginning of the month, the market has shifted from "rising" to "correction" mode. The anticipated capital has already arrived, narratives have not continued, and arbitrage opportunities have diminished. For most holders, this rhythm means that realizing gains and defensive logic take priority.

The Crypto Market Faces Consecutive Setbacks, Black Swan Shadows Remain

In fact, signs of this round of volatility had already appeared. Since the "black swan crash" on October 11, bitcoin's trend has not fully recovered. In just 72 hours, nearly $40 billion in market value evaporated, with total network liquidations exceeding $1.1 billion, and the fear index once dropping to 22. The subsequent rebound in the following days was blocked at $116,000, until Powell's speech this week triggered a new round of panic.

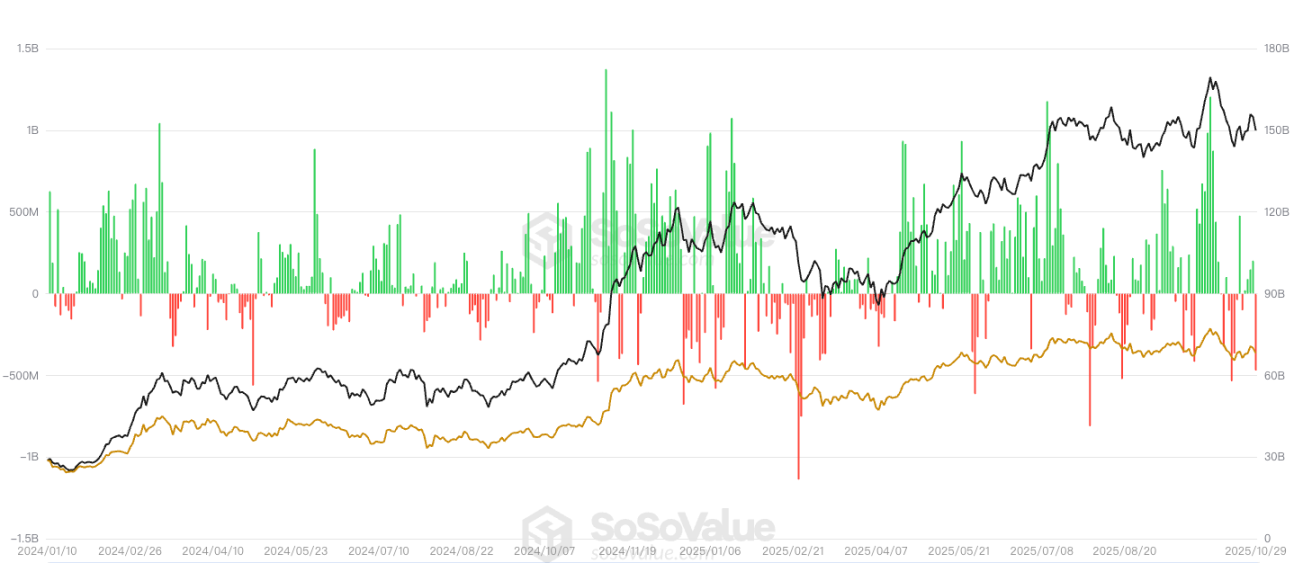

In terms of ETF capital flows, according to SoSoValue data, bitcoin spot ETFs saw a total net outflow of $488 million yesterday, with none of the twelve ETFs recording net inflows. The bitcoin spot ETF with the largest single-day net outflow was Blackrock's ETF IBIT, with a single-day net outflow of $291 million. IBIT's historical total net inflow currently stands at $65.052 billion. Next was Ark Invest and 21Shares' ETF ARKB, with a single-day net outflow of $65.6193 million and a historical total net inflow of $2.053 billion.

Ethereum spot ETFs saw a total net outflow of $184 million, with none of the nine ETFs recording net inflows. The Ethereum spot ETF with the largest single-day net outflow was Blackrock's ETF ETHA, with a single-day net outflow of $118 million. ETHA's historical total net inflow currently stands at $14.206 billion. Next was Bitwise ETF ETHW, with a single-day net outflow of $31.1443 million and a historical total net inflow of $399 million.

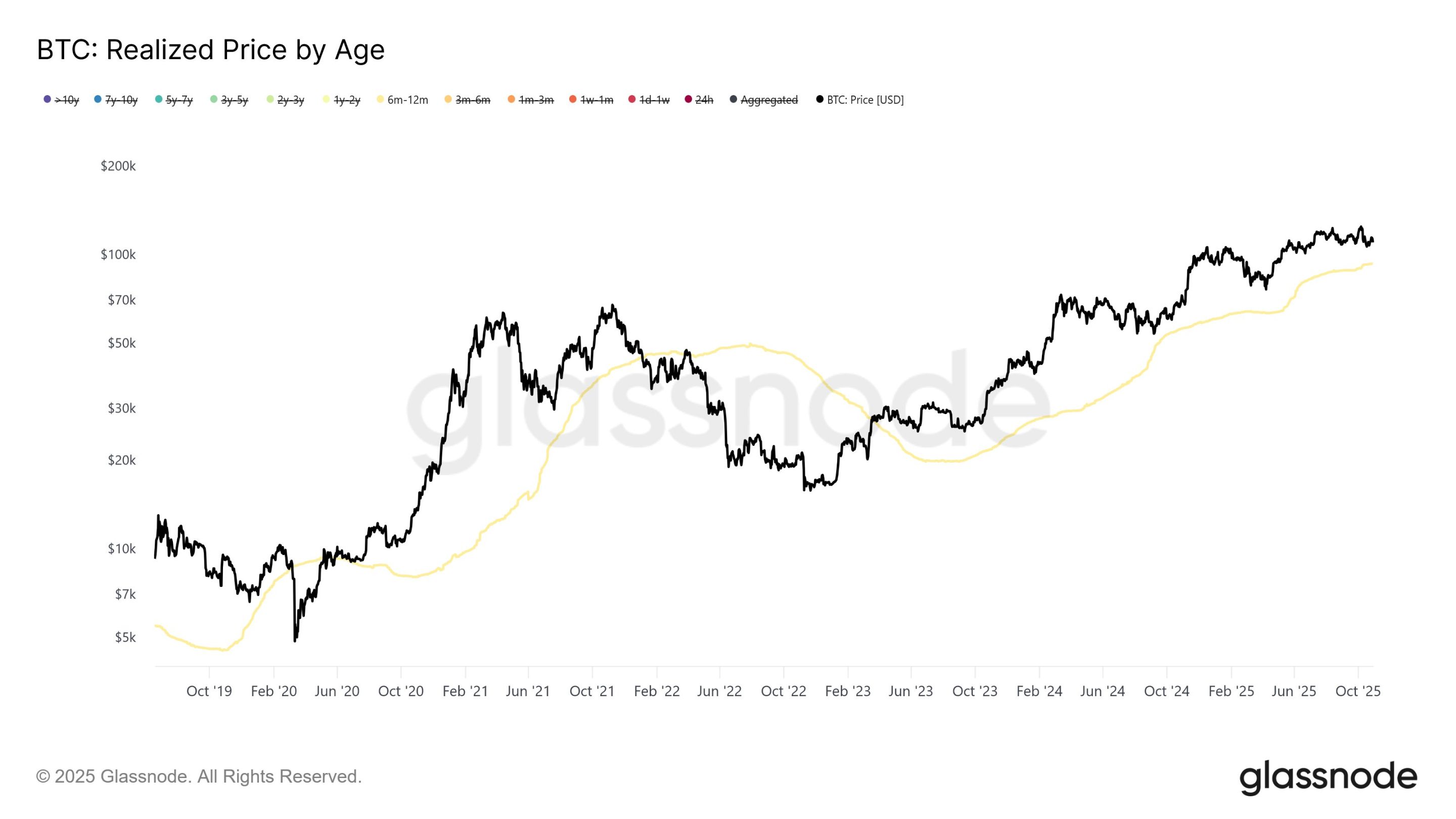

According to Glassnode analysis, since mid-July, long-term bitcoin holders have continued to exert steady selling pressure, keeping the market capped below $126,000. Data shows that the average daily selling by long-term holders increased from about $1 billion (7-day moving average) in mid-July to $2–3 billion by early October. Unlike previous high-selling phases in this bull market, the current distribution pattern is gradual and sustained, rather than sharp short-term selling.

Further analysis by holding period shows that investors holding for 6–12 months contributed over 50% of recent selling pressure, especially evident in the late stage of price peaks. Near bitcoin’s all-time high of $126,000, this group’s average daily selling reached $648 million (7-day moving average), more than five times the early 2025 benchmark level.

The data also reveals that these investors accumulated large amounts of bitcoin mainly between October 2024 (during the U.S. election) and April 2025, with a cost basis between $70,000 and $96,000, averaging about $93,000. Analysts pointed out that if the bitcoin price falls below the $93,000–$96,000 range, this group will face the greatest loss pressure.

Some in the market believe that the crash on October 11 and the subsequent correction have formed a "small cycle top," and Powell’s remarks this week have reinforced the short-term defensive logic.

Liquidity Repricing

After the black swan crash, the crypto market entered a period of deep restructuring. The two main drivers of the altcoin boom in recent years—high-frequency retail speculation and institutional speculation—are collapsing simultaneously. Market makers are deleveraging, VCs have paused primary market investments, and retail investors have exited after consecutive liquidations, leaving the market almost dry of fresh capital.

Bitcoin and Ethereum have once again become the dominant liquidity assets, while the price discovery mechanism for long-tail tokens has failed, forcing market cap and narratives to exit. Except for a few infrastructure projects with real cash flow and user bases, such as stablecoin issuance, RWA asset mapping, or payment settlement systems, most altcoins are in a state of long-term token dilution and exhausted buying interest. The retreat of altcoins reflects the contraction of the entire capital logic. The market is shifting from narrative pricing to cash flow pricing, and capital no longer pays for concepts. Tokens have lost the rationale for sustained value growth, and narratives have become the exclusive privilege of a few core projects.

In addition, the DAT model that was popular in the first half of this year is essentially a form of structured financing that swaps tokens for shares. Its feasibility depends on one premise: that someone in the secondary market is willing to take over. When incremental liquidity dries up, this closed loop collapses. Project teams still want to raise funds, FAs are still brokering deals, but buyers have disappeared. Strategy announced its Q3 2025 financial report, with net profit of $2.8 billion; BTC holdings increased from 597,325 to 640,031; but the stock price fell nearly 14% during the same period, and its market premium relative to BTC holdings narrowed.

Long-tail DATs have almost no transactions, and new financing has become an on-chain token-to-equity hedge. For example, Nasdaq-listed Litecoin treasury company Lite Strategy announced that its board has approved a $25 million stock buyback plan, with the timing and specific number of shares to be repurchased depending on market conditions. For project teams and early investors, this means short-term fundraising can still be completed; for secondary market investors, it means there is almost no exit path. DATs lacking cash flow support, audit custody, and buyback mechanisms are gradually revealing characteristics of empty circulation and circular pledging.

On a deeper level, the bursting of this bubble is a credit rupture between the crypto primary and secondary markets. Without real buying interest, so-called on-chain treasury valuations are meaningless. Capital patience is being exhausted, tokens no longer serve a financing function, and DATs are shifting from innovation to risk.

Short-term Volatility, Long-term Easing Trend Unchanged

The volatility in the crypto market is currently undergoing a repricing process. Powell's remarks caused a sharp short-term sentiment shift, but this shock is more of an expectations adjustment than a trend reversal. Barclays' latest report confirms this view: Powell's real intention is to break the market's excessive expectation of inevitable rate cuts, not to return to a hawkish stance. Macro data still provides conditions for continued easing: labor demand continues to slow, core inflation is falling close to the 2% target, and a cooling economic momentum has become consensus.

From a cyclical perspective, the Federal Reserve's policy space is reopening. The current rate range of 3.75%–4.00% is significantly higher than core inflation, meaning monetary policy remains tight; but against the backdrop of a generally slowing global economy, the marginal benefit of maintaining excessively high rates is diminishing. The next question is not whether to cut rates, but when to restart stronger easing. As balance sheet reduction officially ends in December, the possibility of the Fed returning to quantitative easing will gradually increase.

For the crypto market, this means the medium-term liquidity environment remains friendly. Although short-term volatility is intense, the market's liquidity anchor still points to easing. Improved dollar liquidity will boost risk appetite, and asset pricing will be revised upward again. Historical experience shows that after each round of easing begins, bitcoin usually sees a trend rebound one to two quarters later. The current adjustment is more likely to be accumulating space for the next phase of the market.

From a capital structure perspective, institutions are still waiting for macro confirmation—that is, inflation stabilizing within the target range, employment cooling significantly, and the Fed signaling rate cuts. Once this combination appears, ETF inflows and the rebuilding of futures long positions will restart. For retail and small investors, the real opportunity is not in short-term panic, but in the second wave of inflows after the easing cycle is established.

Whether it is the Fed's policy focus or institutional asset allocation logic, both are transitioning from the end of the rate hike cycle to the beginning of easing. Short-term volatility is inevitable, but the long-term return of liquidity has become an unstoppable trend. For investors still in the market, the most important thing is not to predict the bottom, but to ensure they can hold on until quantitative easing restarts. By then, bitcoin and the entire crypto asset market will usher in a new pricing cycle amid the recovery of liquidity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Spot ETF Set for Nov 13 Launch as SEC Delay Clause Removed

Quick Take Summary is AI generated, newsroom reviewed. Canary Funds removed the "delaying amendment" clause from its XRP spot ETF S-1 filing. This move uses Section 8(a) of the Securities Act, setting an auto-effective date of November 13. The ETF is planned to trade on Nasdaq and will use Gemini and BitGo as digital asset custodians. The strategy mirrors recent auto-effective launches of Solana, Litecoin, and Hedera ETFs.References CANARY REMOVES SEC DELAY CLAUSE — $XRP SPOT ETF NOW ON TRACK FOR NOVEMBER

'Dino' cryptos to soak up institutional funds bound for altcoins: Analyst

Price predictions 10/31: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, HYPE, LINK, BCH

Bitcoin and Ethereum Options Worth $16 Billion Set to Expire, Could Trigger Market Turbulence

Traders Anticipate Market Swings as $13.5 Billion in Bitcoin and $2.5 Billion in Ethereum Options Approach Expiration Date