The real highlight of last night's FOMC meeting: not rate cuts, but the halt of QT

The Federal Reserve announced a 25 basis point rate cut and halted quantitative tightening (QT), but the market experienced short-term panic due to Powell's hawkish comments regarding uncertainty over a rate cut in December. Bitcoin and Ethereum prices declined. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

Last night and this morning, the global crypto market perfectly staged a macro misreading.

Traders only heard Powell's hawkish "BGM," but ignored the fact that he actually loosened his grip on the "water valve."

The Federal Reserve delivered a double dovish gift of "a 25 basis point rate cut + stopping balance sheet reduction (QT)," and the market should have celebrated. However, just because of a few verbal warnings from Powell about "uncertainty in December," the market voted with its feet: Bitcoin briefly fell below $110,000, and Ethereum lost the $3,820 level.

Why did the market overlook the structural benefit of the valve being "loosened," and instead panic over a few verbal warnings?

"Fog": Data Black Box and Divided Hawks and Doves

Let's review this market misreading. There were two triggers: one was admitting internal division, and the other was emphasizing data uncertainty.

Powell, in a rare move, directly conveyed the committee's split. He stressed that a December rate cut is far from a done deal, and even unusually "guided" the market: "The market should not take a December rate cut as a certainty—the fact is, it is not."

This division is real. Last night's vote showed a three-way split: Governor Miran called for an aggressive 50 basis point rate cut, while Kansas Fed President Schmid opposed any rate cut. This hawk-dove battle stems from the Fed being pulled by opposing risks.

The FOMC statement and Powell's remarks both pointed to the same deadlock: a dilemma of rising inflation and declining employment.

- Upside risk: Inflation remains high.

- Downside risk: The risk of declining employment is rising.

Worse, the government shutdown led to missing September employment data, leaving the Fed blind. Powell himself used a metaphor: "If you're driving in fog, you slow down."

The crypto market hates uncertainty the most. When Powell broke the consensus on December easing and admitted to driving in the fog, short-term traders instinctively sold the news.

However, this was a typical knee-jerk reaction. The market was blinded by short-term suspense and ignored the real protagonist—the Fed's announcement to end QT.

The Real Protagonist: Why Must the "Hand on the Water Valve" Be Loosened?

A 25 basis point rate cut is routine, but ending QT is a far more significant structural shift.

What is QT? It's tightening the water valve. Over the past three and a half years, the Fed has been tightening the valve, draining $2.2 trillion in liquidity from the financial system—one of the key factors behind the deep correction in this round of the crypto market.

Now, Powell has personally loosened the valve that had been tightly shut.

Why loosen now? It's not to stimulate the economy. This is a defensive decision, not an aggressive easing.

Powell explained: the banking system's reserve levels have hit their set "ample" bottom line.

In other words: the pipes of the financial system have started to creak.

This judgment is not baseless, but has been confirmed by Wall Street. BofA analysts Mark Cabana and Katie Craig recently released an even more aggressive report: they believe the Fed will not only stop QT, but may even need to immediately "expand the balance sheet."

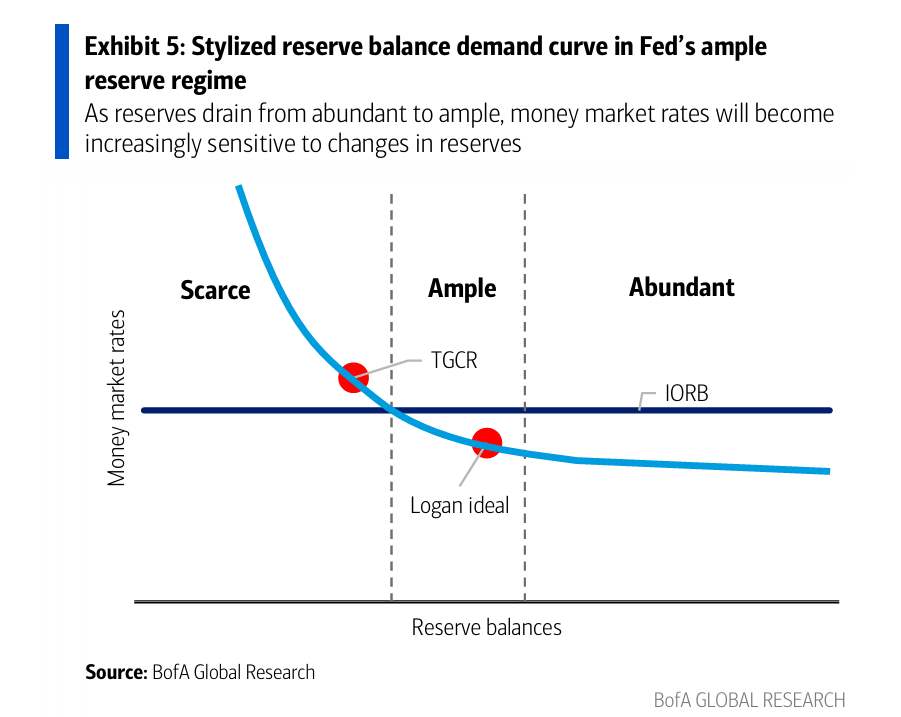

This chart from BofA (see above) perfectly explains Powell's "defensive pivot":

- This "reserve demand curve" shows that when reserves are in the "Abundant" region, money market rates (vertical axis) are flat and firmly anchored near the IORB (Interest on Reserve Balances).

- But as QT progresses, reserve balances (horizontal axis) move left into the "Ample" region. Here, the curve starts to steepen—rates become "increasingly sensitive" to reductions in reserves.

- The "warning signal" Powell mentioned (such as TGCR, the red dot in the chart) is the red light that comes on in this "Ample" zone. It warns the Fed that if they don't loosen up, the system will slide into the "Scarce" region—the steepest part of the curve, which would trigger a "liquidity crunch" crisis like in 2019.

The three warning signals Powell pointed out are exactly the "red lights" shown in this chart:

- Rising repo rates (TGCR)

- Increased use of SRF (Standing Repo Facility)

- Rising Effective Federal Funds Rate (EFFR)

For ordinary investors, these terms may seem distant. But for central banks, these are the engine's warning lights. It means interbank borrowing is getting harder, and the system's "lubricant" (reserves) is running low. Powell further noted that the tension in the past three weeks has clearly intensified.

This brings to mind the repo market crisis of September 2019. At that time, the Fed was also tightening the valve (QT), ignored warning signals, caused a "liquidity crunch," and was forced to make an emergency U-turn (switching to QE).

Last night, Powell learned from that lesson. He chose to loosen up before the pipes burst—stopping the monthly reduction of $5 billion in Treasuries and $35 billion in MBS. As BofA's report said, the Fed's move is to "avoid a repeat of the violent repo market swings of 2019."

Why Act Dovish but Talk Hawkish?

The biggest contradiction is: since the action (loosening the valve) is already a concession, why remain so tough in words?

Because he has to. Powell is trapped in a policy deadlock.

Imagine, if he had been doubly dovish last night (ending QT and promising a December rate cut), the market would have soared instantly, financial conditions would become extremely loose, and the anti-inflation efforts of the past two years would be wasted.

Therefore, Powell chose a split strategy:

- In action (ending QT): Bowing to financial stability, avoiding a repeat of 2019. This is the substance for insiders.

- In words (hawkish Q&A): Attacking inflation expectations, cooling the market by emphasizing uncertainty. This is the appearance for outsiders.

Powell tried to hedge dovish actions with hawkish words. His confidence comes from believing inflation is under control. He revealed a key data point: excluding tariff effects, core PCE is only around 2.3% to 2.4%—not far from the 2% target.

Unfortunately, the highly emotional and leveraged crypto market only understood the hawkish rhetoric, but misread the far-reaching significance of the dovish action.

In fact, BofA's report even predicts that the Fed's actions may go further than last night's "stop QT" announcement. They expect the Fed to soon launch the "Term Open Market Operations" (TOMO) used in 2019, injecting up to $500 billion in liquidity into the market through repo operations.

If this prediction comes true, it won't just be "loosening the valve," but "half-opening the water tap."

Drop First, Rise Later: The Tug-of-War Between Noise and Signal

The drop last night and this morning was a short-term reaction driven by "noise" (hawkish rhetoric). But as we've analyzed, the real "signal" (ending QT) points to a completely opposite long-term direction.

This tug-of-war between noise and signal clearly outlines the crypto market's "drop first, rise later" evolution path.

- Drop first (short-term): Driven by noise. Powell broke the market's complacency about a December rate cut. Before the data fog clears, market volatility will be amplified. As a high-beta asset, the crypto market is forced to seek safety in the short term and digest premiums. This explains this morning's drop.

- Rise later (mid- to long-term): Driven by signal. Ending QT is the clearest signal that this tightening cycle is over.

Whether it's Powell's "stop QT" or BofA's predicted "launch TOMO," the core fact is clear: The liquidity level has stopped falling, which is a structural mid- to long-term bottom support for all liquidity-dependent assets (especially Bitcoin).

Prelude to the Endgame: From "Defense" to "Easing"

Powell's defensive pivot is just halftime. He is now a "caretaker"—guarding against both a resurgence of inflation and a system collapse (he admitted to closely monitoring subprime credit defaults), trying to achieve a soft landing in the data fog.

But the market always looks ahead. Powell's balancing act cannot satisfy the appetite of a debt-driven economy. True super-easing—the next phase you mentioned—will not come from this Powell, who is haunted by the ghost of inflation.

The market has already started to look toward the next Fed chair. Regardless of who succeeds, their core task may shift from fighting inflation to serving fiscal needs.

When monetary policy loses its independence and becomes a money-printing machine for political will and fiscal deficits, that's the real stage for the crypto narrative. Like gold, Bitcoin exists to hedge against the inevitable fate of fiat systems.

For crypto investors, the key is to identify the signal amid the noise.

"Will there be a rate cut in December" is noise; "ending QT on December 1" is the signal.

Powell's hawkish fog is just a temporary cover for his dovish actions. When the market recovers from short-term panic, it will eventually realize: the valve that has been tightly shut and suppressed risk assets for nearly three years has truly been loosened.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interview with Aptos Foundation SVP: Four Major Ecosystem Strategies to Build the World's Fastest Dollar Circulation Network

Exploring the differentiated ecosystem layout of Aptos in the new cycle and competitive landscape of public blockchains, as well as its future growth strategies under the core vision of becoming a "global trading engine."

Crypto entrepreneurs can get rich without issuing tokens—who is paying for the bubble?

The founder is smiling, while investors are panicking.

From Trump to CZ, why are billionaires betting on prediction markets?

Power restructuring in probability games.