Bitcoin’s Lost Year

How Bitcoin and the crypto king have disappointed investors in 2025—and what it means for the market ahead

Despite all the hype around a potential Trump-era crypto boom, Bitcoin has underperformed almost every major asset class. If we look at Bitcoin’s 2025 so far, it’s been what I’d call a 失意之年 — a “year of disappointment.”

Since the U.S. inauguration in January, BTC’s return is only around 5.8%, while the Nasdaq and S&P 500 both delivered double-digit gains, and even gold, the classic safe-haven asset, outperformed by a wide margin.

Investors who expected a “Trump trade” lift are now facing reality: macro conditions, rotation into AI stocks, and persistent profit-taking have capped Bitcoin’s upside for most of the year.

The $100K Ceiling

The key question everyone’s asking is — why can’t Bitcoin break out?

The simple answer is that $100,000 has become a psychological take-profit zone. On-chain data shows that whenever BTC pushes above that threshold, we see a sharp rise in the spent volume of long-term holders — that’s blockchain speak for coins that haven’t moved in years suddenly being sold.

These are early adopters, whales, and long-term believers—they’re not panic-selling; they’re de-risking and rotating into other outperforming sectors like AI and tech equities. Every time Bitcoin crosses $100K, it triggers a wave of supply — not panic, but profit realization.

That creates a structural sell wall, making it very hard for the price to sustain new highs.

Exhausted Demand and Market Structure

The other side of the story is demand exhaustion. Bitcoin is now trading below the short-term holder cost basis — roughly $106,100 (as of 10/30) — and struggling to hold $110,000, which we refer to as the 0.85 quantile support level.

That matters because historically, when BTC fails to hold this zone, it often signals a deeper pullback — potentially toward $97,000, where the 0.75 quantile sits.

This is the third time we’ve seen this pattern in the current cycle: strong rallies, demand exhaustion, then prolonged consolidation.

In short, the market needs a reset. We’re not seeing new capital inflows at scale. Retail is quiet. Institutions are cautious. Without fresh demand, every rally fades faster.

Miners and Macro

Then there’s a double-sided pressure from miners and macro.

Let’s start with miners — post-halving, their profit margins are under strain. Many have had to liquidate part of their holdings to cover operating costs. Combine that with rising U.S. real yields earlier this year, and you get a backdrop where miners are net sellers instead of accumulators.

On the macro side, though, there’s a glimmer of relief with the September CPI coming in softer than expected, mainly because housing inflation eased.

That gives the Fed room to cut rates, in both October and December, which markets have now largely priced in.

If that easing cycle materializes, it could support risk sentiment later in Q4. But for now, the benefit hasn’t yet translated into Bitcoin strength — liquidity conditions remain tight, and capital is still chasing high-beta AI equities rather than digital assets.

Options Boom and Market Evolution

One big structural change this year is in derivatives. Bitcoin options open interest has reached a record high — and continues to grow. That’s actually a positive sign of market maturity.

It also changes behavior. Instead of selling spot Bitcoin, investors are now using options to hedge or to speculate on volatility.

This reduces direct sell pressure in the spot market — but it also amplifies short-term volatility. Every sharp move now triggers dealer hedging flows, which can exaggerate intraday swings.

We’re moving into a phase where price action is driven less by long-term conviction and more by derivative positioning — a sign that Bitcoin has become a fully financialized macro asset.

Where We Are in the Cycle

Putting it all together — this looks like a late-cycle consolidation phase. Long-term holders are de-risking, miners are selling, short-term buyers are underwater, and derivatives are dominating.

That combination usually leads to a long accumulation range before the next real move. Historically, Bitcoin thrives on cyclical resets — where weak hands exit, strong hands rebuild, and macro liquidity eventually returns.

We might just be in that rebuilding stage now.

The Path Forward

So what’s next? The $97K–$100K zone will be critical. If Bitcoin can hold that range through the next two Fed meetings, the setup for early 2026 looks strong — especially if rate cuts and fiscal expansion start to re-ignite risk appetite.

But if that floor breaks, we could see a capitulation-style flush before the next leg higher — much like the mid-cycle resets in 2019 and 2022.

As the industry evolves from a niche enthusiast market to a fully financialized macro asset class, reliable data is paramount. Our role is to provide institutional-grade metrics—from our liquidity scoring to the market cycle indicators we publish—that allow investors to distinguish noise from signal.

The takeaway: this is not a collapse — it’s a recalibration. Bitcoin’s underperformance this year isn’t about fundamentals — it’s about rotation, maturity, and the natural rhythm of a maturing asset class.

Once macro turns supportive again, we’ll see whether Bitcoin reclaims its role as the high-beta hedge of choice in global markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jensen Huang's fried chicken meal sends Korean "chicken stocks" soaring

Jensen Huang appeared at the Kkanbu Chicken restaurant in Seoul and had a fried chicken dinner with the heads of Samsung Electronics and Hyundai Motor, unexpectedly sparking a frenzy in Korean "meme stocks."

Will Solana's latest slogan ignite a financial revolution?

Solana is actively transforming "blockchain technology" into foundational infrastructure, emphasizing its financial attributes and capacity to support institutional applications.

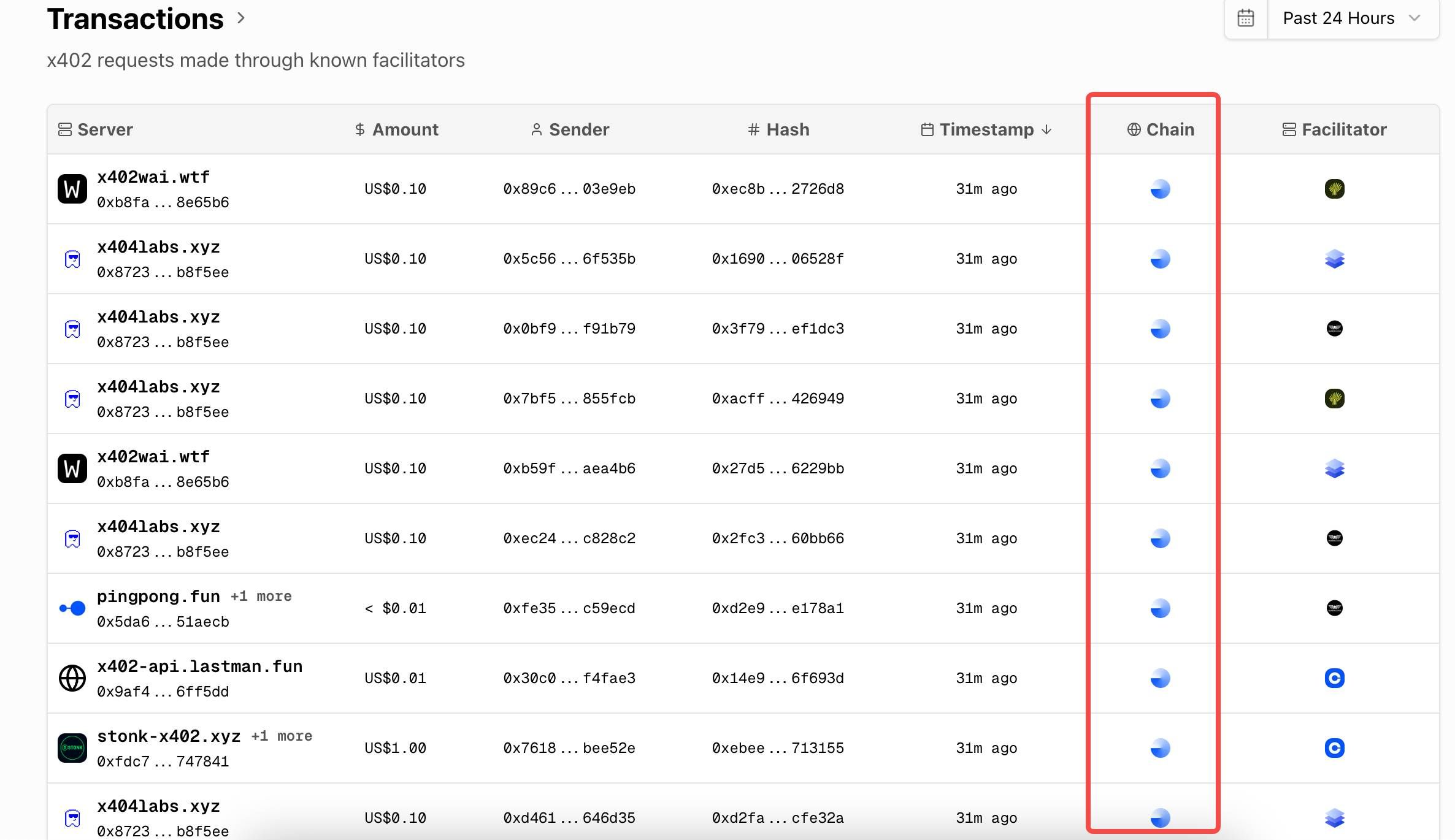

Where are the asset opportunities on BSC and Solana while x402 is booming on BASE?

We have reviewed the BNB Chain and Solana-related x402 projects currently on the market to help everyone better identify assets in this narrative cycle.

Sun Wukong's capital exceeds 100 millions! Innovative gameplay leads DEX resurgence, poised to become the new gateway for decentralized trading

The assets on the Sun Wukong platform have exceeded 100 millions. With its innovative user experience and ecosystem synergy, it is leading a new era of decentralized contract trading. Experts predict that the future will be characterized by the coexistence of DeFi and CeFi, but with decentralization taking the lead.