October 30th Key Market Information Gap, A Must-See! | Alpha Morning Report

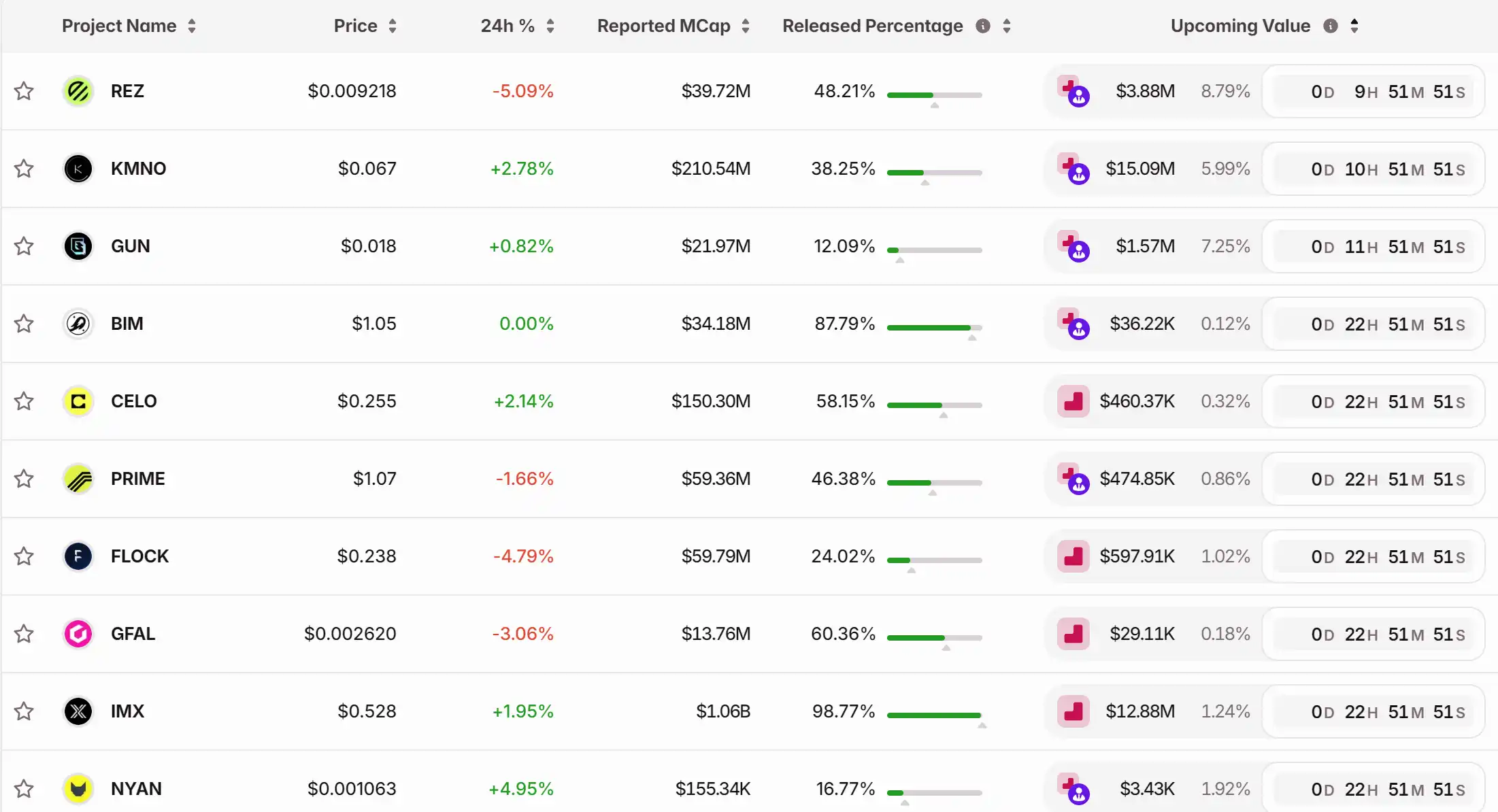

1. Top News: Powell's Hawkish Remarks, Bitcoin Drops Below $110,000, Ethereum Below $3,900 2. Token Unlock: $REZ, $KMNO, $GUN, $BIM, $CELO, $PRIME, $FLOCK, $GFAL

Top News

1. Powell's Hawkish Remarks Lead to Bitcoin Breaking Below $110K, Ethereum Below $3900

2. OpenAI Aims to Go Public in 2027 with Valuation Potentially Reaching $1 Trillion

3. BNB Expected to Cap Total Supply at 1 Billion, Current Circulating Supply Around 137 Million

4. MetaMask's Parent Company ConsenSys Hires JPMorgan and Goldman Sachs to Lead Its IPO

5. Cryptocurrency-Related Stocks See Mixed Performance After U.S. Market Open, Nasdaq Hits New Record High

Articles & Threads

1. "Chillhouse Leads the Rise Alone, The Past and Present of "Web3 Fun People""

The long-silent Solana meme hasn't been this lively in a long time, and it's happening in a way we can hardly imagine — Base Protocol's Jesse Pollak, renowned crypto influencer Cobie, Solana founder Toly, and pump.fun founder alon are "abstracting" each other over a Solana meme coin. Especially with the addition of the Base camp, there is a sense of "breaking the taboo" itself, and in the current environment where various chains are working vigorously to compete with each other, it has taken players by surprise.

2. "Best Market Performance in the Last Two Months of the Year? Should You Go All-In Now or Run?"

As October comes to a close, the crypto market seems to be showing some signs of an uptrend. Over the past two months, "caution" has almost become the theme of the crypto market, especially after experiencing the 10/11 crash. The impact of this major drop is slowly fading, and market sentiment does not seem to be deteriorating further but instead has found new hope. Starting from the latter part of the month, some signals of an uptrend have gradually emerged: net inflow data turning positive, altcoin ETF approvals in batches, and increased rate cut expectations.

Market Data

Daily Market Overall Fund Heat (reflected based on funding rates) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

China and U.S. Leaders Discuss Economic Cooperation

Mastercard Posts Strong Earnings, Yet Investors Scrutinize High Valuation

- Mastercard reported Q3 adjusted EPS of $4.38 and $8.6B revenue, exceeding analyst estimates driven by strong consumer spending and 25% growth in value-added services. - Cross-border payment volume rose 15% (local currency) and cardholder base grew 6% to 3.64 billion, with cyber security and agentic commerce initiatives highlighted as key growth drivers. - The company announced a potential $2B acquisition of crypto firm Zero Hash, signaling strategic shift toward digital assets amid broader payments secto

Hyperliquid News Today: HYPE Faces $50 Barrier: Large Investors Accumulate as November Unlock Approaches

- Hyperliquid's HYPE token nears $50 as whale accumulation, $3M daily burns, and strong derivative activity drive bullish momentum. - Technical indicators show fading RSI momentum and key resistance at $51.432, with $50 acting as critical psychological support. - Upcoming November unlocks pose $10M daily supply risks, but 31% unlocked base and $640M buybacks highlight ecosystem resilience. - DEX open interest surged to $9.4B with Bitcoin accounting for $3.3B, reinforcing HYPE's governance and incentive rol

With the interest rate cut implemented, how should we view the upcoming market trend?