Spartans Turns Crypto Gambling into a Live Blockchain Arena: Speed, Transparency, and Community Converge

- Spartans integrates crypto and blockchain to launch Crash Games and Live Game Shows, offering real-time, transparent gambling with 5,900+ games from 43+ providers. - Crash Games use provably fair algorithms for instant BTC/ETH/USDT settlements, while Live Game Shows blend casino gambling with broadcast-style communal play. - The platform’s crypto-native architecture enables instant transactions and CASHRAKE incentives, aligning with rising crypto gambling trends despite Ethereum’s recent volatility. - Sp

The world of online casinos is experiencing a major transformation as platforms such as Spartans adopt cryptocurrencies and interactive features to deliver engaging, real-time gaming. Moving past conventional slots and table games, Spartans has launched two innovative categories—Crash Games and Live Game Shows—that utilize blockchain to offer rapid gameplay, clear outcomes, and a sense of community. With more than 43 providers worldwide and over 5,900 games, Spartans is changing the way users engage with digital betting in a crypto-centric environment, as detailed in

While traditional casino games are based on fixed odds and solo play, Spartans has adopted algorithm-driven unpredictability and live data to craft more dynamic experiences. Crash Games, for example, require players to cash out before a multiplier drops, combining elements of risk and quick decision-making. The straightforward gameplay—wager $10, exit at 3× to win $30—conceals the sophisticated use of provably fair algorithms and instant blockchain confirmation, as described by the Live

Live Game Shows, on the other hand, blend casino play with elements of live entertainment. Participants join group sessions led by hosts, featuring spinning wheels, multipliers, and bonus rounds. Unlike traditional Live Dealer games, these shows encourage collective excitement, using chat and crypto rewards to create a “broadcast event” for hundreds of players at once, as noted in the Live Bitcoin News article. This style mirrors a wider industry movement toward social gaming, where play is a shared activity rather than a solitary pursuit.

Spartans’ crypto-focused design is a key part of its popularity. By supporting instant crypto deposits and withdrawals and providing transparent odds, the platform removes the delays found in standard payment systems. For instance, a Crash Game bet is settled immediately in cryptocurrency, while Live Game Shows use blockchain to confirm fairness on the spot, as the Live Bitcoin News article points out. This system is backed by over 43 providers, including well-known brands like

The platform’s growth is also driven by its CASHRAKE rewards system, which encourages ongoing play by consistently returning value on bets. This, along with a mobile-optimized interface and support for multiple languages, has helped Spartans become a top name in global crypto gaming, as the TimesTabloid report states. As the

Spartans’ advancements are in step with the rise of crypto-based financial tools, from 21Shares’ Hyperliquid HYPE ETF to innovative fundraising mechanisms in the digital asset space. These trends point to a maturing sector where reliability and speed are crucial. Yet, regulatory issues remain, as shown by an

For Spartans, the popularity of Crash and Live Game Shows marks a move away from repetitive gameplay toward interactive, community-focused entertainment. As more platforms turn to crypto technology, the distinction between gaming and financial innovation continues to

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

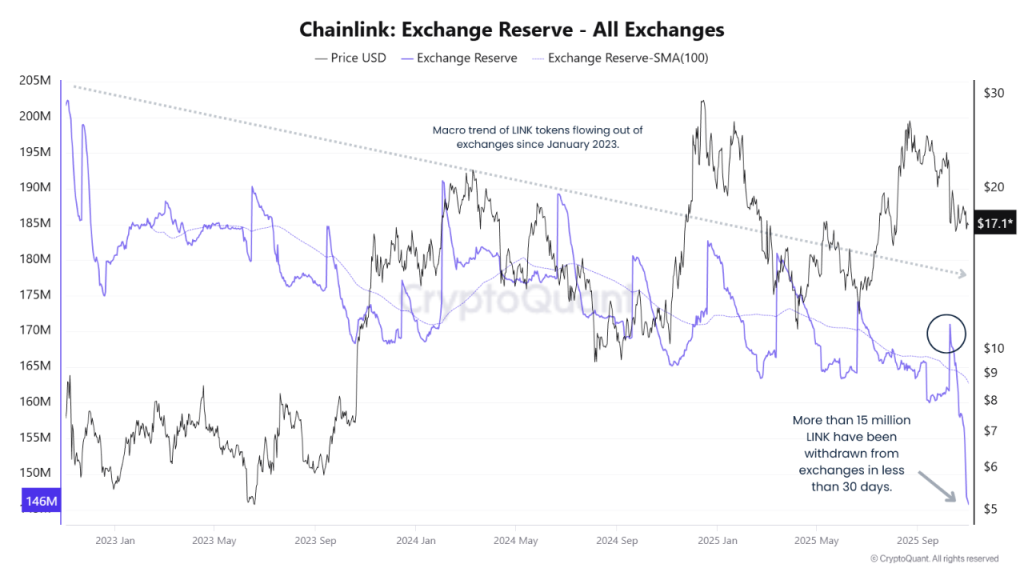

Chainlink Price Prediction 2025: Rising Institutional Adoption Eyes $100 Target

DeFi Faces Confidence Challenges: External Mismanagement Reveals Deep-Rooted Vulnerabilities

- Stream Finance halts deposits/withdrawals after $93M loss from third-party mismanagement, triggering XUSD depegging and systemic risks. - Perkins Coie investigates, highlighting DeFi governance flaws as XUSD’s 58% 24-hour drop impacts $280M in linked loans. - Industry warns of trust fragility; incident coincides with Balancer’s $116M hack, amplifying crypto sector scrutiny. - Stream’s crisis underscores risks in DeFi’s reliance on external managers amid broader economic pressures and regulatory tightenin

Solana Latest Updates: Bitcoin Falters, Solana Shows Uncertainty While MoonBull's Tokenomics Spark November Rally

- Bitcoin fell below $116,000 in late October amid cautious positioning before the Fed meeting, with on-chain metrics showing stable miner holdings. - Solana dropped 6% after Jump Crypto swapped $205M SOL for BTC, highlighting altcoin volatility despite $100B+ market cap support from ETF approvals. - MoonBull ($MOBU) surged 163% in presale with 95% APY staking, leveraging deflationary tokenomics and meme-driven adoption to outpace BNB/AVAX in 2030 ROI forecasts. - Institutional crypto infrastructure deals

Tokenized Treasuries Reach $8.7 Billion as Authorities and Competing RWA Platforms Draw Near

- Tokenized U.S. Treasuries surpassed $8.73B AUM, driven by institutional demand and yield seekers, with BlackRock and Securitize leading the market. - Regulatory scrutiny intensifies as CFTC and Hong Kong tighten oversight, while RWA rivals like tokenized gyms and education assets challenge treasury dominance. - Liquidity constraints and redemption restrictions persist, but ISO 20022 blockchain integration signals progress toward bridging TradFi and digital finance. - Market growth faces hurdles including