India’s no-cost digital payments boom has transformed the way funds are transferred, but it hasn’t changed how fintechs generate revenue. Now, Flipkart’s financial services branch, Super.money, is teaming up with Kotak811—the digital platform of leading Indian bank Kotak Mahindra Bank—to change that. Their collaboration merges UPI payments, savings, and secured credit into a unified account designed to turn user activity into earnings.

The goal of this alliance is to distribute approximately 2 million secured credit cards within the next year—about 60% of which will go to individuals new to borrowing—and reach 5 million cards in two years. Super.money, which already boasts 10 million active users, anticipates that its partnership with Kotak will account for nearly 10% of its revenue next year as it targets profitability by 2026, according to CEO Prakash Sikaria.

The government-supported Unified Payments Interface (UPI) has made instant, free bank transfers the norm in India, handling over 19 billion transactions monthly. However, this widespread adoption has left fintechs with few ways to earn, since regulators—including the finance ministry—prohibit merchant fees that typically fund rewards and credit products. Super.money’s approach—leveraging secured cards and savings accounts to bring back incentives—could serve as a model for profitable businesses built on zero-fee payment rails.

“We don’t use UPI just to address basic payments,” Sikaria explained to TechCrunch. “Our strategy is to use UPI as a foundation for a broader suite of financial services, helping us attract and keep users.”

Debuting in June 2024 as Flipkart’s newest fintech initiative after spinning off PhonePe in late 2022, Super.money is already pulling in about $3 million in monthly revenue, with an annualized rate near $36 million, Sikaria said.

In recent months, the Super.money app has become one of India’s top five UPI platforms, processing over 200 million transactions each month for four consecutive months, according to the National Payments Corporation of India.

Currently, about 80% of Super.money’s income comes from personal loans, 10% from credit cards, and the remaining 10% from payment services like bill payments and mobile recharges. The company reports an 85% user retention rate, with 60–70% of transactions coming from customers under 30 years old.

Sikaria pointed out that Super.money’s revenue model relies on two main streams. “The first is our financial services—loans, cards, deposits, and similar offerings—and the second is commerce,” he said. “We aim to introduce a Klarna-like ‘pay-in-three’ feature for shopping, enabling customers to buy now and pay later within the Super.money platform.”

By partnering with Kotak Mahindra Bank, India’s fourth-largest bank by market value, Super.money gains access to a robust, regulated banking network. This follows an earlier collaboration with Utkarsh Small Finance Bank to offer secured cards, signaling Super.money’s entry into mainstream retail banking.

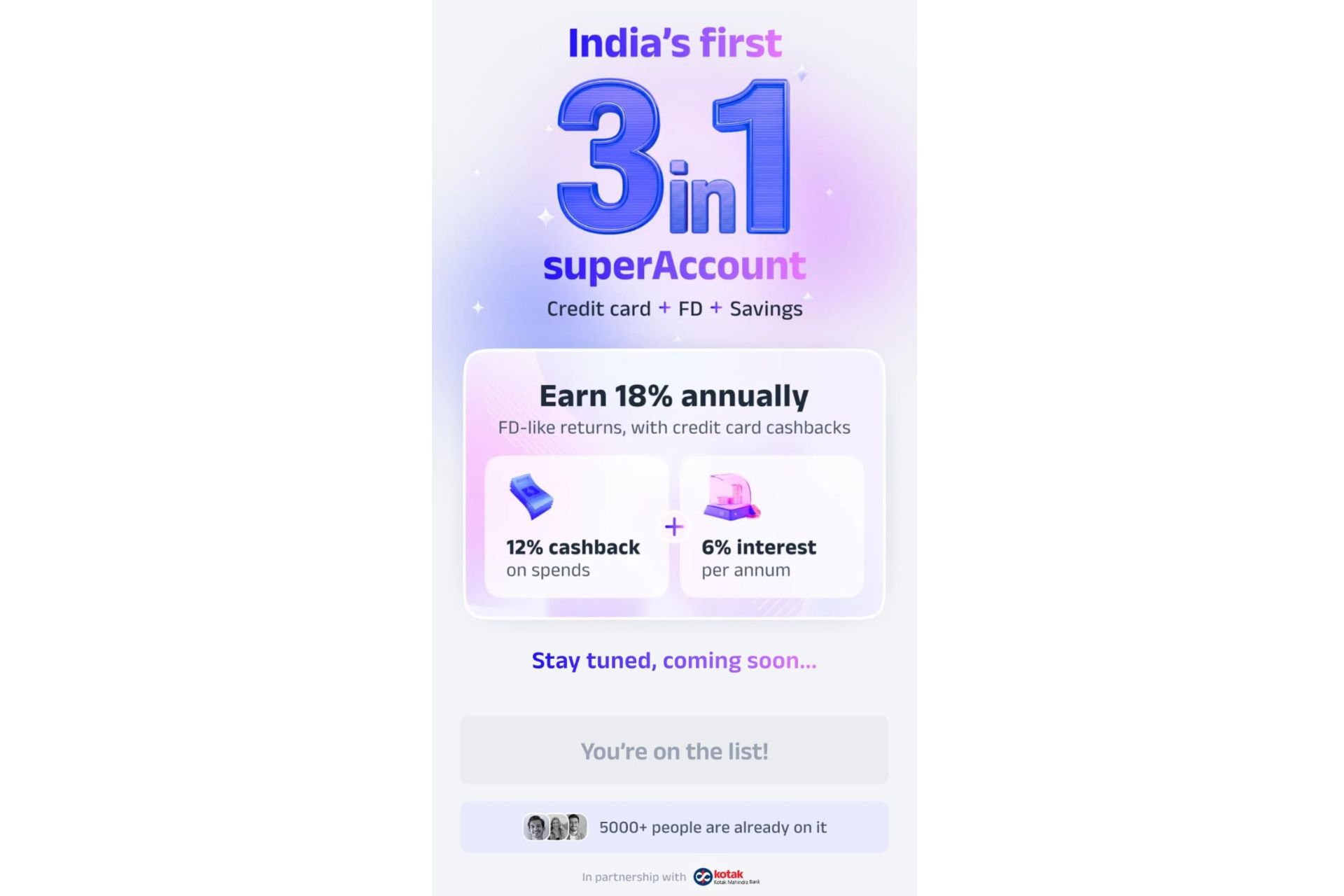

The joint effort brings a “3 in 1 Super Account” to market, which combines a savings account, UPI payments, and a secured credit card backed by a fixed deposit, aiming to broaden credit access for those new to borrowing.

Image Credits:Super.money

Image Credits:Super.money

To set up a 3-in-1 Super Account, users must make a fixed deposit of at least ₹1,000 (around $11). This deposit earns interest, and every transaction earns cashback. The account also features a UPI-on-credit option—a credit line secured by the deposit, with no income documentation required.

Sikaria told TechCrunch that secured cards were chosen as the flagship product because they fit within India’s fee-free UPI ecosystem while still enabling rewards and cashback, which the UPI system wasn’t originally designed to support.

“We’re targeting users who are more likely to engage with our offerings,” he said. “UPI is our main tool for attracting and retaining customers, but for those uninterested in our financial services or other products, we don’t aim to serve them just for payments.”

The Kotak Mahindra Bank partnership follows Super.money’s recent collaboration with Juspay, backed by SoftBank, to launch a one-click checkout for online sellers, mainly targeting direct-to-consumer brands.

Roughly 1,000 merchants are already using this solution, and Super.money intends to grow this network by partnering with more D2C brands and other Flipkart group companies, Sikaria said.

According to Sikaria, the secured card generates revenue from merchant discount fees on transactions, which is then used to fund cashback rewards. “We also charge a standard acquisition fee to our partner bank, which adds to our revenue,” he said.

Super.money plans to issue about 200,000 secured cards each month through its Kotak partnership before expanding to additional banks, Sikaria said.

To date, Flipkart has invested roughly $50 million to launch Super.money. As the company grows, it plans to seek further funding, potentially from outside investors as well.

“We’ll need more capital for at least the next couple of years,” Sikaria said. “We’ll soon begin working on our fundraising strategy.”

He did not specify whether the next funding round would come from Flipkart or external sources, but mentioned that Super.money is attracting significant interest from investors.

Meanwhile, Sikaria said the company is keeping its spending in check, describing its current monthly cash burn as “a low single-digit million figure,” without giving exact numbers.

He also noted that Super.money is intentionally focusing on India’s top 10 to 30 million users, rather than competing with mass-market payment apps like Google Pay or PhonePe, which target hundreds of millions.

“Our aim is to build a strong secured card business with a profitable bottom line—for us, our banking partners, and our customers,” Sikaria said.