While the market was still anticipating the continuation of the "100% win rate myth," savvy whales had already begun to proactively scale back their positions, locking in some profits safely.

![[100% Win Rate Whale] Actively Reduces Positions and Takes Profits! image 0](https://img.bgstatic.com/multiLang/image/social/efa32f55b50c96d94d3eeb6f771494b91761709326347.png)

I. Full Record of Position Changes: Tactical Shift from Aggressive to Conservative

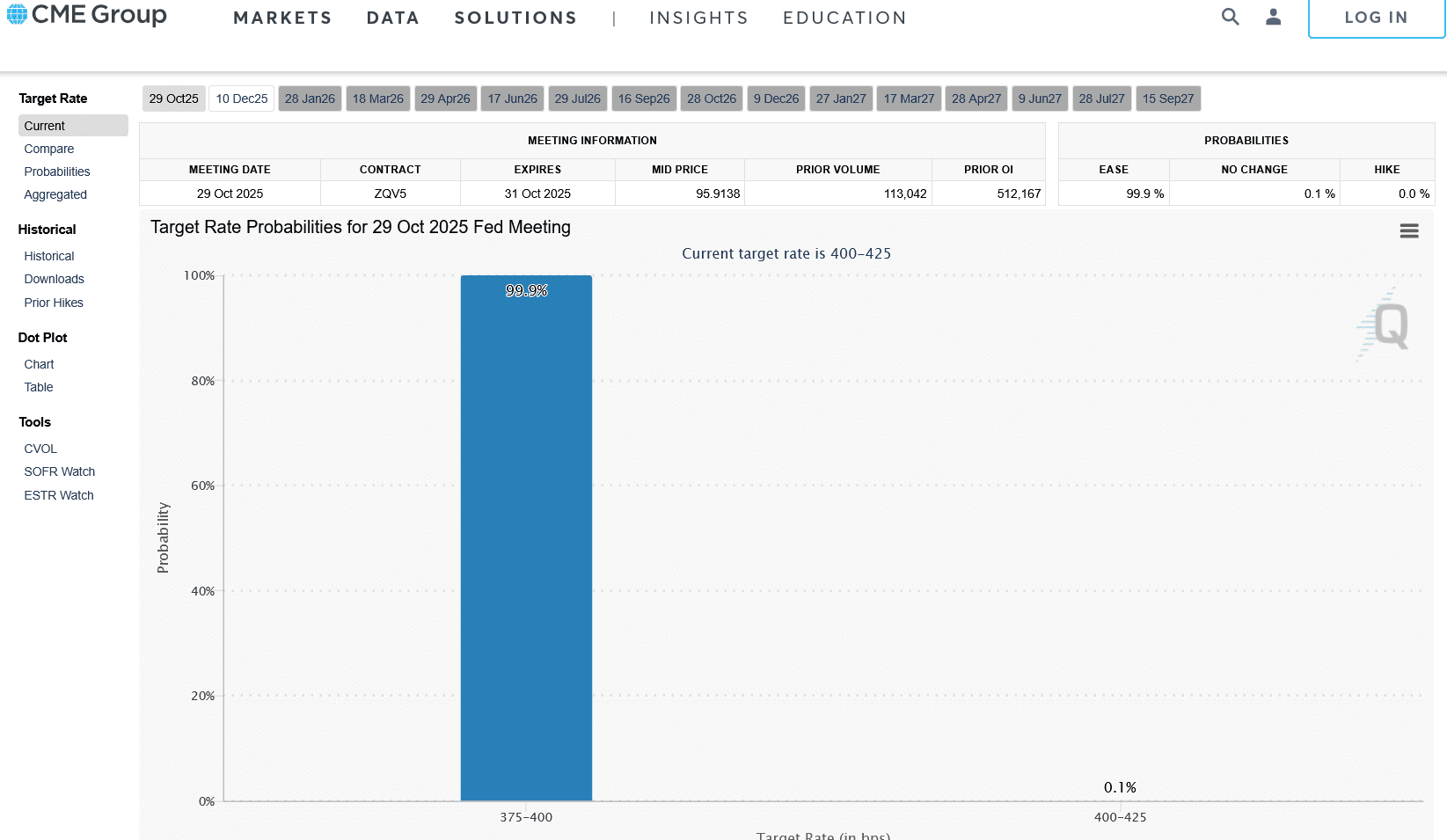

On October 29, 2025, the cryptocurrency market witnessed a key strategic adjustment. According to real-time monitoring by HyperInsight, the well-known whale address (0xc2a...5f2), which had previously maintained a "100% win rate," decisively closed its 13x leveraged BTC long position today after 14 consecutive profitable trades.

Table 1: Key Whale Operations Timeline in October

Date | Operation | Position Value | P&L Status |

October 15 | Started large BTC short positions | Not disclosed | Not disclosed |

October 16 | Reversed to establish BTC long positions | Not disclosed | Not disclosed |

October 17-21 | Continued to increase BTC and ETH positions | Not disclosed | Not disclosed |

October 22 | Closed all long positions | Not disclosed | Profit of $6.04 million |

October 22-23 | Switched to BTC short positions | Not disclosed | Not disclosed |

October 24 | Closed all long positions | Not disclosed | Profit of $1.774 million |

October 26 | Continued to increase positions | Total long positions nearly $300 million | Not disclosed |

October 28 | Added 41.68 BTC | $237 million | Not disclosed |

October 29 | Closed BTC long position | $250.7 million | Profit of $1.4 million |

The timing of this operation is quite meaningful. Within 24 hours before closing, the floating profit of this position once reached $14 million, but the whale chose to exit decisively when the profit retraced to $1.4 million, demonstrating strict risk control discipline.

Table 2: Overview of Current Whale Positions (as of October 29)

Asset | Leverage | Position Value | Entry Price | Current Status | P&L Status |

BTC | 13x | $250.7 million | Not disclosed | Closed | Profit of $1.4 million |

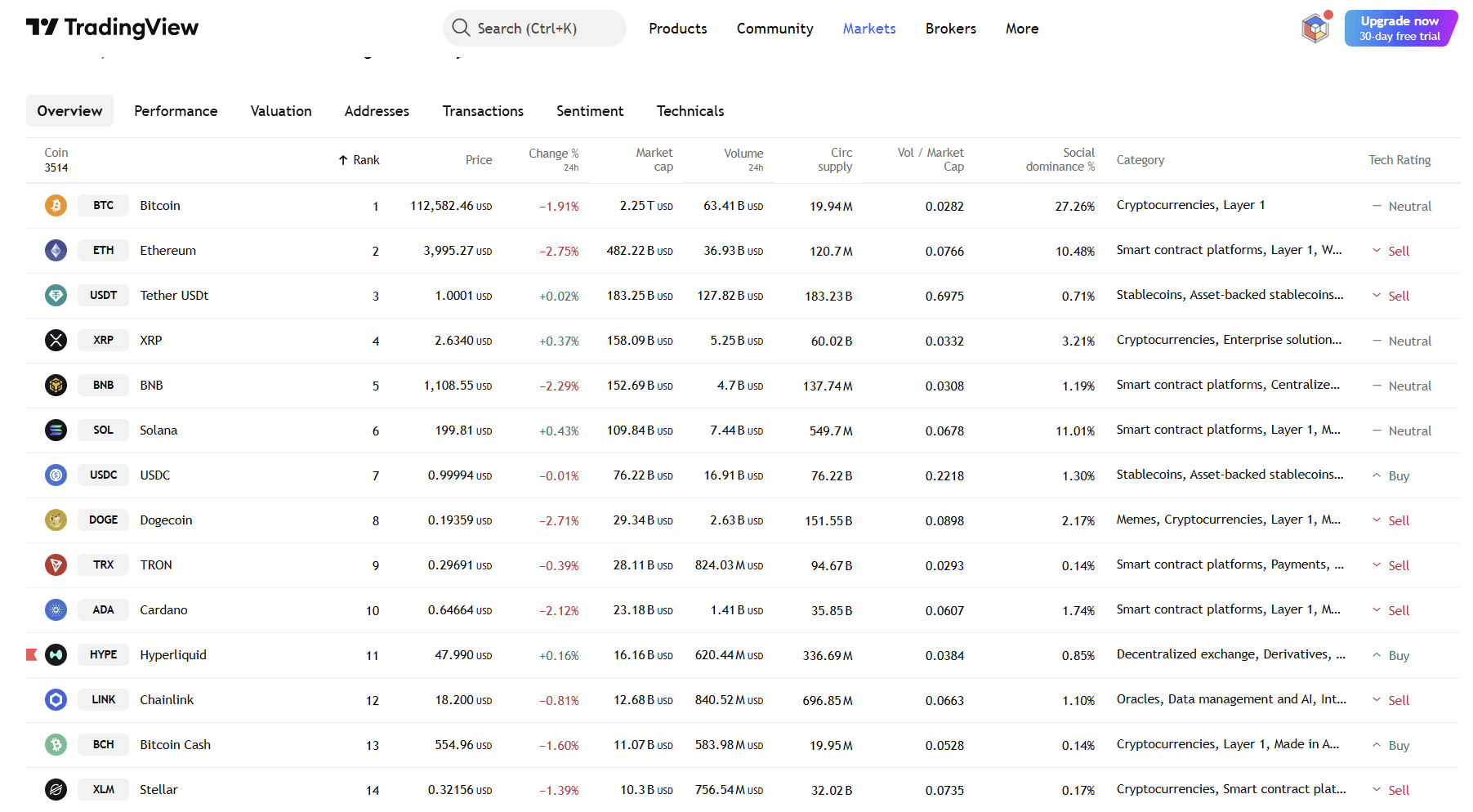

ETH | 10x | $189 million | $3,965.94 | Holding | Floating profit of $240,000 |

SOL | 10x | $74.19 million | $198.3751 | Holding | Floating loss of $1.71 million |

It is worth noting that although the BTC long position has been closed, the whale shows a completely different attitude towards its altcoin positions. The ETH long position, despite a significant retracement from its peak floating profit, remains in profit; while the SOL long position, despite a floating loss of $1.71 million, is also being held. This "selective holding" reflects the whale's differentiated investment logic and time frame for different types of digital assets.

II. Chain Reaction: Ripple Effects of Whale Position Adjustments on the Market

1. The Dilemma and Real Lessons for Copy-Trading Retail Investors

● The "myth" of the whale has attracted a large number of retail investors to imitate, but reality is full of contrasts. Latest monitoring by on-chain analyst Ai Yi (@ai_9684xtpa) shows a dramatic contrast: on one hand, a trader copying the whale closed out their position in less than 24 hours, incurring a cumulative loss of $1.061 million; on the other hand, an "opposing address" targeting the whale's moves achieved a floating profit of $2.68 million in the same period by precisely shorting against the whale.

2. Exchange Liquidity Faces Short-Term Test

● The whale's $250 million-level position closure directly tested exchange liquidity. According to DeFillama data, during the execution of the closing operation, the BTC/USDT bid-ask spread on major exchanges widened to more than three times the normal market conditions.

● "Position adjustments of this scale will trigger short-term price fluctuations even on the deepest exchanges." The HyperInsight research team analyzed in their morning report, "If the whale subsequently makes similar moves on its ETH and SOL positions, it could trigger cross-asset resonance and downside risk."

3. High-Leverage Strategies Face Market Reassessment

● The fading "100% win rate" label has led the market to reassess the rationality of high-leverage trading. On one hand, the whale's use of 13x leverage to amplify returns was seen as "mythical"; on the other hand, once the market moves in the opposite direction, high leverage also accelerates the accumulation of floating losses.

III. How Are Market Participants Interpreting This Position Adjustment?

• On-chain Analyst "Ai Yi"

"Whales have the advantage of capital scale and lower entry costs, which ordinary investors cannot replicate," Ai Yi pointed out. "When retail investors spot whale positions via on-chain monitoring, they have often already missed the best entry point, which dooms copy-trading to a natural disadvantage."

• HyperInsight Research Team

"The whale's position adjustment reflects concerns about short-term market volatility, but retaining ETH and SOL positions shows that the medium- to long-term bullish logic remains unchanged. We believe this move should be interpreted as a tactical adjustment rather than a strategic shift. Market participants need to pay more attention to macro policies and liquidity changes, rather than over-interpreting the actions of a single entity."

• AiCoin Viewpoint

"'100% win rate' is a narrative label under specific market conditions, and the current floating losses in some positions reveal the fragility of high-leverage strategies. Investors should prioritize position management over blindly following myths. Notably, even this whale, hailed as an 'ever-victorious general,' adopted a strategy of diversification (BTC, ETH, SOL) and partial profit-taking, which is worth learning from for all investors."

IV. Risk Warning: Signals Investors Need to Watch Out For

1. Potential Risk of Chain Liquidations

● The whale and many copy-traders still hold substantial high-leverage long positions, which could trigger forced liquidation by exchanges if the market continues to decline.

● The whale's SOL position (floating loss of $1.71 million) is facing a severe test. Its liquidation line is close at $178, like a sword hanging overhead—if SOL drops another 6%, it will hit the forced liquidation point. Investors must be alert to the risk of chain liquidations and closely monitor the support strength of ETH at $3,800 and SOL in the $185 to $178 range.

2. The Time-Lag Trap of Information Asymmetry

● There is a natural time lag when retail investors obtain whale activity via on-chain monitoring, often causing them to buy in at relatively high points. The losses of some copy-traders this time are clear evidence—when retail investors see whales building positions, the best entry timing has already passed.

● On-chain data should be a tool for market analysis, not the sole basis for investment decisions. Blindly following 'whale' moves without understanding the logic behind them can easily make one the "bag holder" in the market.

V. How Will Market Sentiment Shift?

●Everyone's attention is focused on a key question: Will this whale continue to increase ETH and SOL positions, injecting confidence into the altcoin market, or choose to further close positions, triggering broader risk-off sentiment? This uncertainty itself has become an important variable affecting short-term market sentiment.

● While taking profits on BTC longs, the whale chose to retain ETH and SOL positions—even though the latter are currently at a floating loss. This "trimming the fat and keeping the lean" rather than "full retreat" operation suggests that the underlying bullish logic for cryptocurrencies remains intact, and the current adjustment is more of a tactical risk control than a strategic directional shift.

● For ordinary investors, the era of blindly copy-trading may be over. How to stay calm during market frenzy, how to manage risk through diversified asset allocation, and how to decisively take profits even when floating gains retrace—these risk control disciplines and asset allocation wisdom are the real moat for surviving market cycles.

![[100% Win Rate Whale] Actively Reduces Positions and Takes Profits! image 1](https://img.bgstatic.com/multiLang/image/social/52eed9591728ec130e16506598060c101761709326958.png)