Ethereum Trades Steadily Amidst Lack of Fresh Updates

- Ethereum trades in a narrow range with limited volatility.

- No major developer or leader statements in recent days.

- Institutional interest in Ethereum remains substantial.

Ethereum’s market trading remains stable around $3,942 to $3,946 as of October 25, 2025, with low volatility reported across major exchanges such as Binance and Kraken.

Institutional demand continues for Ethereum, yet lacks direct confirmation from primary sources, highlighting the need for primary data access in market analysis.

Ethereum is currently trading around $3,942 to $3,946 with limited price action. Despite trading stability, no significant public statements or strategic updates have been made by influential figures, such as Vitalik Buterin, or core Ethereum developers recently.

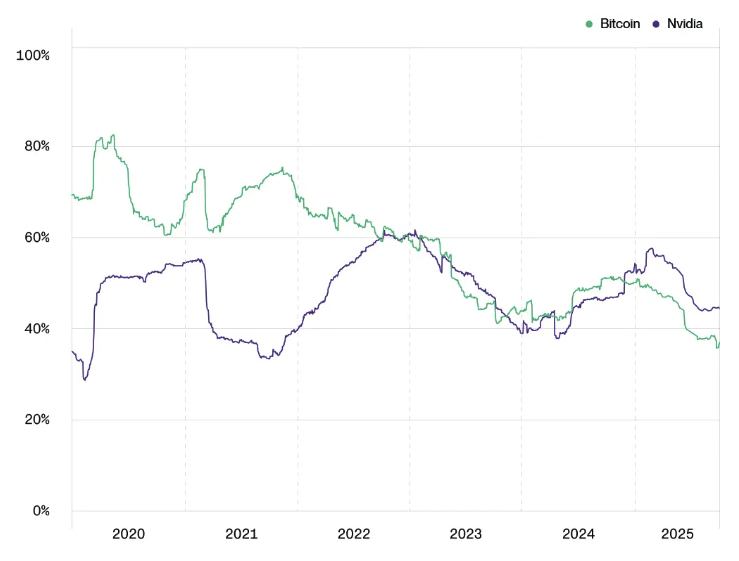

Ethereum’s continued trading within this narrow price range highlights the subdued market activity. Institutional demand appears strong, with ETFs on Ethereum witnessing increased inflows compared to Bitcoin. These patterns show a clear distinction in market interest.

In the broader cryptocurrency sector, Ethereum’s stable position reflects on market participants. While daily transaction volumes hold steady, the absence of major price catalysts results in a minimal impact on either side of the spectrum.

Financially, technical analysis suggests Ethereum finds support between $3,900 and $3,920 with $3,950 to $3,960 acting as short-term resistance. Long-term holders continue to monitor these levels in the absence of direct market triggers.

On the regulatory front, there is no current movement by key agencies like the SEC or CFTC. Ethereum’s near-term future seems unaffected by new policy that could alter its trading dynamics.

Data on investor behavior shows significant inflows into Ethereum , especially among institutions. Historical trends correlate ETH price rises with technology updates and resurgent interest following market corrections, predicting possible upward movements.

“The ETH price analysis indicates that the asset is poised for a breakout amid strong market demand.” – Source: CryptoAdventure

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitwise CIO says bitcoin will break 4-year cycle and set new all-time highs in 2026

Attention Metamask Users! The Long-Awaited Bitcoin (Btc) Announcement Has Finally Arrived!

Bitcoin Holdings Rise as Strategy Buys 10,645 BTC, Reaching 671,268 BTC Total Amid Market Pullbacks

US Spot XRP ETF Reaches $1 Billion in Inflows as Institutional Demand for Non-BTC/ETH Assets Surges