Hyperliquid News Today: DeFi Bets $1 Billion—Will New Ideas Withstand Cyber Risks and Regulatory Pressure?

- Hyperliquid allocates $1B to expand its decentralized financial stack, integrating spot trading, smart contracts, and NFTs. - OpenSea launches SEA token with 50% revenue buybacks, while NFT platforms like Pudgy Penguins diversify into gaming and digital collectibles. - North Korea's $1.65B crypto heists highlight geopolitical risks, with stolen funds funding WMD programs and exposing global cybersecurity gaps. - USD.AI tokenizes Nvidia GPUs as NFTs to democratize AI compute access, offering 13-17% yields

The DeFi and NFT sectors are experiencing major changes as platforms such as Hyperliquid and OpenSea announce bold growth strategies, and new financial frameworks and geopolitical risks reshape the digital asset environment. Hyperliquid, a prominent player in decentralized perpetual trading, plans to invest $1 billion to drive its upcoming expansion, aiming to bring together spot trading, smart contract functionality, and NFT features within a single system, as reported by

At the same time, NFT trading platforms are adjusting their approaches in response to evolving market trends. OpenSea, the leading NFT marketplace, revealed plans to launch its SEA token in the first quarter of 2026, with half of the initial proceeds set aside for buybacks, according to

Geopolitical threats are intensifying, particularly as North Korea increases its cyber thefts. The country reportedly stole $1.65 billion in crypto assets between January and September 2025, including a $1.4 billion hack at Bybit, with the stolen money directly supporting weapons programs, according to a

Despite these obstacles, innovation in tokenized infrastructure is accelerating. USD.AI, a DeFi platform, is connecting crypto investors to real-world Nvidia AI GPUs. By turning GPUs into NFTs and providing yields of 13-17% from rental income, the platform seeks to make AI computing resources more accessible, as detailed by

This reflects a broader movement toward using NFT ownership for governance and financial rewards, a tactic increasingly embraced by DeFi initiatives to align community interests.

As the digital asset space matures, participants must weigh the benefits of innovation against the need for security. North Korea’s cyber activities and the instability of AI-powered financial models highlight the importance of strong regulations and cooperation across industries. For now, platforms like Hyperliquid and USD.AI are pushing the limits of decentralized finance, as the market prepares for a period of heightened complexity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Meme Coin Battle: Excitement Versus Practical Use in the Quest for Supremacy

- Meme coin investors shift focus to Layer Brett ($LBRETT), an Ethereum L2 project combining meme appeal with utility, as Dogecoin (DOGE) ETF delays stall its momentum. - Pepe Coin (PEPE) struggles to sustain engagement despite social media-driven surges, lacking infrastructure for long-term on-chain activity. - Layer Brett offers low fees, instant transactions, and 590% APY staking, attracting $4.4M in pre-sales amid DOGE's 17% three-month price drop. - Shiba Inu (SHIB) retains brand strength but faces sc

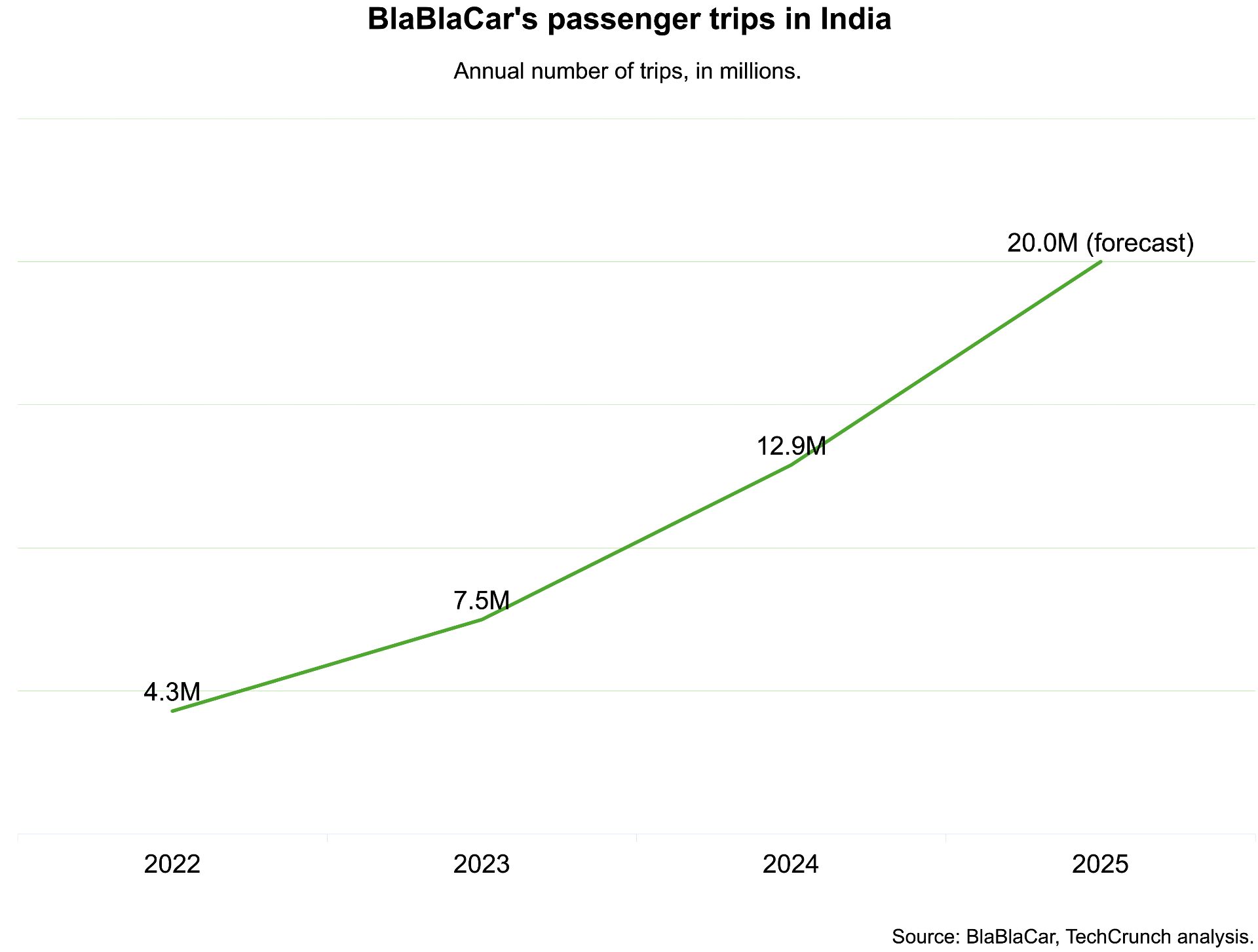

India, which BlaBlaCar previously exited, has now become its largest market

TechCrunch Mobility: The debate over the ‘robot army’