Ferrari plans to launch the "Token Ferrari 499P" and auction the Le Mans champion racing car through crypto.

BlockBeats News, October 25, according to Reuters, Ferrari (RACE.MI) is entering the cryptocurrency market by planning to launch a new type of digital token, aiming to attract tech-savvy younger generations. Its wealthiest fans will be able to use this token to participate in the auction of a Ferrari 499P—a endurance race car that has won the Le Mans championship for three consecutive years.

Currently, the scale of this plan remains relatively limited. The Italian luxury sports car manufacturer aims to follow the trend of luxury brands to reach a group of young tech entrepreneurs who have rapidly accumulated wealth due to the AI and data center boom.

Following Ferrari's move in 2023 to accept Bitcoin, Ethereum, and USDC as payment for car purchases in the United States, and the expansion of this service to Europe last year, this initiative further demonstrates its active embrace of emerging technologies and digital assets.

Ferrari is working with Italian fintech company Conio to launch the "Token Ferrari 499P" for its "Hyperclub" members—a club composed of 100 of the most unique and endurance racing-loving clients. Members can trade tokens internally and use them to bid for this race car. The project is scheduled to officially debut at the start of the 2027 World Endurance Championship season.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: If ETH falls below $3,747, the cumulative long liquidation intensity on major CEXs will reach $1.302 billion.

Trending news

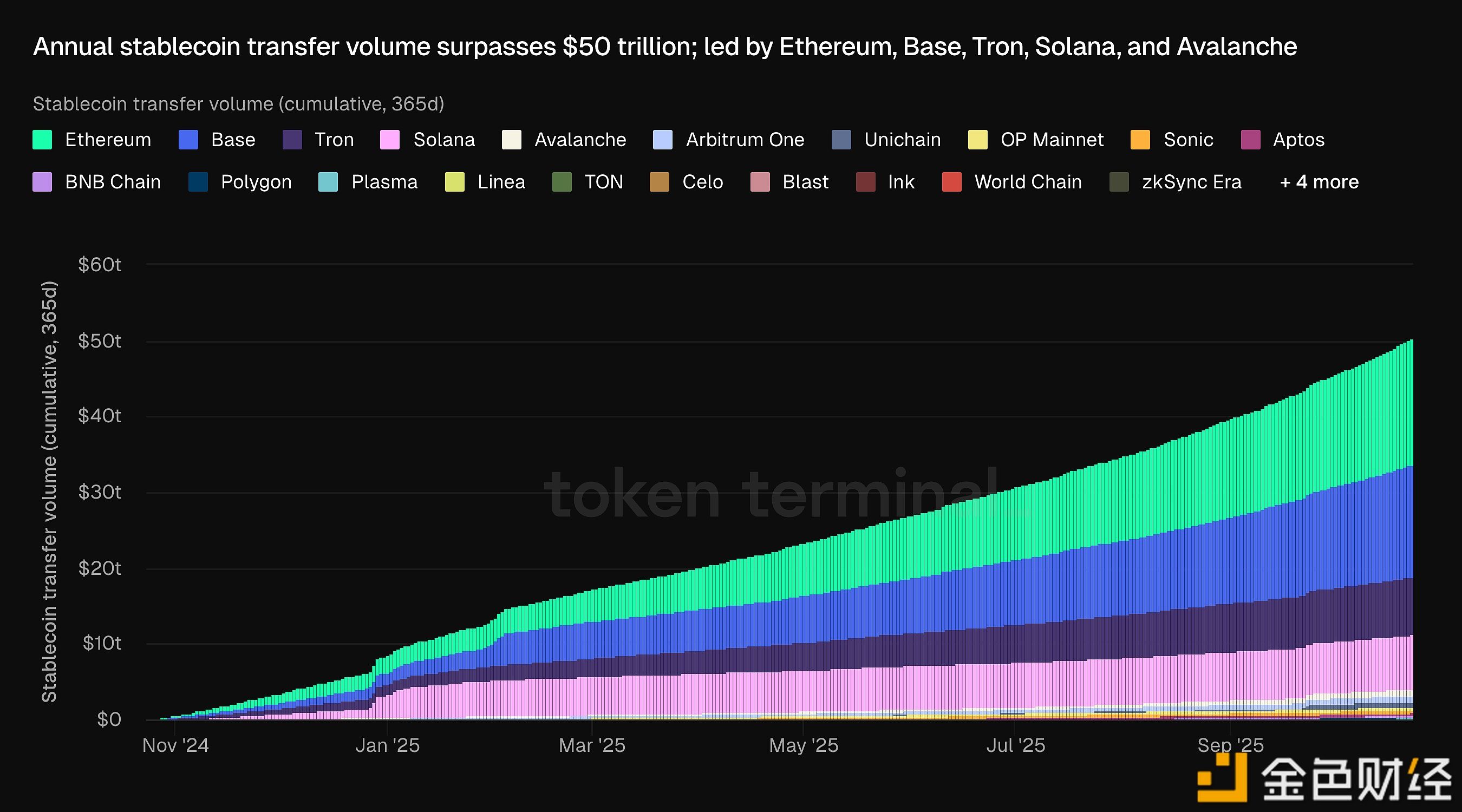

MoreData: Annual stablecoin transfer volume surpasses $50 trillion, with Ethereum and Base ranking as the top two transfer networks

Data: In the past 24 hours, total liquidations across the network reached $127 million, with long positions liquidated for $55.43 million and short positions liquidated for $71.97 million.