Will XRP Break Its Downtrend as Inflation Cools Slightly?

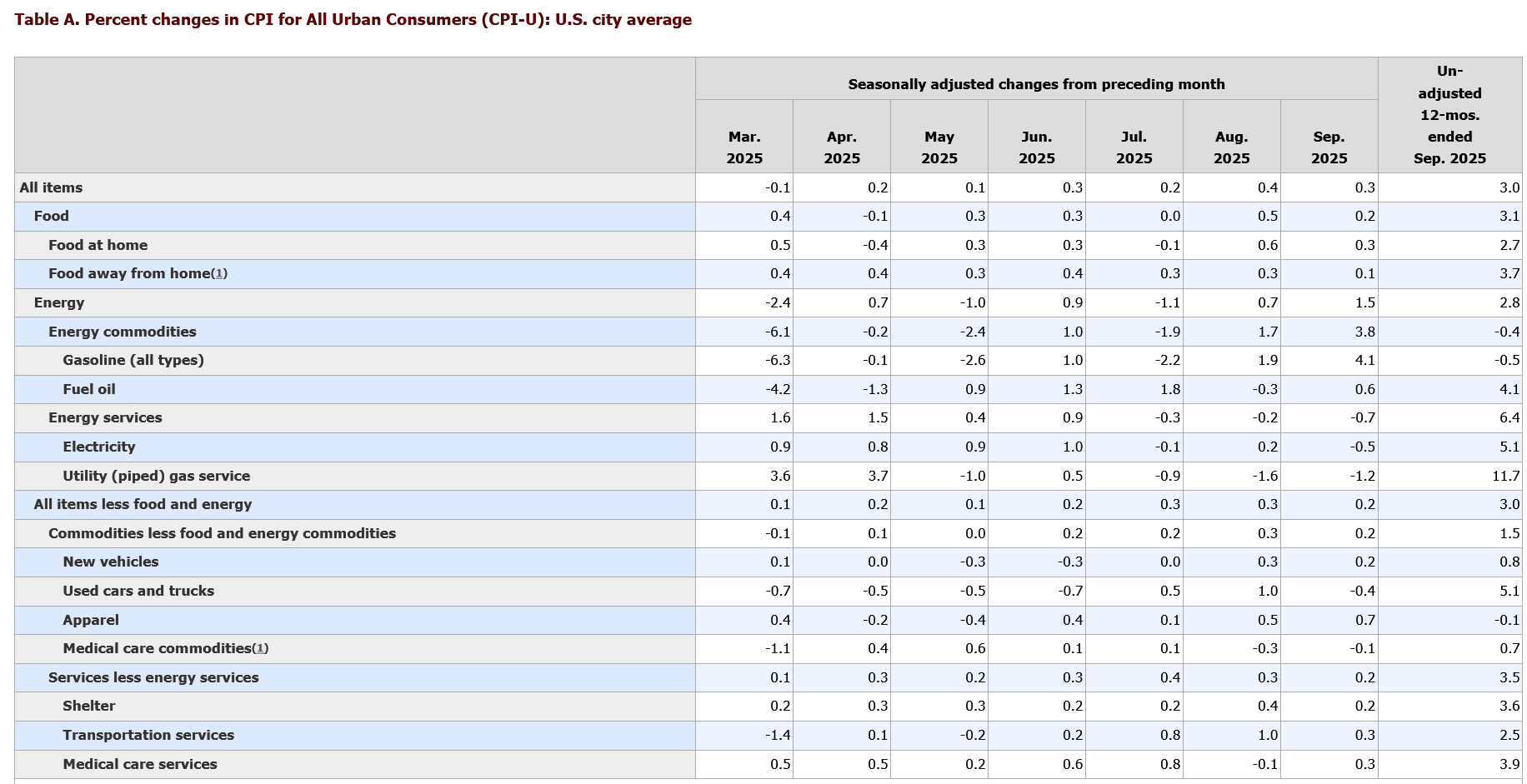

The latest U.S. Consumer Price Index (CPI) data gave the crypto market something to think about. Inflation came in at 3% in September—still high, but a hair below expectations of 3.1%. That minor miss eased fears of a faster tightening cycle and injected a bit of optimism into risk assets. XRP price chart shows that shift too, with the token attempting to claw back above a key resistance level after weeks of decline.

Why Inflation Matters for XRP Price Prediction Right Now

Cryptocurrencies, especially XRP, tend to react sharply to macroeconomic shifts because they sit on the riskier side of the investment spectrum. A lower-than-expected CPI reading suggests the Federal Reserve might hold off on any surprise rate hikes. That improves liquidity sentiment across markets—something XRP badly needs after a prolonged downtrend.

However, the CPI report also highlighted that inflation isn’t cooling fast enough to satisfy the Fed. Gasoline prices rose 4.1% in September, and tariffs have quietly pushed up import costs. That combination means any crypto relief rally will be fragile unless inflation data consistently softens in the coming months.

Technical Analysis: XRP Price Attempts a Reversal

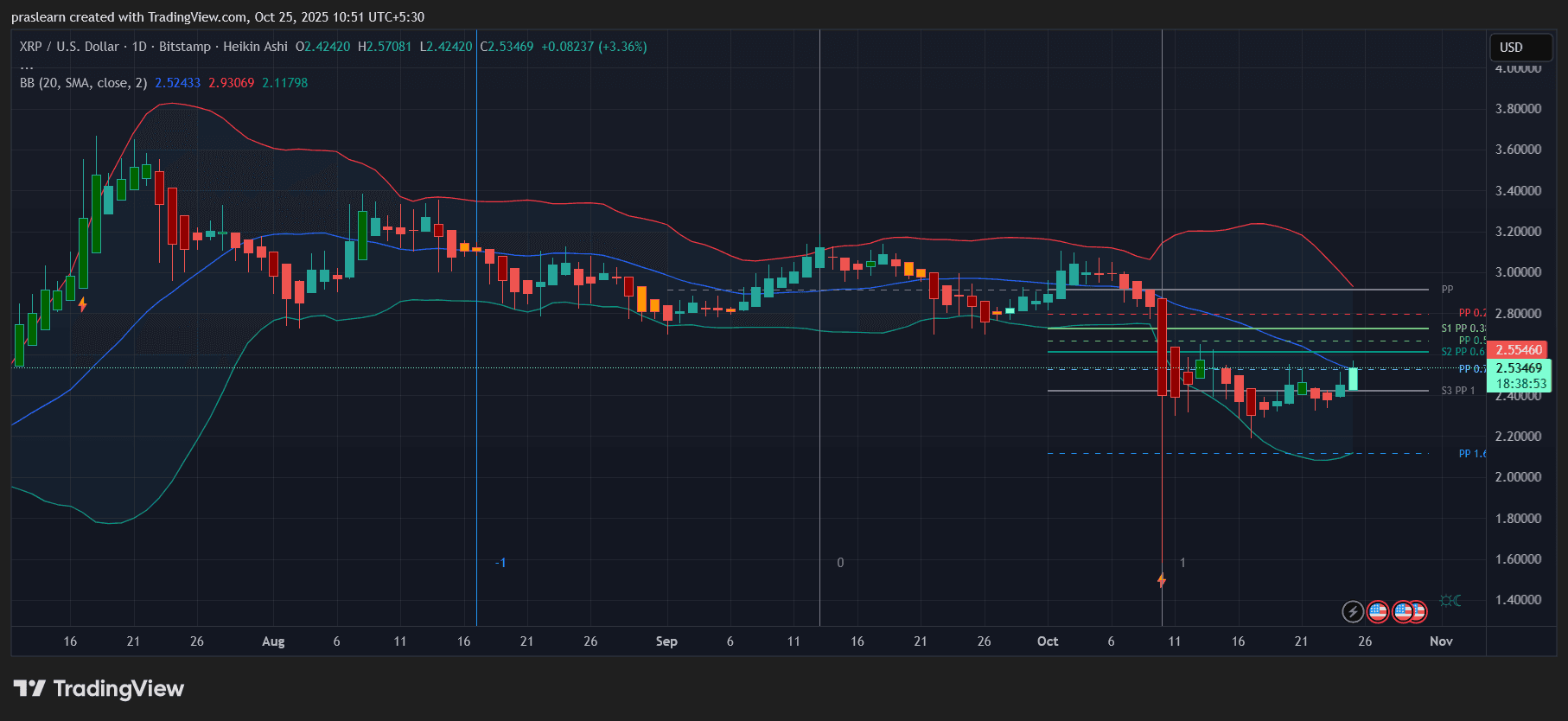

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

Looking at the daily XRP/USD chart, the token is trading near 2.53 USD, gaining about 3.3% on the day. After a steep fall earlier in October, XRP price found support around 2.20 USD, where buyers stepped in to defend a multi-month low.

Bollinger Bands show price emerging from the lower band—an early sign of mean reversion. The mid-band (around 2.52 USD) has acted as dynamic resistance for nearly three weeks, and XRP is now testing that level again. A daily close above 2.55 USD could open the way toward 2.80 USD, where the upper Bollinger Band and previous pivot resistance converge.

If XRP price fails to hold this breakout attempt , the next support lies near 2.25 USD, with a deeper downside target around 2.05 USD if bearish sentiment returns.

Volume and Sentiment Signals

Volume has been slightly improving since October 18, suggesting renewed trader participation. The recent green Heikin Ashi candles with longer bodies indicate bullish momentum building after a washout phase. Still, the rally lacks strong conviction compared to earlier moves, meaning any reversal needs confirmation via higher volume and sustained closes above the 20-day SMA.

Market sentiment remains mixed. While inflation relief is modestly bullish, macro uncertainty—like tariffs and the ongoing U.S. government shutdown—can still limit upside momentum. XRP price traders seem to be cautiously rotating back into positions, but with tight stop levels.

Short-Term XRP Price Prediction: Testing Resistance Ahead

If XRP price can maintain momentum above 2.55 USD, short-term targets of 2.75 USD and 2.95 USD come into play. Breaking 3.00 USD would be a major technical signal, potentially marking the start of a broader recovery trend.

Failure to sustain above 2.45–2.50 USD, however, could invite fresh selling pressure and send XRP price back to the 2.20 USD zone. Given that inflation isn’t accelerating but not yet cooling decisively, markets could oscillate between optimism and caution—keeping XRP in a tight range for now.

Long-Term XRP Price Prediction: Inflation, Tariffs, and Macro Pressure

The macro backdrop still defines XRP’s trajectory more than any single chart setup. Persistent inflation keeps the Fed defensive, limiting the kind of liquidity that fuels major crypto rallies. At the same time, tariff-driven cost pressures and energy price swings continue to weigh on risk appetite.

Yet the good news is that inflation is no longer shocking markets to the upside. If the next CPI reports show a continued drift toward 2.5% or lower, XRP could finally regain strength as investors reprice risk and re-enter altcoins.

$XRP is showing the first hints of stabilization after weeks of pain. The CPI data, while not stellar, has eased some macro pressure. Still, this is a fragile setup: XRP price needs a confirmed breakout above 2.55 USD with volume follow-through to validate a trend reversal. Until then, the market remains in wait-and-see mode—watching both inflation prints and XRP’s ability to defend its support zone.

In short, the next CPI report might decide whether XRP’s bounce turns into a breakout or just another false start.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Santa rally is dead – But 2026 could have something better in store

20% Bitcoin Drawdown in 2025 Sparks Bear Market Fear for 2026

Hyperscale Data Expands Its Bitcoin Holdings

BC Card Enables Stablecoin Payments for Foreigners in South Korea