US CPI year-over-year growth in September lower than estimates at 3%

Key Takeaways

- US CPI rose 3% year-over-year in September, lower than estimates.

- Inflation shows signs of further cooling, easing pressure on consumers.

US CPI year-over-year growth reached 3% in September, falling below analyst estimates and signaling continued cooling in inflation pressures. The Consumer Price Index, a key inflation gauge from the Bureau of Labor Statistics, showed the softer-than-expected reading that markets interpreted as supportive for risk assets.

The September data marked another step in the gradual decline of inflation from peak levels experienced in recent years. Financial analysts viewed the lower CPI print as potentially encouraging for Federal Reserve policy considerations moving forward.

Recent market commentary has tied lower inflation readings to growing optimism about controlled price pressures across the US economy. Under the current administration, inflation data releases have become closely watched indicators for potential policy adjustments aimed at economic stability.

The September CPI report reinforced analyst expectations that inflation continues moving toward more manageable levels, supporting broader investor participation in equity markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

‘It felt so wrong’: Colin Angle on iRobot, the FTC, and the Amazon deal that never was

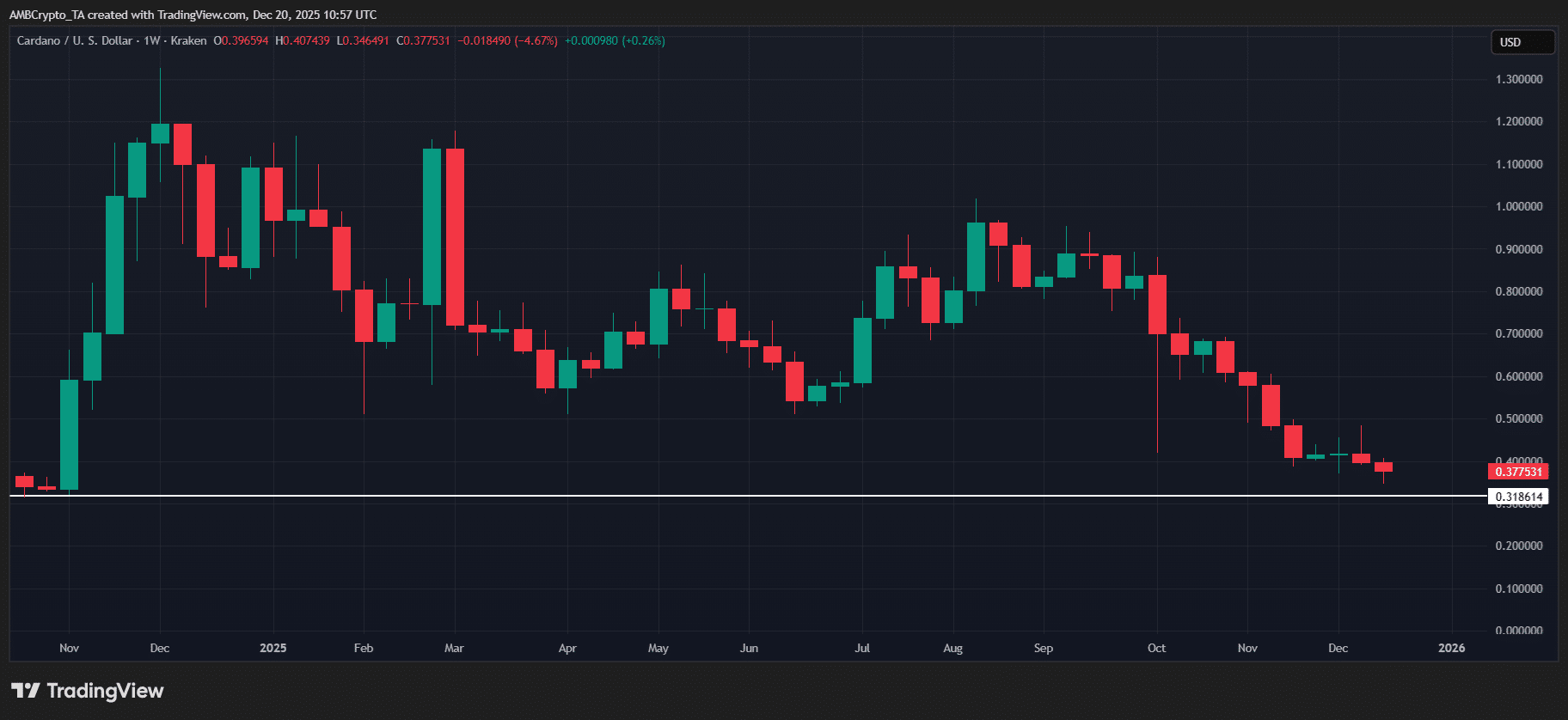

Cardano erases 100% of election rally gains – Can ADA hold top 10?

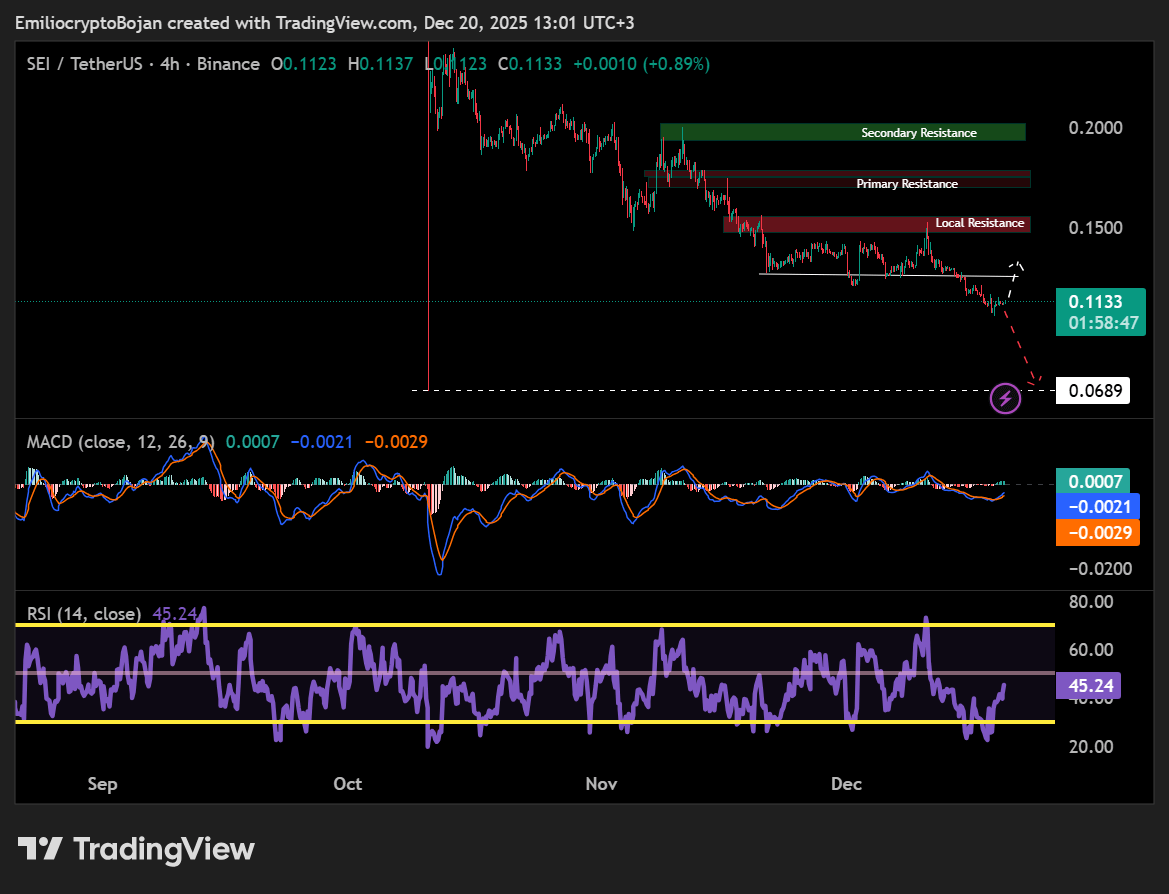

Why SEI must reclaim KEY support to avoid drop below $0.07