BlockDAG’s innovative combination of DAG and PoW technology, along with its equitable pricing approach, marks a new phase in blockchain’s journey toward greater scalability

- BlockDAG's $430M presale (27B tokens at $0.0015) and $0.05 listing price highlight its fair pricing model and market traction ahead of November's Genesis Day. - The hybrid DAG-PoW architecture, Binance AMA roadmap updates, and F1 team partnership position BDAG as a scalability-focused blockchain rivaling Bitcoin's security. - CertiK/Halborn audits, 3.5M X1 miner users, and 300+ dApps on testnet reinforce trust in its transparent governance and developer ecosystem growth. - Analysts project $1 price by 20

BlockDAG (BDAG) is capturing increasing interest within the crypto community, having raised $430 million and distributed more than 27 billion tokens, making it one of the most ambitious blockchain ventures set for 2025. With its listing price confirmed at $0.05 and the current price at $0.0015 in Batch 31, BlockDAG is gaining traction ahead of its Genesis Day event on November 26. An upcoming

BlockDAG’s core technology merges Directed Acyclic Graph (DAG) with Proof of Work (PoW), allowing for concurrent block validation, easing network congestion, and maintaining security standards comparable to Bitcoin, as previously reported. The live testnet already enables micropayments, machine-to-machine interactions, and is compatible with EVM, making it easy for

CertiK and Halborn have audited the project, confirming the reliability of its vesting processes, contract structures, and treasury safeguards. These security measures, along with multi-signature verification and delayed execution protocols, help build confidence in a sector often cautious of speculative ventures. The community is expanding rapidly, with more than 3.5 million users on the X1 mobile miner and swift hardware distribution.

Strategic alliances are boosting BlockDAG’s profile. Its partnership with the BWT Alpine Formula 1® Team, announced at Token2049, features interactive fan simulators, international hackathons, and Web3 activity zones. This collaboration, part of the “Crypto Fast Lane” initiative, has propelled BlockDAG’s recognition beyond the crypto industry, connecting it with mainstream audiences. Additionally, a $600 million roadmap includes DeFi solutions, cross-chain bridges, and a crypto payment card, while hackathons with HackerEarth and partnerships with rugby and cricket leagues are set to foster both developer and fan participation.

The launch plan is designed to promote market stability, with a six-week strategy that covers mainnet rollout, community node activation, and staggered exchange listings to support liquidity and stable price formation. This measured approach stands in contrast to projects that often see sharp price swings on launch day. Analysts believe BDAG could reach $1 by 2026 if its current momentum continues, thanks to its operational testnet, growing user base, and completed security audits.

While BlockDAG remains in the spotlight, other tokens are also influencing the market. Binance Coin (BNB) has climbed to $1,300, reclaiming the third spot in market capitalization, according to a

The Binance AMA on October 24 is set to showcase progress on the roadmap, including updates on Keynote 4 and GENESIS DAY. With 4,500 developers working on more than 300 dApps on the live testnet, as reported by a

As the crypto sector faces broader economic challenges, projects like BlockDAG that emphasize scalability, openness, and real-world application are emerging as frontrunners. With $430 million secured and a hybrid architecture set to transform blockchain scalability, BlockDAG’s progress mirrors the shifting priorities of a maturing crypto industry.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google and Apple reportedly warn employees on visas to avoid international travel

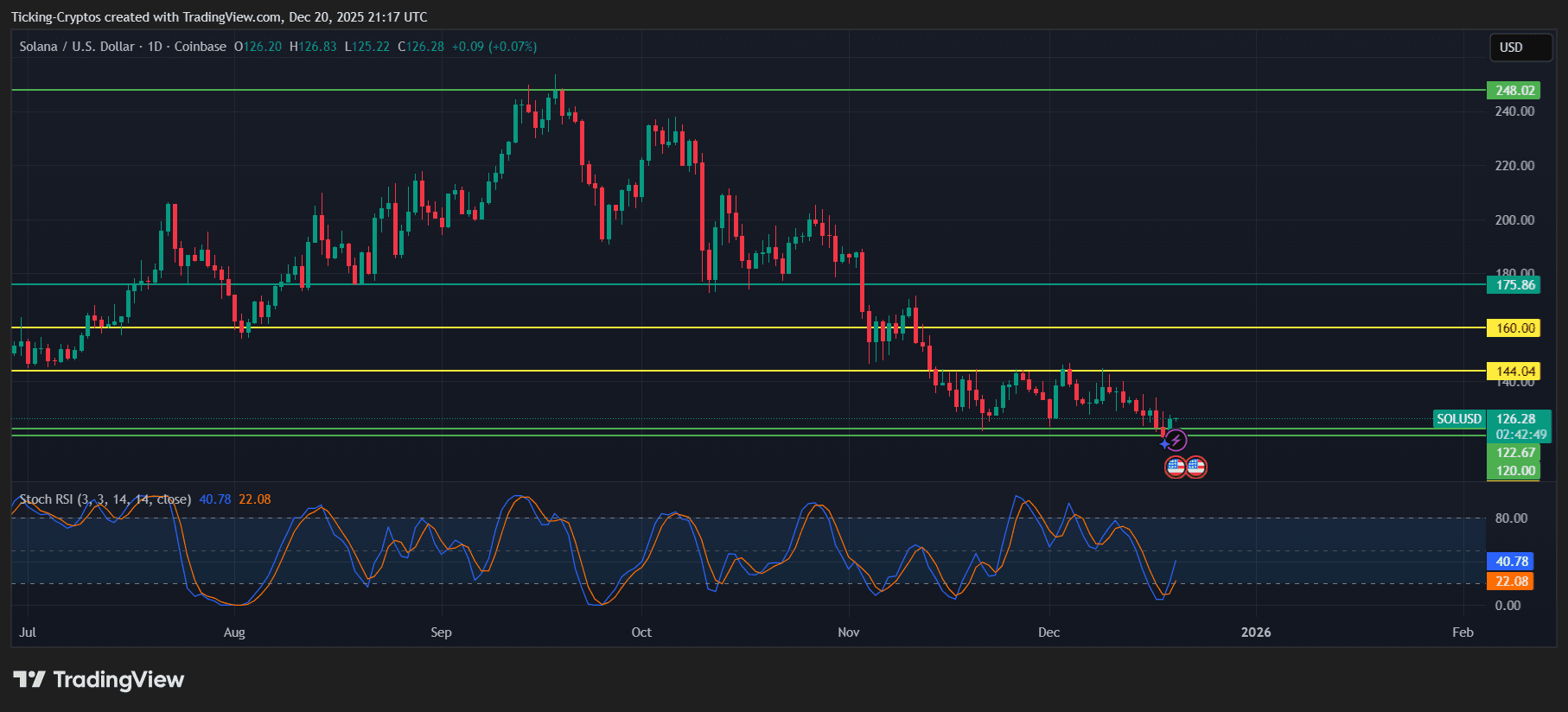

Solana (SOL) Still Under Market Pressure, Institutions Are Eyeing GeeFi (GEE) as Presale Raised Over $1.6M

Solana Price Depends On Existing SOL Holders, Here’s Why

Crypto Price Today: Bitcoin, Ethereum, Dogecoin, and Solana at Key Levels