Bitcoin News Update: Trump's CZ Clemency Fuels WLFI Rally, Warren Raises Concerns Over Political Misconduct

- Trump's pardon of Binance's Zhao sparks 15% WLFI token surge, breaking months-long consolidation amid heightened trading volume. - WLFI's $3.5B market cap outperforms Bitcoin/Ethereum by 8x, fueled by Trump's crypto agenda and Binance's prior USD1 stablecoin partnership. - Senator Warren condemns pardon as "corruption," citing Zhao's financial ties to Trump's stablecoin venture and potential conflicts of interest. - Zhao denies allegations, framing pardon as Biden administration "war on crypto," while Bi

World Liberty Financial's (WLFI) native token jumped more than 15% within a single day after U.S. President Donald Trump issued a controversial pardon for Changpeng Zhao, the former CEO of Binance. This move has ignited discussions around the influence of politics and regulatory approaches in the cryptocurrency sector, as reported by

The pardon, made public on October 23, 2025, was described by

Market experts observed that WLFI’s price increase outperformed leading cryptocurrencies such as

The political fallout from the pardon has sparked strong backlash. Senator Elizabeth Warren denounced the action as “corruption,” pointing to Zhao’s previous financial involvement with Trump’s stablecoin initiative. “If Congress does not stop this kind of corruption, it owns it,” Warren posted on social media, raising alarms about possible conflicts of interest. Detractors claim that Binance’s use of World Liberty Financial’s USD1 stablecoin in a 2024 agreement with Abu Dhabi-based MGX established a “transactional relationship” that may have swayed Trump’s decision.

Zhao, meanwhile, rejected Warren’s accusations, asserting that she had “misrepresented” his legal situation and accused her of using a “war on crypto” narrative to rationalize the pardon. Binance, which added WLFI to its listings in September, has since distanced itself from the token, though public support from its leadership for Zhao’s return has fueled optimism about the future of U.S. crypto policy should Trump return to office.

WLFI’s rally highlights the growing impact of political events on cryptocurrency markets. As Trump’s pro-crypto stance gains momentum, tokens linked to his associates or projects are attracting renewed investor attention. Nonetheless, the pardon has also increased scrutiny of the relationship between political power and digital asset ventures, with lawmakers and regulators expected to face mounting calls to address potential conflicts of interest.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google and Apple reportedly warn employees on visas to avoid international travel

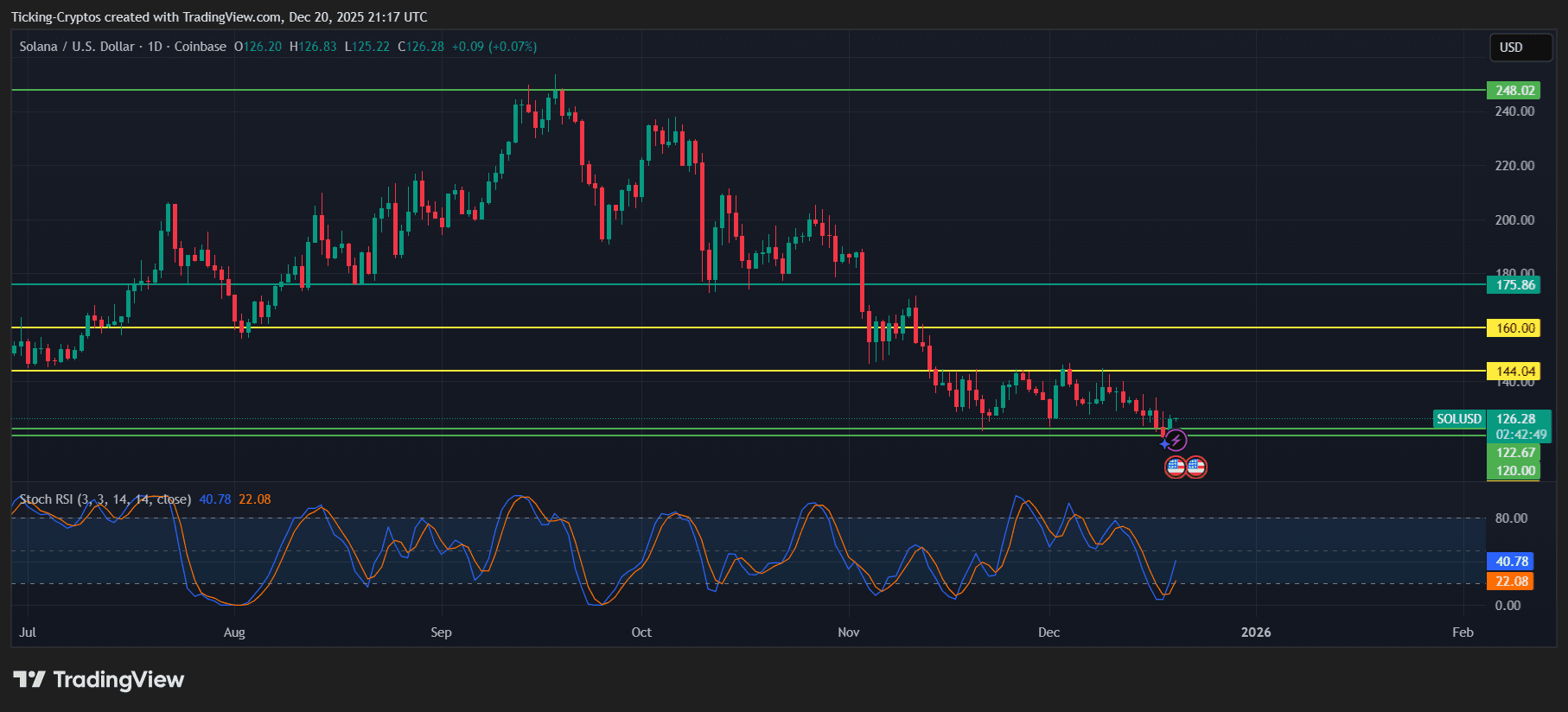

Solana (SOL) Still Under Market Pressure, Institutions Are Eyeing GeeFi (GEE) as Presale Raised Over $1.6M

Solana Price Depends On Existing SOL Holders, Here’s Why

Crypto Price Today: Bitcoin, Ethereum, Dogecoin, and Solana at Key Levels