Dogecoin Updates Today: The Latest in Crypto—How Meme Coins Are Bringing People and Investments Together

- Binance founder CZ's potential pardon may reignite meme coin frenzy, with Maxi Doge (MAXI) emerging as a top contender. - Slerf's $10.3M refund to 25,444 investors boosted its market cap to $740M, highlighting community-driven accountability. - Coinbase's $25M investment in UpOnly NFT spurred Base-based tokens like UPONLY and COBIE to surge over 7,900%. - Maxi Doge's 65% presale visibility and 84% APY position it as Dogecoin's ambitious successor in crypto's evolving landscape. - U.S. regulatory shifts a

Speculation is running high in the crypto community that a possible pardon for Binance founder Changpeng "CZ" Zhao could spark a new wave of excitement in the

This new chapter unfolds amid a climate of innovation and perseverance. For example, the Solana-based meme coin Slerf recently wrapped up a 19-month process to return $10.3 million in burned funds to 25,444 backers. Developer Grumpy’s openness—calling it "the biggest mistake of my life"—turned a setback into a rallying cause for the community. Following the incident, the token’s market cap soared to $740 million, highlighting how transparency can transform meme coins into cultural icons, as noted in

At the same time, major players are joining the action. Coinbase’s reported $25 million investment to relaunch the UpOnly podcast through a tokenized NFT has triggered a surge in Base-based meme coins. Tokens like UPONLY and COBIE have skyrocketed by 7,900% and 5,800%, respectively, demonstrating how media-driven ventures can ignite market excitement, according to

The timing is ideal. A recent directive from the U.S. Federal Housing Finance Agency now allows Fannie Mae and Freddie Mac to accept crypto as mortgage collateral, pushing meme coins like DOGE further into mainstream finance. While DOGE’s $28 billion market cap cements its status, more investors are turning to MAXI, which channels the same "all in" spirit but with even greater ambition.

"MAXI is more than just a token—it’s a movement," one analyst commented, highlighting the project’s 84% dynamic APY for staked tokens and its audited smart contract. With 6% of the total supply already locked up, the dedication of its community points to a long-term vision rather than a passing trend, as reported by CoinSpeaker.

As the crypto landscape shifts, cross-chain platforms like Printr are accelerating the meme coin surge by enabling launches across multiple blockchains at once, helping to solve liquidity fragmentation, according to

While it remains uncertain if a pardon for CZ will trigger another round of wild volatility, one thing is certain: meme coins have moved beyond the fringes of crypto. They have become a competitive arena where community, culture, and capital intersect—led by tokens like Maxi Doge that aim for even greater heights.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google and Apple reportedly warn employees on visas to avoid international travel

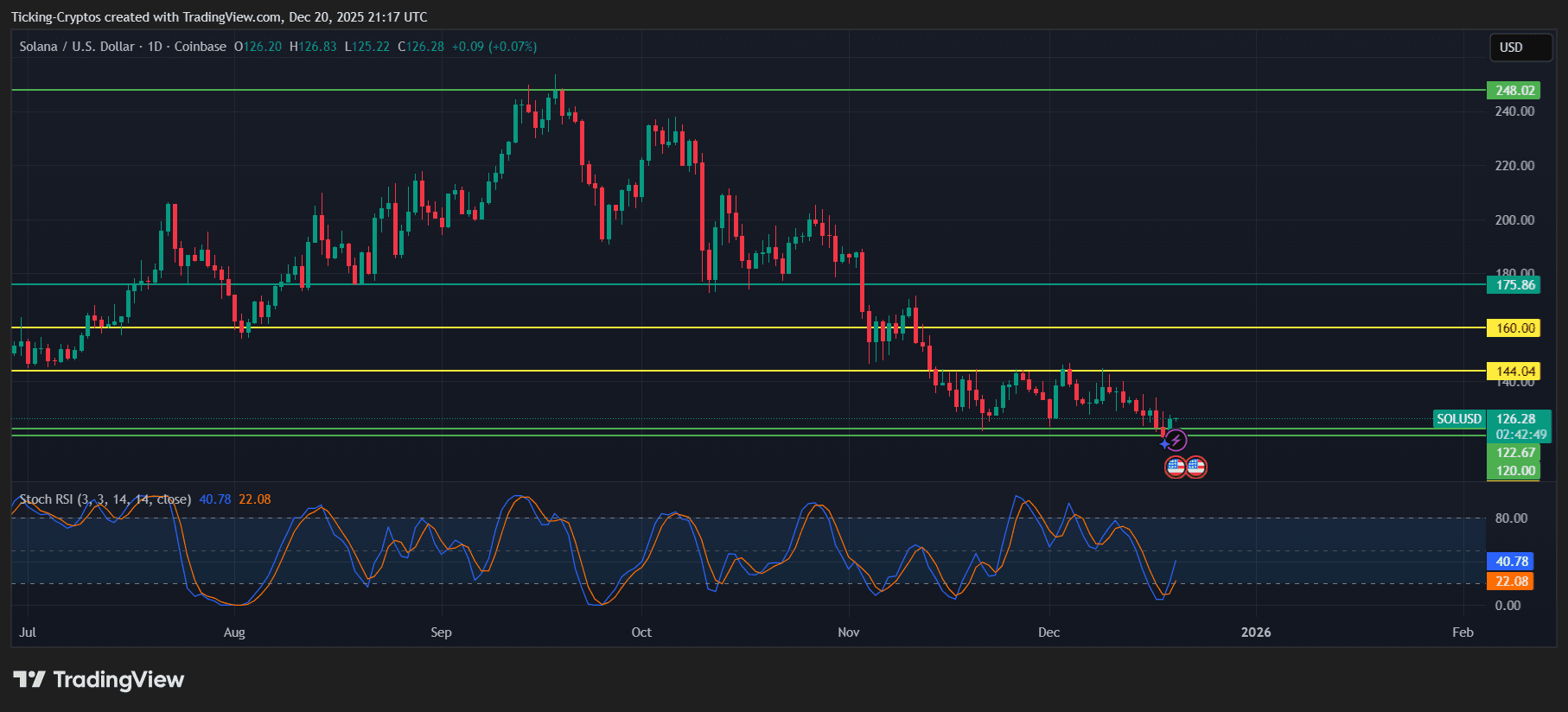

Solana (SOL) Still Under Market Pressure, Institutions Are Eyeing GeeFi (GEE) as Presale Raised Over $1.6M

Solana Price Depends On Existing SOL Holders, Here’s Why

Crypto Price Today: Bitcoin, Ethereum, Dogecoin, and Solana at Key Levels