BOB Gateway Unlocks Bitcoin’s Utility Beyond Its Network

On October 24, 2025, a new step in blockchain interoperability was made by the disclosure of the BTCBwBTC Bridge, the BTCtowBTC Bridge, in a post by OxDavinci. BOB is a hybrid Layer 2 network that bases its finality on the blockchain of Bitcoin and is an EVM-compatible optimistic rollup. The design enables it to adopt the security assurances of Bitcoin and apply the developer tools to create Ethereum applications, including Solidity, Truffle, and Hardhat. The integration will make it possible to deploy DeFi, AI, and privacy-oriented applications without shifting BTC off-chain or utilizing wrapped tokens.

For years, Bitcoin’s power has been locked behind its own walls, secure, proven, but isolated. @build_on_bob changes that by merging Bitcoin’s security with Ethereum’s flexibility.

— Da Vinci (@OxDavinci) October 24, 2025

It’s not about moving BTC off-chain or wrapping it somewhere else, it’s about extending Bitcoin’s… pic.twitter.com/dRx3GU0WRA

Technical Background and Economical Effect

In contrast to wrapping models that decrypt BTC in its native chain. BOB expands the economic layer of Bitcoin by making its consensus security directly connected to the execution of EVMs. The two-layered system also opens the liquidity aggregation of Bitcoin and Ethereum systems. Now developers are able to develop protocols in which native BTC is involved in DeFi lending. Also yield farming and staking applications. This model also reinforces the use of Bitcoin as an active capital base. It is without compromising on the areas of decentralization and verifiability.

Cross-Chain Innovation and Developer Utility

The interoperability of BOB also opens the following application. Privacy dApps: BOB allows privacy-sensitive contracts, which are compatible with the security ethos of Bitcoin. The gateway enables developers working with Ethereum and other Layer 2s to develop on Bitcoin without changing their development stack by enabling smooth access to EVM.

Being an optimistic rollup, BOB has a seven-day withdrawal period, typical of security against fraud. Its model is dual layer, which necessitates constant audits to avoid vulnerabilities of smart contract. Nonetheless, the immutable anchoring to the Bitcoin ledger of BOB makes the consensus-level attack risk. Thereby considerably less than that of regular cross-chain bridges. This has historically been susceptible to exploits resulting in a cumulative loss over time of, as of 2020, more than $2 billion.

Placing in the Blockchain Landscape

Interoperability is also among the largest bottlenecks in blockchain by October of 2025. The fact that BOB is compatible with major networks and customizes the Bitcoin PoW with Ethereum. Thereby tooling is a significant milestone in the crypto stack. Analysts consider it a bridge protocol but not a wrapped-asset system, which conforms to the trend in the sector towards minimizing cross-chain liquidity through trusts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

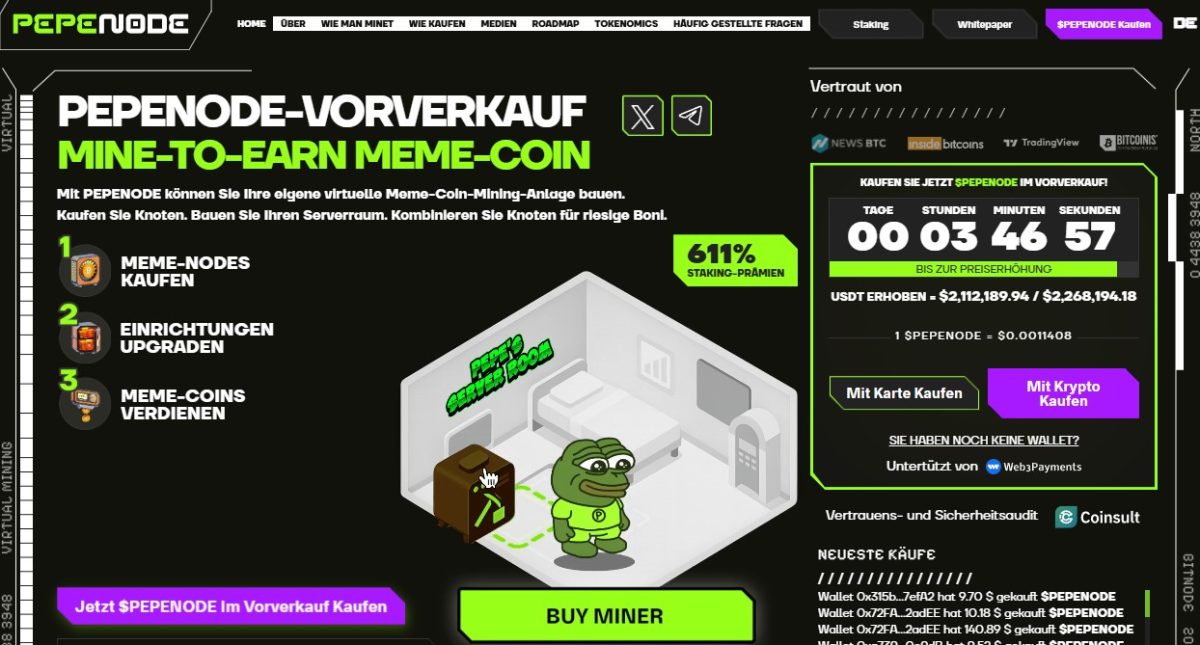

Ethereum Prognose: PepeNode als Ausweich-Play

Cardano price forms bullish divergence as NIGHT token demand jumps