EU Bans Russia-Backed Stablecoin In First Crypto Sanction

Brussels sanctioned a ruble-backed stablecoin used to bypass SWIFT, marking its first crypto-specific penalty on Russia. The EU is now preparing a MiCA-compliant euro token to assert financial sovereignty and counter alternative payment networks.

The European Union adopted its 19th sanctions package against Russia — the first to target a cryptocurrency.

The bloc banned the ruble-backed stablecoin A7A5 as part of a wider crackdown on energy and financial networks funding the war in Ukraine.

Brussels Expands Measures to Stablecoin and LNG

According to the Council’s statement, the EU will prohibit all A7A5 transactions across the bloc starting November 25. The coin, issued in Kyrgyzstan and backed by deposits at PSB Bank, had been used by Russian firms to settle cross-border trade and sidestep SWIFT restrictions.

The EU also sanctioned its developer and the operator of the trading platform.

“It is becoming increasingly difficult for Putin to finance his war. Every euro we deny Russia is one it cannot spend on aggression. The 19th package will not be the last.”

— Kaja Kallas, EU High Representative for Foreign Affairs and Security Policy

The Council also tightened restrictions on Rosneft and Gazprom Neft and banned Russian liquefied-natural-gas imports from 2027. Yet the spotlight fell on digital assets. Officials described A7A5 as a “shadow ruble system” created to bypass Western controls.

Before the ban, the token’s daily turnover reached several hundred million dollars, making it the largest non-dollar stablecoin in Eurasia. EU officials warned that such coins pose systemic risks by letting sanctioned states build parallel payment networks outside the dollar and euro zones.

Brussels also extended sanctions to Chinese and Gulf intermediaries involved in Russian oil exports. It barred European institutions from interacting with Moscow’s “Mir” and “Fast Payments” systems.

By targeting both fiat and blockchain channels, the EU aims to shut down the remaining routes financing the Kremlin’s war economy.

Moscow Legalizes Cross-Border Crypto as EU Closes Loopholes

In response, Moscow moved to legalize crypto for international settlements while criminalizing unlicensed domestic use. Finance Minister Anton Siluanov said the goal is to “restore order” under strict anti-money-laundering and know-your-customer oversight.

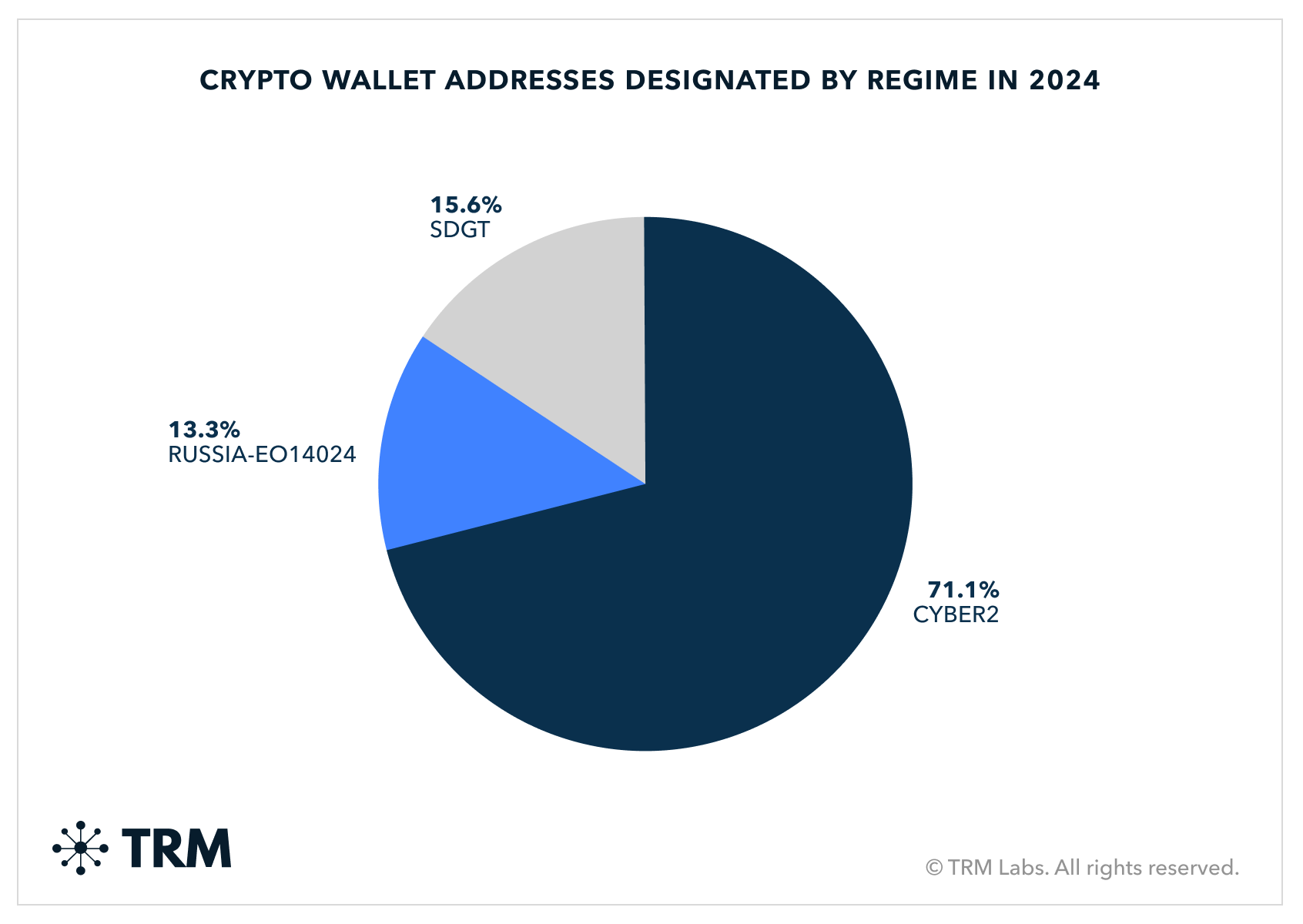

Source | TRM Labs

Source | TRM Labs

Analysts view the EU’s digital-asset sanctions as part of a broader push to choke off Russia’s alternative payment rails. A report by TRM Labs found that sanctioned entities made up one-third of global illicit crypto flows in 2024. Russian exchanges such as Garantex ranked among the top offenders.

The study also noted that cross-border bridges and stablecoins have become key tools for sanctions evasion.

Recently, A7A5 had already moved $6 billion through blacklisted wallets despite US sanctions. The case highlights how enforcement remains difficult across jurisdictions.

Industry experts see stablecoins as core financial infrastructure, not speculative assets.

In a statement to BeInCrypto, Stablecore CEO Alex Treece described dollar-pegged tokens as a “modern Eurodollar system” meeting global USD demand outside banks.

He said they already account for about 8% of GDP-level flows in Latin America and Africa — reinforcing dollar dominance and pressuring EU regulators to accelerate their MiCA-compliant euro framework.

As Russia’s war enters its fourth year, Europe’s sanctions strategy has shifted from symbolic deterrence to systemic disruption — now stretching from LNG cargoes to blockchain transactions and the shadow networks that sustain them.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.