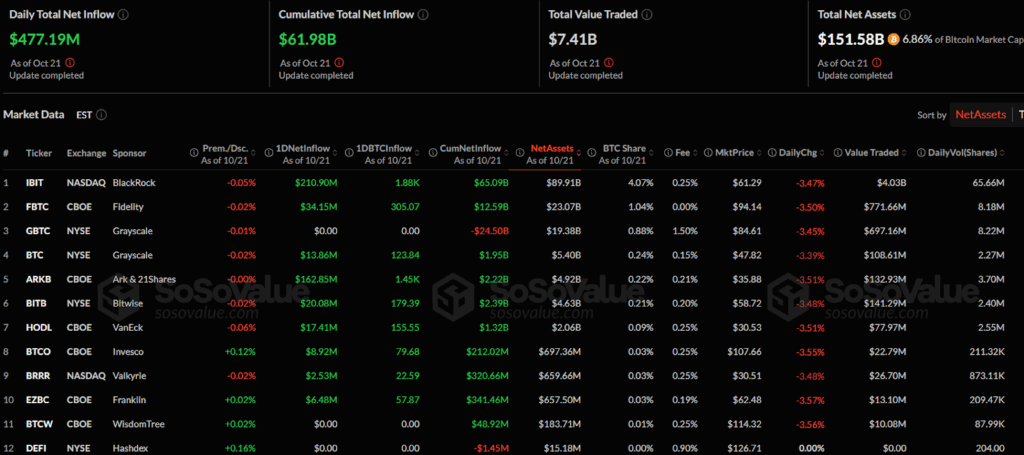

According to a recent market update on Bitcoin ETFs by SoSoValue, total daily net inflows reached $477.19 million, while cumulative inflows stood at $61.98 billion. Assets under management across all Bitcoin ETFs totaled $151.58 billion, representing 6.86% of Bitcoin’s market capitalization. Trading volume remained high at $7.41 billion. However, the momentum extended beyond ETFs as Nexchain AI continued attracting significant investor interest. The ongoing accumulation reflects growing confidence in its AI-integrated blockchain model and upcoming Testnet 2.0 release.

BlackRock’s IBIT Leads Bitcoin ETF Inflows With $210.9 Million

A deeper value on the update reveals that BlackRock’s IBIT recorded the largest daily inflow of $210.90 million, pushing its cumulative inflows to $65.09 billion. Fidelity’s FBTC followed with $34.15 million in new inflows and $12.59 billion in cumulative gains.

Source: SoSoValue (Bitcoin ETFs)

Ark & 21Shares’ ARKB added $162.85 million, marking one of the strongest inflow performances among smaller funds. Bitwise’s BITB registered $20.08 million in net inflows, while VanEck’s HODL gained $17.41 million. Grayscale’s GBTC showed no inflow activity, maintaining a cumulative net outflow of $24.50 billion.

Market prices across ETFs experienced declines, ranging from 3.39% to 3.57%, indicating a uniform market drop. IBIT’s market price settled at $61.29 with a 3.47% decrease, and FBTC closed at $94.14 after a 3.50% fall. Overall, the ETFs exhibited consistent trading volume, with IBIT recording 65.66 million shares traded and GBTC reaching $697.16 million in value traded.

Nexchain AI’s Growth in the Crypto Market

Nexchain AI is the first blockchain developed entirely through artificial intelligence, merging adaptive scalability with decentralized security.

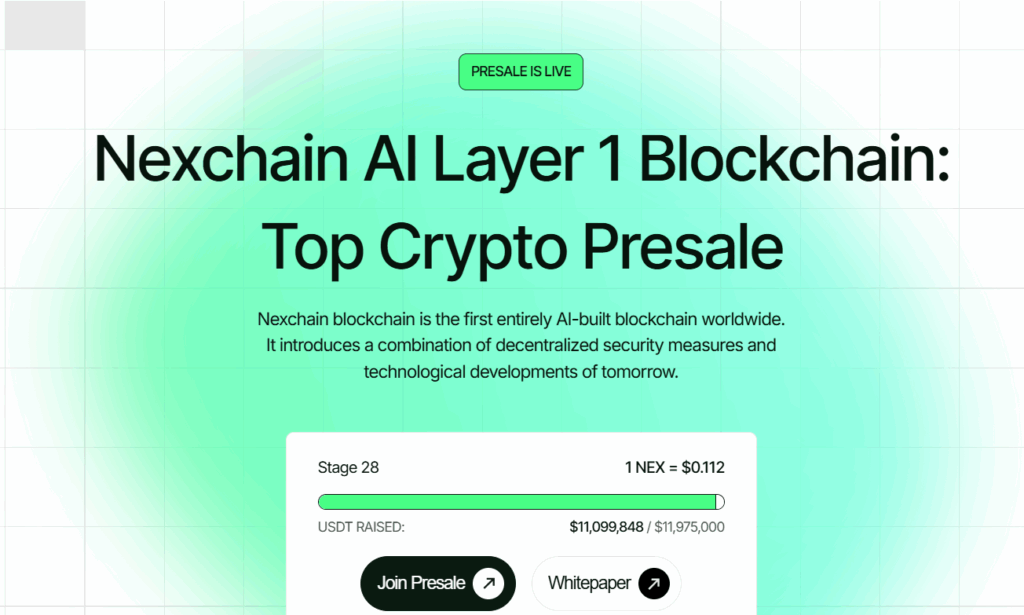

Source: Nexchain AI

Testnet 2.0: Launching in November With New Features

The upcoming Testnet 2.0, running from October 13 to November 28, introduces a redesigned interface and AI-powered transaction verification tools. During confirmations, users will see an “AI Risk Score” indicating potential threats such as MEV and scam attempts before approving transactions.

Using promo code “TESTNET2.0,” participants receive a bonus. This initiative strengthens transparency and safety while promoting hands-on engagement with Nexchain’s evolving ecosystem.

Expanding Airdrop, Security, and Ecosystem Readiness

The Nexchain AI airdrop remains active with a $5 million NEX prize pool. Participants can earn weekly rewards by completing short-term quests before the mainnet launch. Flash Quest offered a 48-hour bonus, while the ongoing rewards week, active from October 16–23, multiplies all buy quests by two. This system ensures early backers benefit from consistent engagement and reward cycles.

Nexchain employs CertiK as its official auditing partner, reinforcing its commitment to security and transparency. With AI-driven fraud detection, hybrid Proof-of-Stake consensus, and Directed Acyclic Graph (DAG) architecture, the platform optimizes transaction validation speed and network reliability.

As Bitcoin ETFs record substantial inflows, Nexchain AI’s performance continues gaining traction, nearing its current stage target. With Testnet 2.0 launching in November, ongoing bonuses, and an expanding airdrop, Nexchain positions itself as a leading AI-blockchain project ready for mainnet deployment. Its adaptive design and robust security framework mark it as a project to watch as accumulation momentum grows in the market.