Cryptocurrency Mining Electricity Cost Management: Where is the World's Cheapest Electricity Price?

In the cryptocurrency world, electricity is the new gold. You may know how many coins a mining rig can mine, but what truly determines a miner's profitability is often not the hash rate, but rather — the electricity bill.

Original Title: "Cryptocurrency Mining Electricity Cost Management: Where is the World's Cheapest Electricity Price?"

Original Author: Dr. Chai Crypt

In the world of cryptocurrency, electricity is akin to gold. You may know how much a mining machine can mine, but what truly determines a miner's profitability is often not just the hash rate, but rather — the electricity bill.

Many newcomers initially focus only on "how much Bitcoin can be mined per day," overlooking the fact that electricity cost is actually the biggest cost burden on earnings. Today, Dr. Chai will systematically dissect the composition of mining electricity costs, global electricity price distribution, and how ordinary miners can find the optimal solution.

01 Electricity Cost: The Miner's First Lifeline

According to the Cambridge Bitcoin Electricity Consumption Index from the University of Cambridge, the Bitcoin network consumes over 120 TWh of electricity annually, nearly equivalent to the entire national electricity consumption of Greece.

What does this mean for miners? It means that for every $0.01/kWh increase in electricity price, the payback period could be extended by several months. The electricity price determines whether miners can survive in a bear market and also determines who can earn more during a bull market.

In countries with high electricity costs (such as Germany and Japan), there are hardly any traces of large-scale mining farms; whereas regions with electricity prices as low as $0.03/kWh — such as parts of the United States like Texas, Kazakhstan, Argentina, the UAE, and certain hydroelectric areas in Laos — are hotspots for global mining industry layout.

Everyday Analogy

Electricity cost is like the "fuel cost" for gold mining; the mining machine is the vehicle, the lower the fuel price, the farther it can go, and the more it can earn

02 Four Modes of Miners Paying Electricity Bills

Self-built Mining Farm: Lowest Electricity Price, Highest Barrier to Entry

Large miners or institutional players often choose to build their own mining farms. They directly contract with power companies for electricity, with metering and transparent settlement.

The advantage is the lowest electricity cost, which can be as low as $0.025–0.035/kWh in some areas;

The downside is the high barrier to entry, considering issues such as land, cooling, transformers, compliance, and maintenance.

For example, some mining farms in Texas have successfully reduced costs by utilizing wind energy and stranded resources, with electricity prices more than 40% lower than traditional sources.

Hosted Mining: Worry-Free but Costly

Miners without the conditions for self-building often choose hosting—handing over mining machines to professional organizations for operation, paying monthly electricity and management fees.

The advantage is peace of mind and convenience;

The disadvantage is relatively higher electricity prices (around $0.05–$0.08/kWh) and susceptibility to policy risks.

For example, after the Kazakhstani government tightened energy regulation in 2023, hosted electricity prices generally increased by 20%–30%.

Cloud Mining: A Light Asset Model Bundling Electricity Fees

Cloud mining is the entry point for ordinary investors. Platforms sell virtualized computing power, allowing users to participate in mining by purchasing computing power shares, with electricity fees generally included in the contract or settled based on computing power.

Advantages: Low barrier to entry, no maintenance required.

Disadvantages: Electricity prices higher than actual costs, and users cannot control power on/off independently.

For example, KuCoin's KuMining platform, through cooperation with leading global mining farms, enables users to obtain real BTC, DOGE, and LTC combined computing power in a one-click manner, while enjoying low-cost energy and real-time revenue settlement, significantly reducing the mining threshold.

Home Mining: More about Interest than Profit

Some miners choose to directly plug in mining machines at home. Electricity is charged at residential rates (around $0.16–$0.20/kWh in the United States), nearly three times that of industrial electricity.

The advantage of home mining is flexibility and control, with the ability to power on/off anytime; however, due to the high electricity prices, it is more like a way to experience the fun of mining rather than a stable profit-making model.

03 Electricity Billing Method and Cycle

· Pay-Per-Use Pricing ($0.0x/kWh): The most transparent, most fair way, suitable for self-hosted or large-scale hosting.

· Pay-Per-Hashrate Pricing ($/TH/day): A common cloud mining model, convenient but with higher electricity costs.

· Fixed Monthly Fee: Simplifies settlement, but full payment is required even during downtime.

· Prepayment or Earnings Deduction: A popular practice on cloud mining platforms, convenient but requires monitoring of balance and income fluctuations.

The settlement period is usually monthly or prepaid, and some platforms support using USDT or BTC to offset electricity costs, achieving a cryptocurrency-based management.

04 How Does Electricity Cost Variability Alter Miner Strategy

· Pay-Per-Use Miner: Tends to use electricity during off-peak hours at night, flexibly turning machines on and off;

· Hosting and Cloud Mining Miners: Passively endure electricity price fluctuations;

· Fixed Monthly Fee Miner: Seeks 24/7 full-load operation to spread costs.

Smart power management platforms even support dynamic scheduling—automatically shutting down when electricity prices are too high to protect the profitability. Such solutions are becoming the new standard for large mining farms.

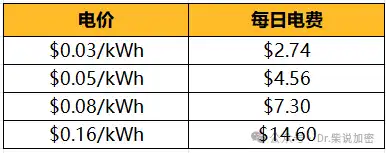

Simple Calculation: Electricity Price Gap

Using a mining machine with a power consumption of 3,800W as an example:

At the same earnings, a home miner's profit may be directly consumed. That's why "finding inexpensive electricity resources" is almost every miner's ultimate goal.

05 Global Distribution of the Cheapest Electricity Prices

Based on data from the International Energy Agency (IEA) and various local mining facilities:

06 Beyond Hash Rate: Electricity Price is King

The essence of mining is the game between hash rate and electricity. The more concentrated the hash rate, the fiercer the energy competition. The future focus of mining competition is no longer "who has more mining rigs," but rather who can access cheaper, more stable, and cleaner electricity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Ethereum Eyes $5,000 as Whales Accumulate Amid Bitcoin Withdrawals and Broader Economic Challenges

- Ethereum (ETH) trades at $3,957, with technical indicators suggesting potential for a $5,000 rally if $3,750–$3,800 "triple bottom" support holds and $4,000 resistance breaks. - Whale accumulation and on-chain data hint at institutional buying, contrasting with $127M ETH ETF outflows versus Bitcoin's $20M inflows amid macroeconomic uncertainty. - Key risks include $3,700 support breakdown triggering $3,600 losses, while rising U.S. Treasury yields and Bitcoin dominance complicate ETH's short-term recover

"Time-Based Tokenomics Ignite 500% RIVER Rally, Transforming the Airdrop Landscape"

- RIVER token surged 500% to $10 after Binance listing and a time-encoded dynamic airdrop conversion model. - The 180-day conversion mechanism incentivizes long-term holding, with River Pts rising 40x and creating arbitrage opportunities. - Perpetual futures on major exchanges generated $100M+ daily volume, while 120,000+ addresses engaged in ecosystem campaigns. - Critics question sustainability as short-term incentives wane, though the model redefines tokenomics by encoding time into value formation. - R

Dogecoin News Today: DeFi Drives Institutional Adoption: Transforming Crypto Market Fluctuations Into Steady Earnings

- Dogecoin (DOGE) remains a passive income focus despite a 25% monthly price drop to $0.20, with community-driven initiatives like House of Doge acquiring an Italian soccer team to boost real-world utility. - XDC Network's $10M XDC Surge program targets DeFi growth by incentivizing liquidity provision on DEXes like Curve Finance, aiming to enhance trading efficiency and institutional readiness. - Crypto investors increasingly leverage BTC, SOL, and DOGE through staking/yield farming while balancing risks f

Bitcoin News Update: AWS Disruption Underscores Centralization Risks; Decentralization Efforts in Crypto Accelerate

- A 2025 AWS outage disrupted global services, exposing centralized cloud infrastructure risks as 4M users faced outages across finance, government, and aviation sectors. - Experts warned of systemic vulnerabilities in over-reliance on major cloud providers, while UK regulators questioned AWS's lack of critical infrastructure designation. - Zelle's stablecoin expansion aims to challenge traditional cross-border payments, with $1T+ annual transactions already processed through its network. - Bitcoin markets