Bitwise Chief Investment Officer: Why Has Gold Outperformed Bitcoin by So Much?

Do not envy the skyrocketing gold price, as it may be showing us the future path of Bitcoin.

Original Article Title: "Bitwise: Gold's Price Surge Will Far Outpace BTC, Signaling BTC's Own 'Golden Moment' by 2025"

Original Article Author: Matt Hougan, Chief Investment Officer at Bitwise

Original Article Translation: Golden Finance

The current crypto market has two core questions regarding Bitcoin:

1. Why has gold's price performance far exceeded Bitcoin's?

2. With ETFs and corporations buying heavily, why is Bitcoin's price still stagnant?

In fact, by carefully answering the first question, the answer to the second question will also emerge — and this answer paints an extremely bullish picture of Bitcoin's future.

Next, I will analyze this in detail.

Question One: Why Has Gold's Price Performance Far Exceeded Bitcoin's?

Currently, although gold prices have experienced a pullback, they have seen a rapid rise this year, with a 57% increase in 2025, moving towards the second-best annual performance in history when priced in US dollars. At the same time, Bitcoin has been stagnant near the $110,000 mark, with its price remaining relatively flat since May.

This has left investors who view Bitcoin as "digital gold" feeling frustrated, but there is a simple explanation behind this: the difference stems from the actions of various central banks.

Since the US froze Russian-held US Treasuries following Russia's invasion of Ukraine, central banks around the world have begun to significantly increase their gold holdings. According to Metals Focus data, central bank gold purchases have nearly doubled since the outbreak of the Russia-Ukraine conflict, from an annual average of about 467 tons to approximately 1000 tons today, a scale that is roughly twice the estimated gold ETP (Exchange-Traded Product) purchase volume.

Bitcoin has not been able to benefit from this treatment. While some central banks are researching Bitcoin, none have actually made purchases. Therefore, it is logical that Bitcoin has not followed the rise in gold prices if central banks are the main driver behind this gold price increase.

This view is not new. Institutions and individuals such as Morgan Stanley, JPMorgan, and Mohamed El-Erian have all pointed out that central bank gold purchases are a key driver of the surge in gold prices.

Question Two: Why, Despite ETFs and Corporations Buying Heavily, is Bitcoin's Price Still Stagnant?

How is this related to the second question?

The answer is: highly related.

The biggest mystery in the Bitcoin market is that, despite ETFs and corporations buying in large quantities, its price remains relatively stable. Since the introduction of the Bitcoin ETF in January 2024, ETFs and corporations have accumulated 1.39 million bitcoins, while the new supply of the Bitcoin network during the same period is less than a quarter of this amount. Although the price of Bitcoin has risen by 135% since then, performing well, many are still wondering: shouldn't it have gone even higher?

I also had the same question: who is selling Bitcoin in large quantities? What is preventing it from breaking through the $200,000 mark?

The current rise in the price of gold provides the answer.

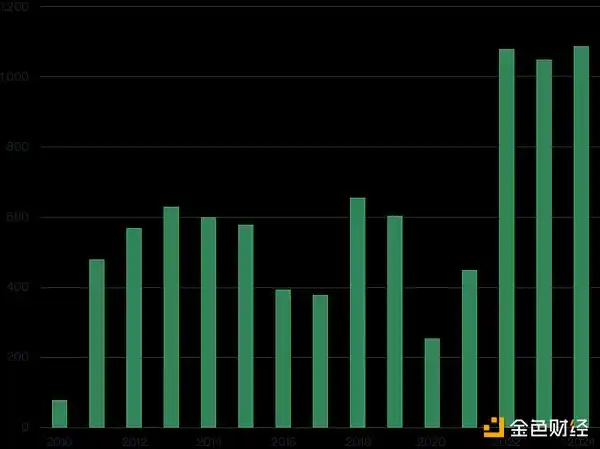

See the table below, which shows the annual gold purchase volume of central banks from 2010 to 2024. Central bank gold purchases in 2021 were 467 tons, rising to 1,080 tons in 2022, and has since remained at this high level (forecasts indicate that demand in 2025 will be slightly lower than in 2024).

Central Bank Gold Purchase Volume 2010-2024 (tons):

Source: World Gold Council

In short, although central bank gold purchases have been a key catalyst for this year's rise in gold prices, such purchases did not start this year, but rather in 2022.

This also provides an answer to the current situation of Bitcoin.

When central bank gold purchases started to increase significantly in 2022, the pace of the gold price rise was relatively slow: the average price in 2022 was $1,800, rising to $1,941 in 2023 (only an 8% increase), and reaching $2,386 in 2024 (a 23% increase). It was only this year that the price of gold saw an explosive surge, rising by almost 60% to around $4,200.

In other words: central banks started purchasing gold in 2022, and the gold price didn't experience a parabolic rise until 2025.

I believe the logic of the situation is very clear: in any market, there is a part of investors sensitive to price changes — these investors often take action when the price rises or falls by 10%-15%. When central banks started buying gold in large quantities in 2022, driving the gold price up, these investors would sell gold as demand increased. However, eventually, this selling pressure would be exhausted, and the price would then rise significantly.

I suspect Bitcoin is currently in a similar stage.

As mentioned earlier, since 2024 when ETFs and corporations began buying heavily, the price of Bitcoin has risen 2.3 times. During this period, price-sensitive holders take the opportunity to sell and exit.

But as the example of the gold price shows, there will come a day when these selling pressures will be exhausted. As long as the joint buying trend of ETFs and corporations continues (which I believe is highly probable), Bitcoin will experience its "2025 Gold Moment."

My advice is: be patient.

Do not envy the sharp rise in the price of gold, but take it as a sign—it may be showing us the future direction of Bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu, Remittix and PEPE Coin: Factors Shaping November Market Trends

The era of permanent quantitative easing by the Federal Reserve is coming—where are the opportunities for ordinary people?

The article analyzes the background of the Federal Reserve potentially ending quantitative tightening and shifting towards quantitative easing, explores the current liquidity crisis facing the financial system, compares the differences between 2019 and the present, and suggests that investors hold gold and bitcoin to cope with possible monetary expansion. Summary generated by Mars AI. This summary is produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

The Lives of Korean Retail Investors: 14 Million "Ants" Flock to Cryptocurrency and Leverage

The article discusses the high-risk investment behavior of retail investors in South Korea, including going all-in on stocks, leveraged ETFs, and cryptocurrencies. It also examines the socio-economic pressures behind this behavior and its impact on individuals and the financial system. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Was Bitcoin "stolen" or "seized"? The mysterious connection between $14 billion worth of Lubian old coins and the US government

Wallets related to suspected fraudster Chen Zhi have transferred nearly $2 billion worth of bitcoin. The U.S. Department of Justice has accused him of involvement in a $14 billion crypto fraud case. Chen Zhi is currently at large, and some of the bitcoin has been seized by the U.S. government. Summary generated by Mars AI.