Crypto and Fintech Coalition Urges U.S. Regulators to Protect Consumer Data Rights in Open Banking Rule

Quick Breakdown

- Crypto, fintech, and retail groups call on CFPB to finalize a strong open banking rule under Section 1033 of the Dodd-Frank Act.

- Coalition includes Blockchain Association, Crypto Council for Innovation, and Financial Technology Association.

- Groups argue consumers, not banks, should own and control their financial data, supporting access for DeFi and digital finance apps.

A coalition of major crypto, fintech, and retail trade groups is calling on the U.S. Consumer Financial Protection Bureau (CFPB) to finalize an open banking framework that ensures consumers retain control over their financial data, a move seen as crucial for the growth of decentralized finance (DeFi) and digital innovation.

The letter was jointly signed by the Blockchain Association, Crypto Council for Innovation, Financial Technology Association, American Fintech Council, and several retail and small business groups. The coalition’s comments respond to the CFPB’s review of the Personal Financial Data Rights Rule under Section 1033 of the Dodd-Frank Act.

⚡️JUST IN: CRYPTO & FINTECH GROUPS BACK OPEN BANKING

🇺🇸Industry leaders urge the CFPB to enforce the rule ensuring Americans, not big banks, own their financial data. pic.twitter.com/ruPXR9LBrc

— Coin Bureau (@coinbureau) October 21, 2025

Push for consumer control and data access

The coalition urged the CFPB to enshrine consumers’ ownership of their financial data, emphasizing that Americans not banks should decide how and where their information is shared. The groups called for a rule allowing consumers to authorize data sharing with any third party of their choice, rather than limiting access to fiduciaries.

The letter also defended the existing ban on data access fees, warning that allowing banks to charge for data sharing could undermine open competition. According to the coalition, a free and fair market depends on protecting access through secure APIs that connect financial institutions, fintechs, and decentralized finance platforms.

Open banking as a bridge to crypto and DeFi

The coalition highlighted that open banking serves as a vital bridge between traditional finance and emerging digital ecosystems, including crypto on-ramps, DeFi protocols, and digital payment apps. More than 100 million Americans already rely on open banking to access financial tools, the letter noted.

However, the groups cautioned that large U.S. banks are seeking to limit data portability and weaken competition, threatening the innovation and consumer empowerment that open banking enables.

Across the world, financial institutions are rethinking their role in the blockchain era. Japan’s largest banks — Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group (SMBC), and Mizuho Financial Group are jointly developing a dual-pegged stablecoin for real-world settlements.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

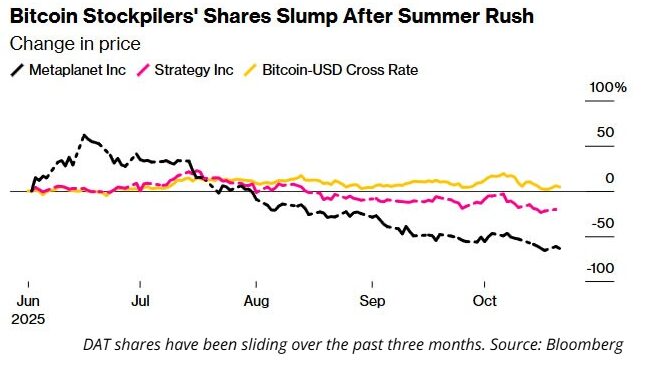

Asia’s Exchanges Crack Down on Crypto Treasury Firms

Bitcoin price to 6X in 2026? M2 supply boom sparks COVID-19 comparisons

Whale ‘BitcoinOG’ Boosts $227M Short, Sends $587M BTC to CEXs

ARK Bitcoin Purchase Totals $162.85 Million Amid Crypto Growth