Solana DEX Meteora to launch MET token with half supply circulating: What will its FDV be?

Meteora’s MET token debuts on October 23, with nearly 48% of its 1 billion supply entering circulation. What will its FDV be?

- Meteora is distributing 480 million MET tokens (48% of supply) via an airdrop to users and partners.

- The Solana-based DEX commands 26% of network trading volume and generates around $3.9 million in daily fees — eight times higher than Raydium.

- Polymarket traders see a 53% chance of a $1B FDV one day post-launch, but many are concerned that the large token float could trigger early selling pressure despite solid performance metrics.

Meteora’s TGE is set for October 23, with the MET token confirmed to list on major exchanges including OKX and Bitget, alongside several Solana-native launchpads. The debut marks one of the most anticipated Solana ecosystem launches of the year, with nearly 48% of the total 1 billion MET supply — or 480 million tokens — entering circulation at launch.

Meteora is taking a community-first approach to the launch, airdropping MET to eligible users, including Mercurial Finance stakeholders, Meteora liquidity providers, JUP stakers, and partner launchpad participants. Recipients can either hold their tokens unlocked or provide liquidity in Meteora’s dynamic AMM pools to earn trading fees.

About Meteora

For context, Meteora was built by the team behind Jupiter , Solana’s largest DEX aggregator. It was born from the remnants of Mercurial Finance, which was wound down following the FTX collapse. To revitalize the protocol, the team created Meteora in 2023, promising to compensate legacy Mercurial users through MET token distribution.

According to analysis by @0xashensoul , Meteora currently commands 26% of Solana’s DEX market share, generating roughly $3.9 million in daily trading fees — eight times higher than Raydium’s $466,000. Its TVL stands at around $829 million.

Meteora FDV one day after launch: Is $1B a safe bet?

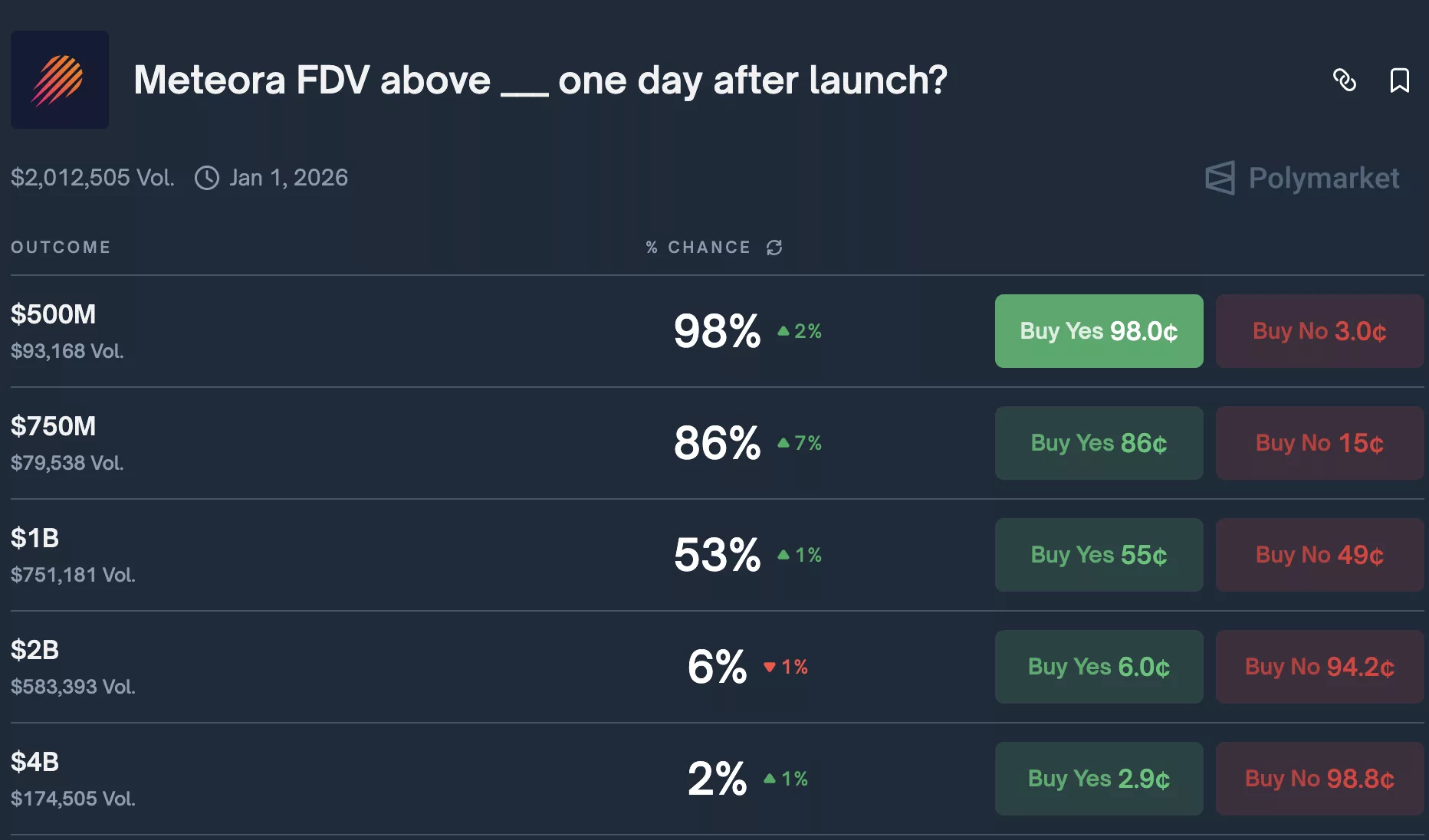

With such a high-profile project launching a token, speculation is intensifying over Meteora’s FDV after launch. Polymarket shows that traders are leaning toward a valuation between $750 million and $1 billion one day after launch.

As of October 22, Polymarket traders are assigning a 98% probability that Meteora’s FDV will exceed $500 million, an 86% chance it will top $750 million, and a 53% chance it will surpass $1 billion. Expectations drop sharply beyond that range, with only 6% betting on a $2 billion valuation and less than 2% on anything above $4 billion.

Meteora FDV one day after launch | Source: polymarket.com

Meteora FDV one day after launch | Source: polymarket.com

The prevailing sentiment in the community is that Meteora’s biggest challenge lies in the circulating supply being too large. As @0xashensoul summed it up:

“Meteora fundamentals are strong, generating 8 times more fees than Raydium, which supports a premium valuation. But, the 48% token unlock on day one is unprecedented for a Solana launch. This large immediate supply will likely cause significant selling pressure. Thats why i think the best risk-adjusted bets are YES on $750M and NO on $2B+, leveraging the disconnect between strong fundamentals and unprecedented 48% float risks.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto projects spend $1.4 billion on token buybacks in 2025

Ethereum Foundation sets per-transaction gas limit for Fusaka upgrade

10x Growth in 4 Months! Leading Market Prediction Platform Polymarket Seeks Funding at $15 Billion Valuation

In June of this year, Polymarket completed a funding round at a valuation of $1 billion. Just four months later, its valuation target has soared to a range of $12 billion to $15 billion.

ERC-8004: The Rise of Digital Assets and the Machine Economy

In the wave of AI and blockchain integration, the release of ERC-8004 marks the entry of the Machine Economy into the Trust Era.