Pi Coin Price Caught Between Bulls and Bears — But One Side Has the Edge

Pi Coin price sits at $0.20, trapped between bullish hope and bearish pressure. A tiny 5% drop could trigger a selloff, while a 34% surge is needed for a breakout.

Pi Coin (PI) price is down 2% in the past 24 hours and 4.5% over the last week, extending its 43% monthly decline. The token has been stuck in a tight range near $0.20, with neither buyers nor sellers taking full control.

However, recent signals show a clear divide between bullish and bearish forces. While sellers appear to be losing some strength, key indicators still point to a fragile setup where the downside looks easier to trigger than a Pi Coin price recovery.

Two Bearish Indicators Keep Bulls on the Back Foot

The Money Flow Index (MFI), which tracks money moving in and out of the asset, highlights a bearish divergence. Between October 10 and 17, PI’s price formed a higher low, but the MFI printed a lower low. That pattern shows weaker buying strength despite stable prices — a sign that retail traders are holding back.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Pi Coin Retail Not Active Enough:

TradingView

Pi Coin Retail Not Active Enough:

TradingView

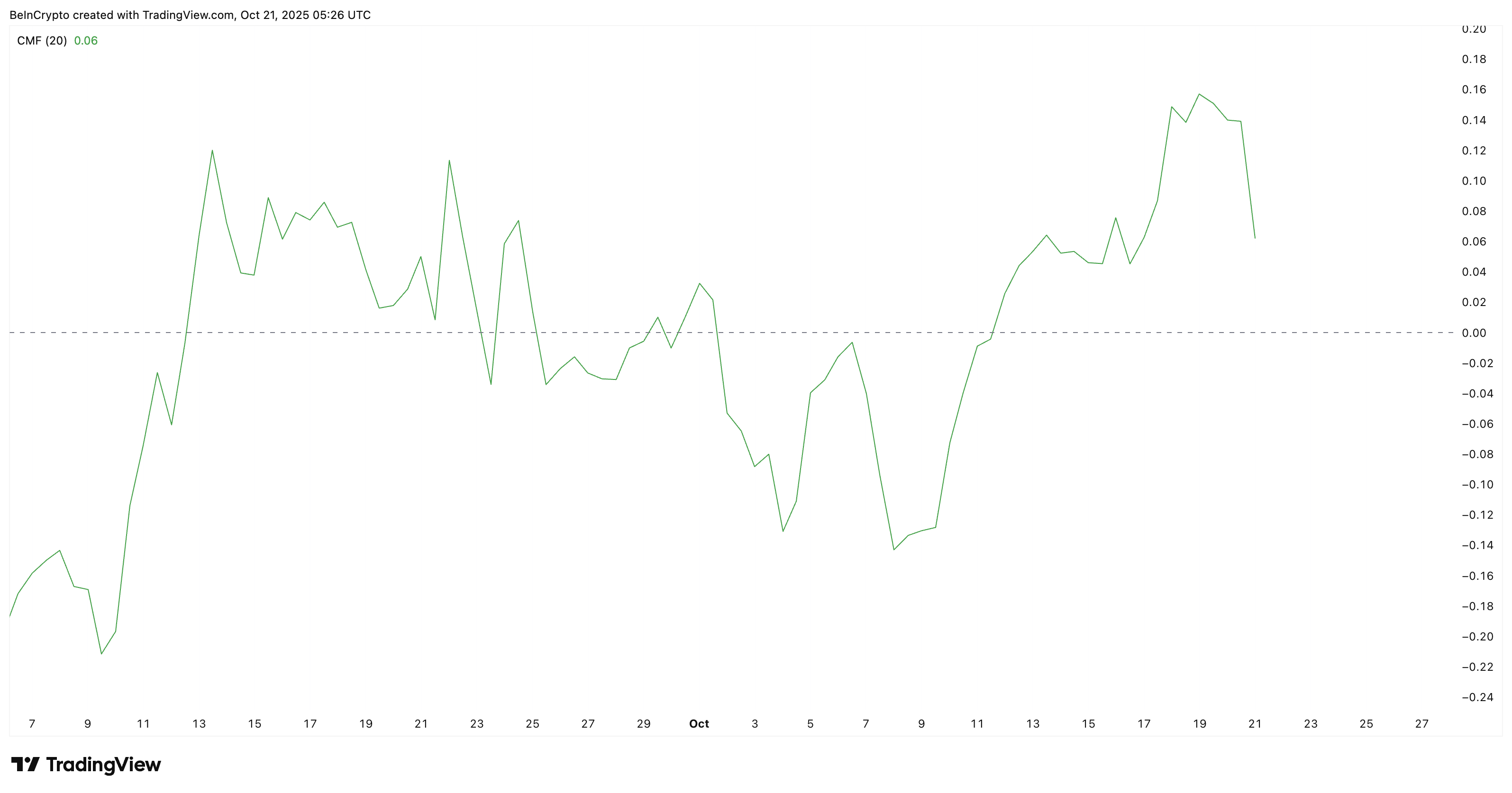

Adding to that, the Chaikin Money Flow (CMF), which tracks large money inflows, remains slightly positive but has fallen sharply since October 20. A drop in CMF above the zero line often signals that while big investors are still present, they’re pulling back on fresh buys.

Large Money Leaving Pi Network:

TradingView

Large Money Leaving Pi Network:

TradingView

Together, the falling MFI and CMF point to fading demand from both small and large holders. Unless inflows improve, any Pi Coin price rebound could stay short-lived.

One Bullish Signal Keeps the Setup From Turning Fully Negative

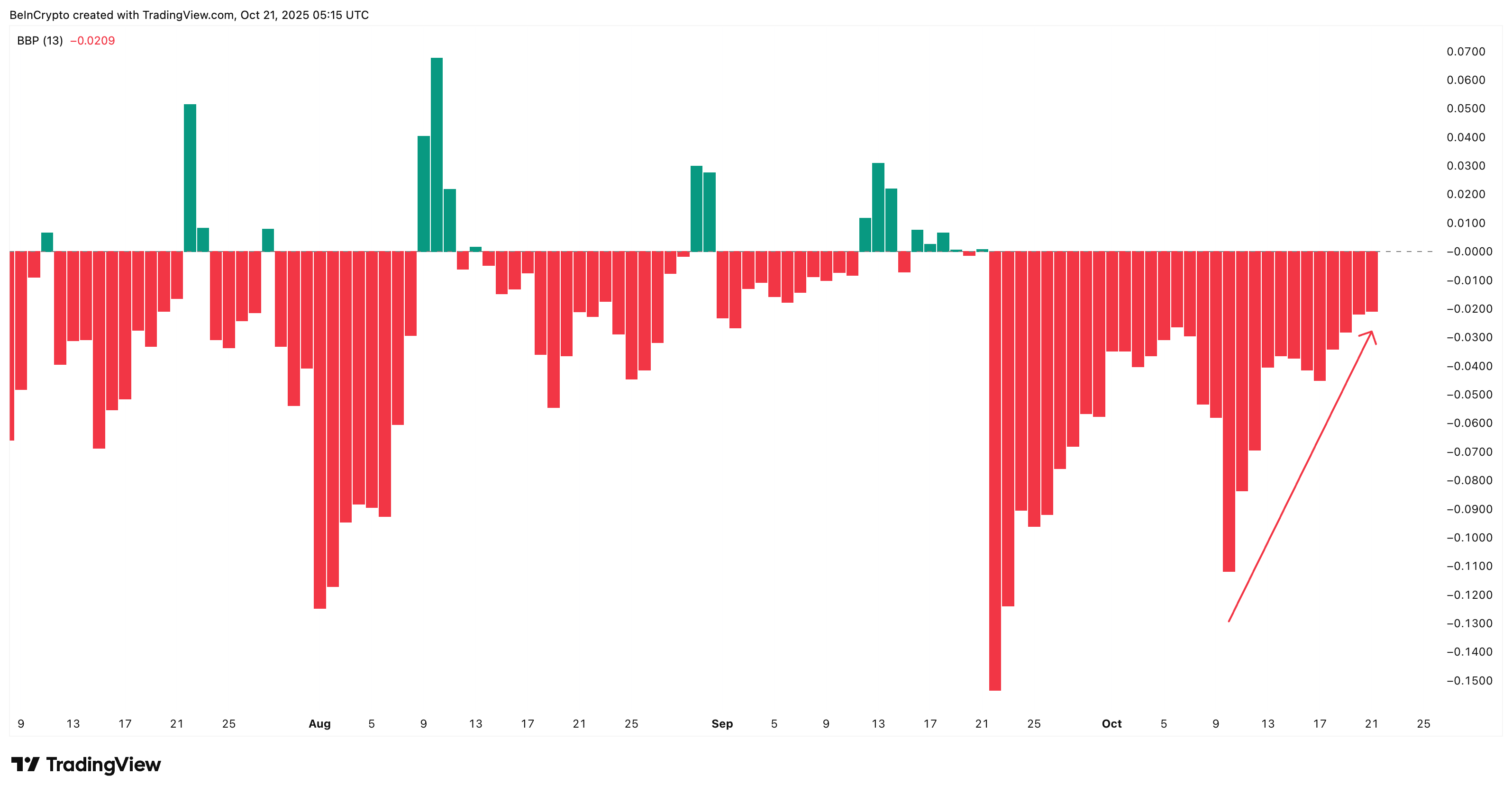

The one indicator holding the bullish structure together is the Bull Bear Power (BBP). This indicator measures the gap between buying and selling strength. Since October 7, bearish momentum has been shrinking steadily. The red bars on the chart have grown smaller — showing that sellers are losing force.

Pi Coin Bears Are Getting Weaker:

TradingView

Pi Coin Bears Are Getting Weaker:

TradingView

It’s not a full reversal yet, but the consistent decline in bearish power suggests that downside pressure is slowly wearing off. This is the only factor currently keeping Pi Coin’s short-term structure from breaking down completely.

Falling Pi Coin Price Wedge Pattern Hints at a Battle Between Two Extremes

Pi Coin continues to trade inside a falling wedge on the daily timeframe. This pattern typically precedes bullish reversals. But the breakout point remains far above current levels.

For a confirmed upside move, the PI price would need a 34% rally to cross $0.27 (the strongest near-term resistance), followed by a close above $0.29 to break the upper wedge boundary. If that happens, the price could target $0.30 and even $0.34.

On the other hand, the bearish scenario is much easier to trigger. A clean drop below $0.19 could send the Pi Coin price quickly to $0.15, where the wedge’s lower trendline sits. Since that lower wedge trendline only comes with two clear touchpoints, it’s weak — and a break there could open the door to deeper losses.

Pi Coin Price Analysis:

TradingView

Pi Coin Price Analysis:

TradingView

In short, the Pi Coin bears have a shorter distance to win. A 5% drop would confirm a breakdown, while bulls need more than six times that effort for a breakout.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PBOC Leverages Technology in Financial Sector to Safeguard China's Economic Prospects

- China's PBOC prioritizes tech-driven finance, digital yuan (ECurrency), and "Five Major Articles" to align financial reforms with real economy needs. - Strategic focus supports semiconductors, EVs, AI, and clean energy sectors under the five-year plan to reduce foreign tech reliance and boost competitiveness. - Digital currency research aims to streamline transactions, enhance policy effectiveness, and position China as a CBDC innovation leader amid global trends. - Inclusive/green finance initiatives ad

Dogecoin Latest Updates: BlockchainFX Claims 500x Returns—Will Practical Applications Surpass Meme Coin Hype?

- Crypto whales are shifting focus to utility-driven projects like BlockchainFX (BFX), which raised $9.7M in presale and targets 500x ROI by 2025, as meme coins like Dogecoin and Shiba Inu lose momentum. - BlockchainFX's hybrid platform integrates crypto, stocks, forex, and commodities trading with a deflationary staking model, offering real-world utility via its BFX Visa Card and 30% presale bonus. - Institutional backing and traditional finance integration (e.g., Visa's stablecoin initiatives) highlight

XRP News Update: SEC Postponements and Major Holder Sell-Offs Drive XRP Under $2.50 Despite ETF Optimism

- XRP fell below $2.50 in October 2025 due to whale selling, SEC ETF delays, and macroeconomic pressures, per CoinoTag. - Institutional and retail investors exacerbated the selloff amid regulatory uncertainty, while Ripple's co-founder sold $120M in XRP. - A $1.8T mutual fund's XRP ETF application and RLUSD's $1B valuation signal long-term institutional confidence in the asset. - Technical analysis suggests potential rebound above $2.40, but a drop below $2.10 risks further declines to $1.80 support. - Reg

Solana News Update: Fidelity Supports Solana’s Rapid Expansion Despite Ongoing Stability Issues

- Fidelity expands crypto offerings by adding Solana (SOL) to its platforms, enabling U.S. investors to trade the high-speed blockchain asset. - Solana's 60,000 TPS and low fees position it as a DeFi and RWA hub, with recent Hong Kong ETF approval and institutional staking partnerships boosting adoption. - Despite network outages and hardware challenges, Solana gains traction as the third crypto ETF-approved asset in Asia, with JPMorgan forecasting $1.5B in U.S. inflows. - Analysts remain divided on SOL's