Bitget Daily Briefing (Oct 21) | Four Crypto ETPs Listed on London Stock Exchange; All Three Major US Stock Indexes Close Higher

Today's Preview

- The 4th ETHShanghai Summit continues through October 22, 2025, with the theme "Scaling Ethereum, Shaping an Open Future." The event is hosted by Wanxiang Blockchain Labs, ETHPanda, and other organizations.

- Scroll (SCR) will unlock 82.5 million tokens on October 22, 2025, valued at approximately $14.08 million, representing 43.42% of its circulating supply.

- Multiple projects have upcoming token unlocks this week. Plasma (XPL) will release about 88.89 million tokens at 8:00 PM on October 25, worth around $36.9 million and making up 4.97% of its circulating supply.

Macro & Hot Topics

- VanEck has filed an S-1 registration statement with the SEC to launch the "VanEck Lido Staked ETH ETF," aiming to provide institutional investors with a compliant and tax-efficient way to invest in staked Ethereum.

- Last week, global listed companies (excluding mining firms) made net Bitcoin purchases totaling $33.74 million. Strategy (formerly MicroStrategy) added 168 BTC, bringing its holdings to 640,418 BTC. Metaplanet has suspended purchases for two consecutive weeks.

- A so-called "Trump insider whale" deposited $40 million to Hyperliquid on October 20 and opened a $340 million short position in Bitcoin with 10x leverage. Their historically accurate long and short trading continues to draw attention from the market.

Market Updates

1.BTC and ETH are consolidating within a narrow range. Market sentiment remains cautious, with $420 million in liquidations over the past 24 hours—mainly affecting short positions.

2.All three major US stock indexes rose sharply on Monday: the Dow Jones, Nasdaq, and S&P 500 each posted gains of over 1%.

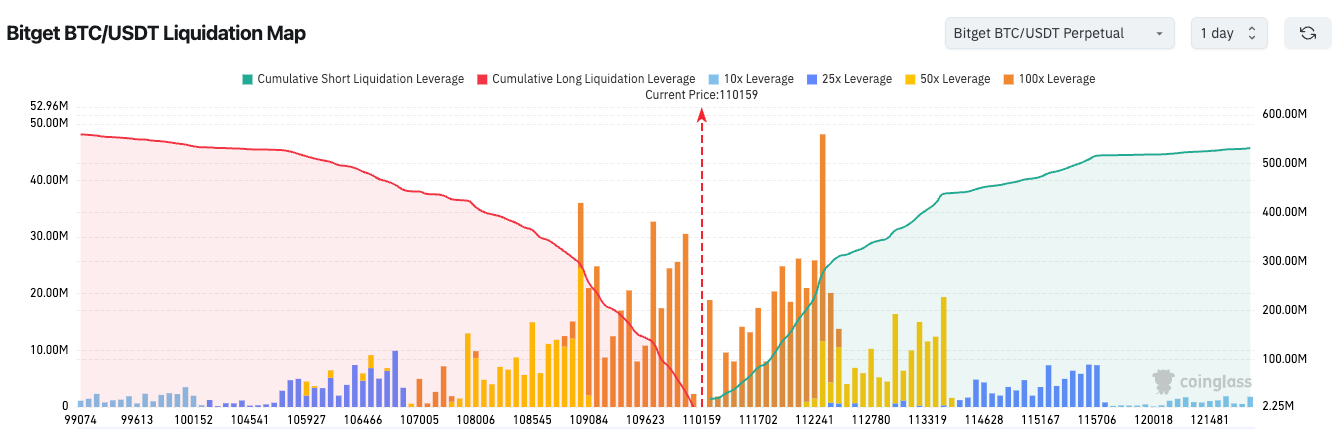

3.According to the Bitget BTC/USDT liquidation map, the current price is $110,163 with dense leveraged long and short positions clustered in this range. A breakout or breakdown could trigger significant liquidations, raising short-term volatility risks.

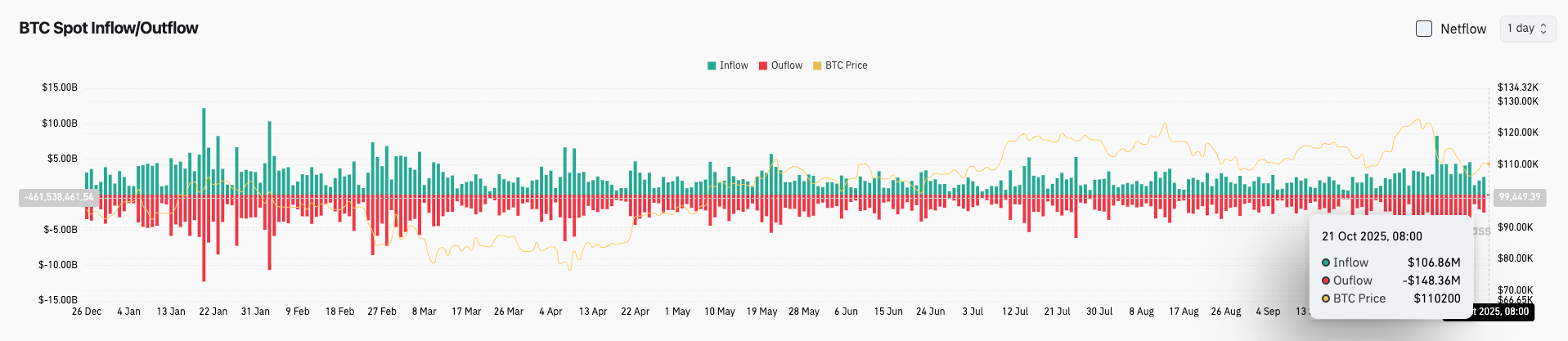

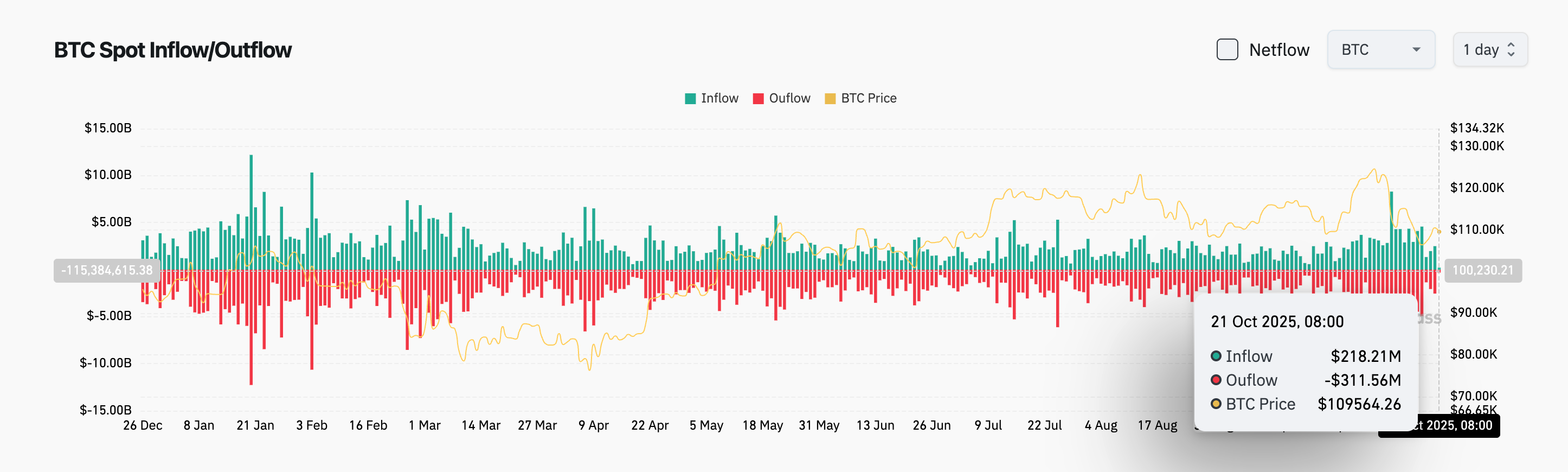

4.In the last 24 hours, spot BTC saw $218 million in inflows and $311 million in outflows, for a net outflow of $93 million.

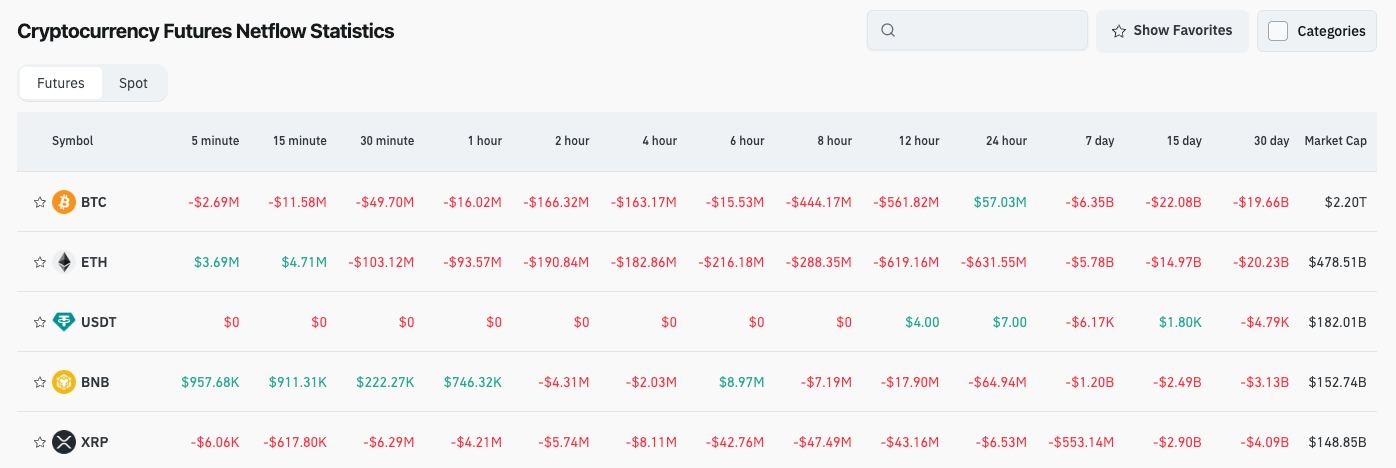

5.Over the past 24 hours, BTC, ETH, BNB, and XRP futures saw net outflows, potentially presenting trading opportunities.

News Updates

- British Columbia, Canada will impose restrictions on electricity use for AI data centers and is permanently banning new cryptocurrency mining projects, prioritizing power supply for other industries.

- Blockchain.com, a cryptocurrency trading and wallet provider, is reportedly in talks to go public in the United States via a SPAC merger.

- The US CFTC’s request for public comment on crypto asset regulation ended on October 20. The Federal Reserve will hold a Payments Innovation Summit on October 21 to discuss stablecoins and tokenization of financial products.

- Latest data shows Zooz Power purchased 888.88 BTC last week, worth approximately $10 million. Publicly listed companies are accelerating allocation to digital assets.

Project Developments

- Solana Company has opened PIPE investors' share sales ahead of schedule, causing its share price to plunge by 60%.

- Solana officially announced its Chinese name as “索拉拉” (Suǒ Lā Lā) on social platform X.

- Bitwise: Four crypto ETP series have been listed on the London Stock Exchange.

- Ethena is conducting its first major team expansion, opening 10 new positions focused on new business lines and products.

- Jupiter: Officially launched Solana Ultra V3 trading engine.

- House of Doge: Became the largest shareholder of Italy's Triestina Football Club.

- Turtle: Completed a $5.5 million fundraising round to drive product iteration.

- Jackson.io: A Sui ecosystem protocol has launched its native token JACKSON.

- Plasma: Will unlock 88.89 million XPL tokens on October 25, representing 4.97% of its circulating supply and attracting market attention.

- Aria, the IPRWA protocol under the Story ecosystem, announced an airdrop plan for its native token $ARIAIP, with 10% of the total supply allocated to community distribution.

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SOL Price Forecast and Solana's Market Strength in Late 2025: A Two-Factor Assessment

- Solana (SOL) faces pivotal 2025 juncture with Fed easing and blockchain upgrades driving price resilience. - Fed rate cuts and $421M institutional inflows via ETFs (e.g., REX-Osprey) boost crypto adoption amid low yields. - Firedancer/Alpenglow upgrades cut validator costs by 80%, enabling 100-150ms finality and $10.2B DeFi TVL growth. - $133 support level and bullish TD Sequential signals suggest $150-$165 target by year-end despite inflation risks.

The Federal Reserve's Change in Policy and Its Effects on Rapidly Growing Cryptocurrencies Such as Solana

- Fed's 2025 rate cut and QT halt injected $72.35B liquidity, briefly boosting crypto markets and Solana (+3.01%) amid easing monetary policy. - Prolonged US government shutdown and $19B October liquidation event exposed crypto's liquidity risks, despite Fed support for speculative assets. - Solana saw $3.65B trading volume but 6.1% price drop in November, with TVL falling 4.7% as regulatory pressures and macro volatility offset institutional inflows. - SIMD-0411 proposal aims to reduce Solana issuance by

LUNA Rises 42.62% Over the Past Week Amid Ongoing Legal Developments in the Terra Ecosystem

- Terra's LUNA token surged 42.62% in 7 days amid ongoing legal proceedings against co-founder Do Kwon. - Prosecutors seek 12-year prison sentence for Kwon over 2022 Terra collapse, which triggered $40B market losses. - LUNA Classic and LUNC rose 70-130% as investors view legal drama as catalyst for renewed Terra ecosystem interest. - Kwon's guilty plea and sentencing hearing on Dec 11 could shape market sentiment, though pardon odds remain at 2%. - "Bankruptcy concept coins" like USTC and FTT also surged,

Bitcoin’s Latest Price Swings and Institutional Outlook: Managing Uncertainty in an Evolving Cryptocurrency Environment

- Bitcoin's 40% November 2025 price drop highlights volatility challenges despite growing institutional adoption and regulatory clarity. - 55% of hedge funds now hold Bitcoin as strategic inflation hedge, driven by ETF approvals and $3 trillion institutional asset unlocking. - Macroeconomic correlations (S&P 500 at 0.48) and Fed policy shifts demonstrate Bitcoin's evolving role as macroeconomic barometer. - 72% of institutions adopted advanced risk frameworks in 2025, emphasizing AI monitoring and regulato