The Crypto That Beat The Market Crash—What’s Driving TAO’s Silent Ascent?

Bittensor’s TAO token has surged amid market weakness, supported by institutional backing, record volumes, and strong staking participation. As its first halving nears, investors see growing potential in TAO’s decentralized AI ecosystem.

Bittensor (TAO) has emerged as one of the market’s standout performers, swiftly reversing all losses from the recent Crypto Black Friday crash — a feat that even Bitcoin (BTC) and Ethereum (ETH) have yet to achieve.

Supported by rising trading volumes, increasing institutional exposure, and a tightening supply ahead of its first halving, TAO’s prospects appear increasingly favorable.

What Drives Bittensor (TAO) to Outperform the Market?

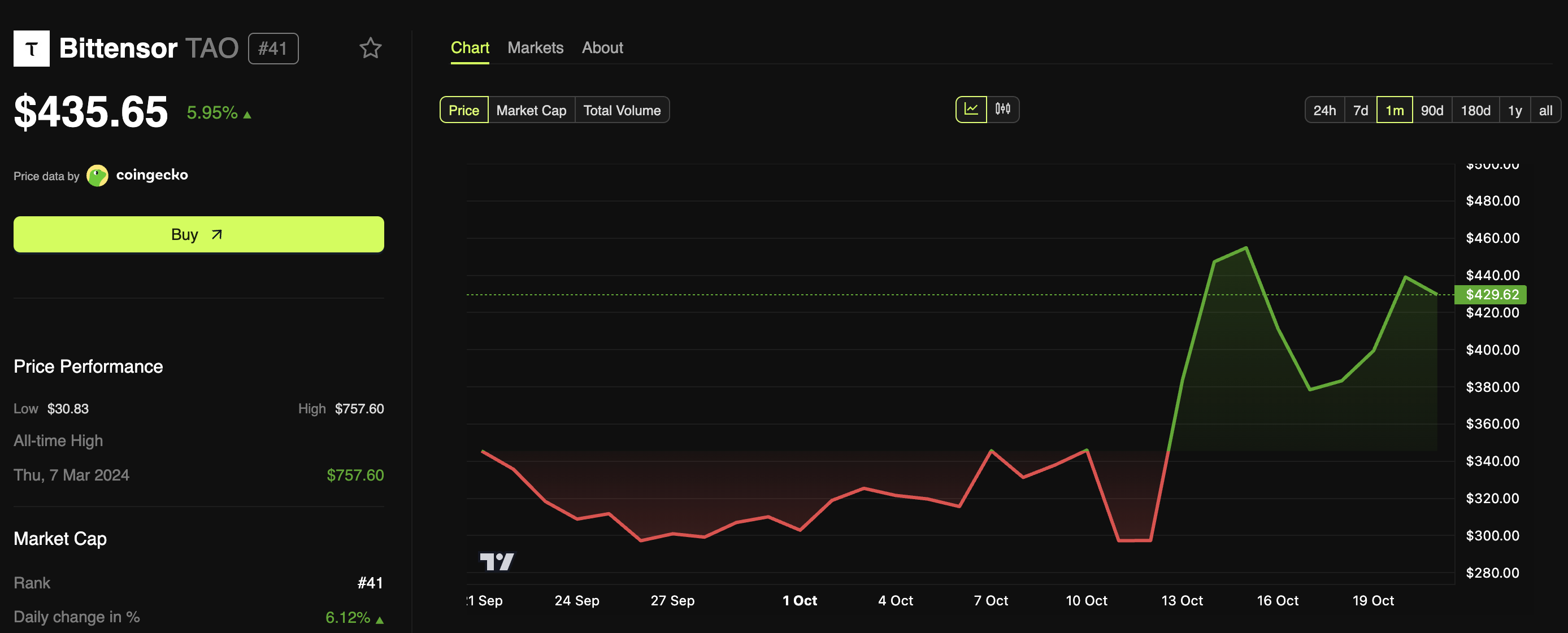

According to data from BeInCrypto Markets, most leading cryptocurrencies have traded lower over the past fortnight. In contrast, Bittensor (TAO) has bucked the trend, recording a 35.7% gain during the same period.

The cryptocurrency not only managed to recover from the October market crash but also rose to multi-month highs. Over the past day alone, the altcoin’s value has appreciated by 5.95%, bringing it to trade at $435.65.

Bittensor (TAO) Price Performance. Source:

BeInCrypto Markets

Bittensor (TAO) Price Performance. Source:

BeInCrypto Markets

Several factors drive TAO’s strong performance. CoinGecko data indicated that the token has maintained daily trading volumes above $400 million throughout the past week, except yesterday. On October 15, volume reached $943 million, a sign of high trader interest and activity.

TAO’s growth is further supported by its strong staking participation. Taostats data revealed that over 70% of circulating TAO is staked. This restricts the available trading supply and supports prices.

Institutional Interest Accelerates Momentum

Institutional adoption has widened Bittensor’s reach. The Decentralized AI Fund by Grayscale has allocated over a third of its holdings to TAO, signaling increased confidence in the coin as a central player in decentralized AI.

Grayscale’s AI Fund with 33.53% in $TAO 👀

— Quinten | 048.eth (@QuintenFrancois) October 19, 2025

Furthermore, the firm recently filed a Form 10 for the Grayscale Bittensor Trust with the SEC. This could pave the way for future exchange-traded products, similar to developments seen in other major cryptocurrencies like BTC and ETH.

An ETF launch could further boost liquidity, attract institutional participation, and enhance TAO’s overall market visibility.

Bittensor Awaits Its First Halving in December 2025

While current catalysts are driving short-term gains, additional factors could fuel further long-term growth for TAO. December 2025 brings a milestone for Bittensor holders: its first halving event.

As stated in official documentation, Bittensor’s halving does not follow a block timeline like Bitcoin. Instead, TAO’s supply-based trigger will cut daily emissions when set thresholds are reached. The planned reduction in new token supply could lead to an increase in prices, especially when strong staking limits liquidity further.

While the halving timeline may shift slightly due to token recycling, the main impact is increased scarcity, which can trigger heightened demand.

Buying $TAO here!This will be even bigger than $ZEC $TAO halving is coming in December 2025. Don’t miss it

— Crypto Eagles (@CryptoProject6) October 19, 2025

In addition, the asset has also attracted substantial support from key market experts. In fact, analyst Quinten Francois recently claimed that TAO could become a trillion-dollar asset by 2030-2031.

“The most fascinating thing about TAO is that its path should follow Reed’s Law, and not Metcalfe’s Law like BTC. Bitcoin reached a trillion-dollar market cap in 2021. That’s only 12 years after its genesis block. In theory, TAO should do it in less than 12 years,” he projected.

Francois cited the project’s competitive subnet model and Bitcoin-like tokenomics as key strengths. He also described TAO’s model as “brilliantly thought out.”

Thus, with high volumes, staking, and institutional interest, TAO is well-positioned as December approaches. The upcoming months will test Bittensor’s resilience as it transitions into a phase of reduced supply and ongoing investor focus.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BitGo Becomes First US Provider to Offer Canton Coin Custody Services

BitGo Enhances Security with $250M Insurance, Regulated Cold Storage, and Multi-Signature Protection for Canton Coin Custody

Canaan Secures 4.5 MW Contract in Japan for Crypto Mining Grid Stabilization

Avalon A1566HA Hydro-Cooled Mining Servers to Bolster Regional Utility's Power Grid in Japan by 2025

Powell: Another rate cut in December is not a certainty, there are significant divisions within the committee, the job market continues to cool, and there is short-term upward pressure on inflation (full text attached)

Powell stated that inflation still faces upward pressure in the short term, while employment is facing downside risks. The current situation is quite challenging, and there remains significant disagreement within the committee regarding whether to cut rates again in December; a rate cut is not a foregone conclusion. Some FOMC members believe it is time to pause. Powell also mentioned that higher tariffs are driving up prices in certain categories of goods, leading to an overall increase in inflation.

Mars Morning News | Due to uncertainty over Federal Reserve rate cut expectations, the crypto market seeks support downward

Federal Reserve Chairman Powell stated that a rate cut in December is not inevitable, leading to a significant decrease in market expectations for rate cuts and a decline in risk assets. The crypto market also dropped as a result, with bitcoin falling below $110,000. The trading volume of Bitwise Solana ETF continues to grow. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively updated.