Date: Mon, Oct 20, 2025 | 05:54 AM GMT

The cryptocurrency market is off to a strong start this week after a period of choppy momentum last week. Both Bitcoin (BTC) and Ethereum (ETH) are trading in the green, posting impressive gains of over 3% and 4%, respectively — lifting sentiment across the broader altcoin market, including Kaspa (KAS).

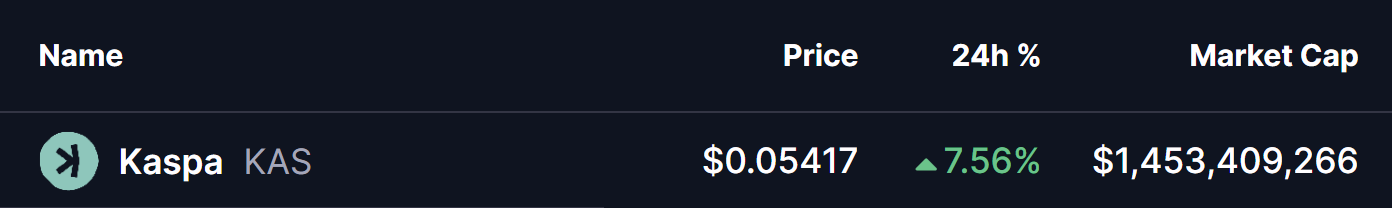

KAS has surged by more than 7% today, and its chart is revealing a notable bullish pattern that hints at a potential continuation of this upward momentum.

Source: Coinmarketcap

Source: Coinmarketcap

Bump-and-Run Reversal (BARR) Pattern in Play

On the 1-hour chart, Kaspa’s price action appears to be forming a Bump-and-Run Reversal (BARR) pattern — a rare yet highly reliable technical setup that often marks the transition from a bearish phase to a bullish trend.

The Lead-in Phase started when KAS faced rejection from its descending trendline near the $0.06551 zone, pushing prices lower to form the Bump Phase bottom around $0.048.

Following this low, KAS rebounded strongly, breaking above the trendline resistance before pulling back for a throwback retest — a healthy technical sign that often precedes the start of a sustained rally.

Kaspa (KAS) 1H Chart/Coinsprobe (Source: Tradingview)

Kaspa (KAS) 1H Chart/Coinsprobe (Source: Tradingview)

At press time, KAS is trading around $0.054, hovering just below its 200-hour moving average (MA) at $0.05646. This moving average has now become a key decision point; a decisive close above it could confirm the bullish breakout and signal the beginning of the Uphill Run Phase in the BARR pattern.

What’s Next for KAS?

If this pattern continues to unfold as expected, a successful reclaim of the 200-hour MA could fuel a strong move higher, with the next target sitting near $0.06359 — representing a potential 17% upside from current levels.

However, if KAS fails to break above the moving average, a short-term pullback or sideways consolidation could follow before the next leg up. Still, as long as the broader structure remains intact and the price holds above the $0.050 support region, the overall bias remains bullish.

For now, Kaspa’s technical setup looks promising, and traders are closely watching to see if this reversal structure can confirm into a sustained rally in the coming sessions.