Has the threat to address funds decreased after Huiwang refused to guarantee some illegal transactions?

Huione Group is a large financial conglomerate based in Cambodia, with subsidiaries that include cryptocurrency wallets, payment services, and more.

Huione Group is a large financial group based in Cambodia, with business segments including cryptocurrency wallets, payments, transaction guarantees, insurance, and cryptocurrency exchanges. Due to its relatively weak KYC and KYT requirements, criminals have exploited the anonymity of USDT to widely conduct illegal activities (such as fraud, money laundering, etc.) through this platform for payments and guarantee transactions, making its business addresses a source of contamination for risky crypto funds.

In the third quarter of this year, Huione Group announced that it would refuse to provide transaction guarantee services for certain illegal activities and published its latest six guarantee deposit addresses. This article aims to audit the funds of both its new and old addresses to determine whether it is truly fulfilling its commitment.

Huione Guarantee Clarifies Business Bottom Line

Located in Southeast Asia, Huione Guarantee's business scope highly overlaps with notorious local organized crime groups. As a result, its business addresses have been affected to some extent, receiving large amounts of crypto funds associated with illegal activities and attracting widespread international attention.

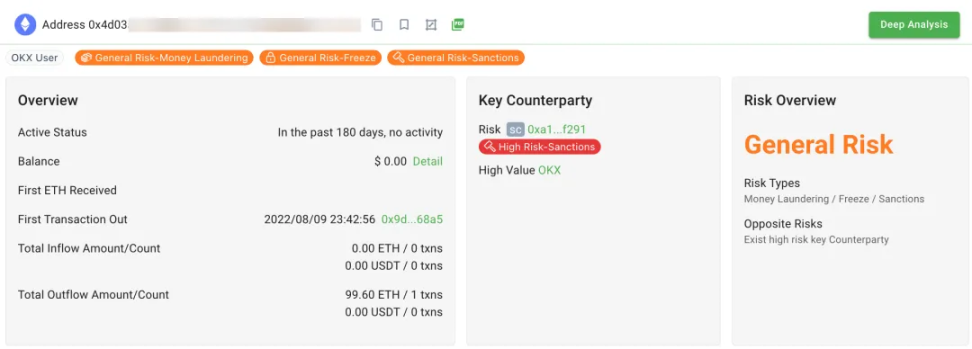

However, in July this year, Huione Group suffered a "backlash." According to Bitrace's initial investigation, the payment business (HuionePay) address under Huione Group was frozen by Tether for receiving funds from the hacked cryptocurrency exchanges DMM and Poloniex, totaling 29.62 million USDT. This amount accounted for about 75% of HuionePay's reserves at the time, putting some pressure on user withdrawals and affecting the platform's normal operations to some extent, serving as a wake-up call for Huione.

After this freezing incident, Huione Guarantee's official website added a special reminder stating that it will not provide guarantees for businesses related to serious criminal activities such as cryptocurrency theft, human trafficking, drug transactions, arms and ammunition trading, as well as terrorism and violence. It also refuses to guarantee businesses involving US-related capital flows and cross-chain mixing and laundering activities.

Huione Guarantee has made a clear distinction regarding its business boundaries, shifting its attitude towards certain high-risk businesses from ambiguous in the early days to explicit rejection. This demonstrates its inclination to strengthen compliance management in order to avoid involvement in illegal activities or further legal risks.

Does the Data Support Huione's Statement?

So, is Huione Guarantee's public resistance to risky activities in order to improve business compliance effective? Bitrace conducted a risk fund audit of the six business addresses most recently disclosed by Huione, comparing them with previous old business addresses to observe the inflow of risky funds before and after Huione's statement.

The six guarantee addresses include: TX36xR, TVf2Na, TYQLMe, TKBiAw, TFMp4o, TU7X7b

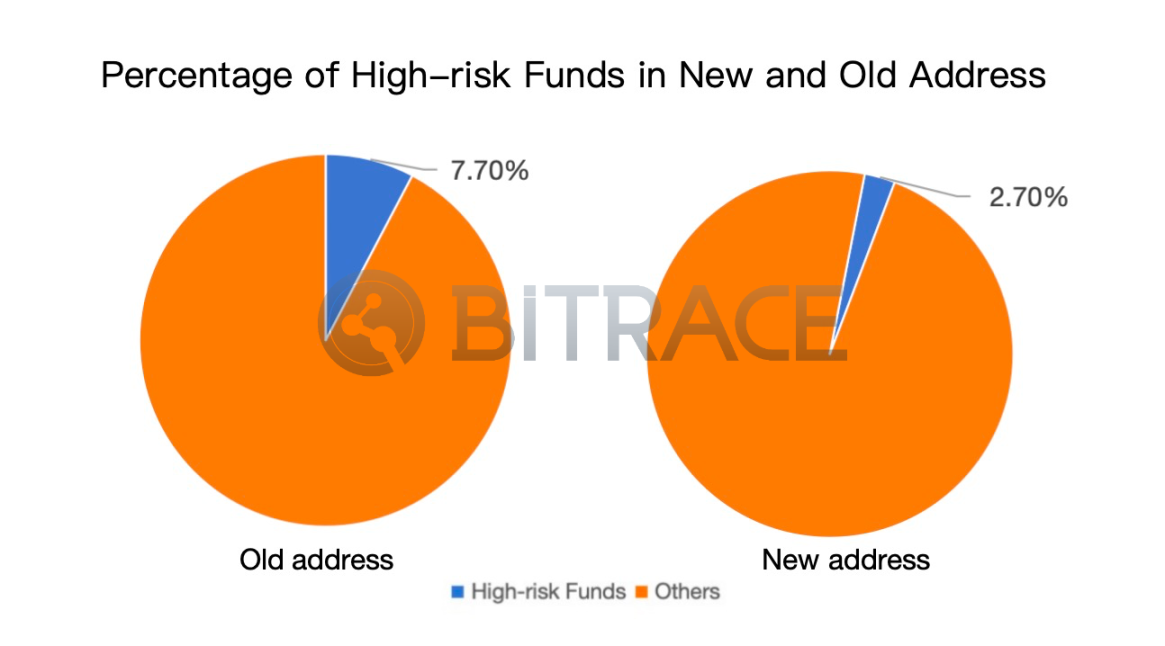

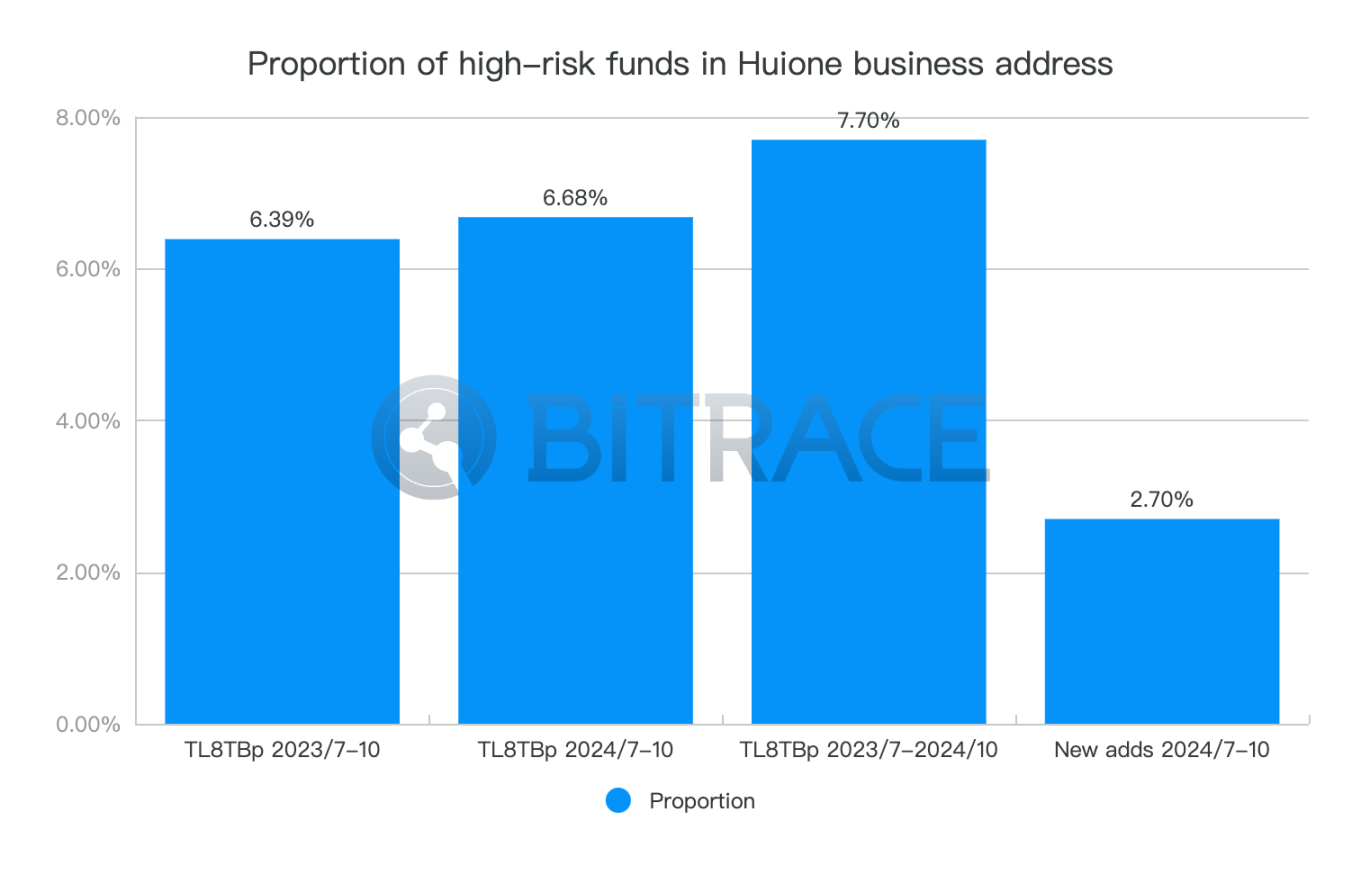

Huione's old business address TL8TBp saw a total inflow of over 2.244 billions USDT from July 16, 2023 to October 13, 2024, of which high-risk funds amounted to 173 millions USDT, accounting for 7.70%. The latest business addresses of Huione saw a total inflow of over 300 millions USDT from July 16, 2024 to October 13, 2024, with high-risk funds reaching 8.14 millions USDT, accounting for 2.70%. It is evident that the proportion of risky funds in Huione's inflows has significantly decreased.

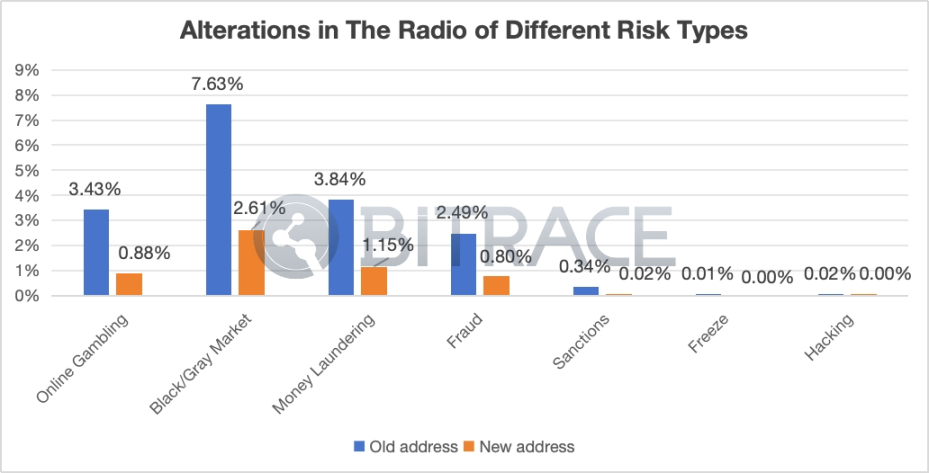

Breaking down high-risk funds by different risk categories, the inflow of black and gray market funds has significantly improved, dropping from 7.63% to 2.61%. The inflow of high-risk funds such as money laundering, gambling, and fraud has also noticeably decreased.

In addition, Bitrace further calculated the proportion of high-risk funds for new and old business addresses over different time periods. It was found that for TL8TBp, from July 16, 2024 to October 13, 2024, the proportion of high-risk funds in total inflows was 6.68%, slightly higher than the same period last year and slightly lower than the entire audit period.

From the above data, it is not difficult to see that whether for new or old addresses, the inflow of high-risk funds into Huione Guarantee's business addresses has indeed improved, which may be related to its tightening of merchant participation thresholds.

However, it is worth noting that these new business addresses do not have a sufficiently long operating history, and the currently available data may not accurately reflect the compliance progress of Huione Guarantee. Bitrace will continue to monitor the situation.

The Importance of KYT

The expansion of the crypto industry and the proliferation of risky funds have put increasing compliance pressure on Web3 institutions. The lack of ability to identify the risk of funds at platform user addresses may affect platform operations and even put operators at risk of investigation.

Know Your Transaction (KYT), as a fundamental tool for cryptocurrency companies to maintain safe and compliant operations, is indispensable for preventing illegal activities, protecting user assets, and enhancing platform reputation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Markets Face a Rollercoaster: What Happened in the Past 24 Hours?

In Brief Bitcoin price dropped by 2.4%, influencing overall crypto market sentiment. The top 10 cryptocurrencies saw a general decline over the past 24 hours. Market seeks stability amid cautious investor behavior and potential short-term volatility.