Gold Breaking $5000 - What Does It Mean for Bitcoin?

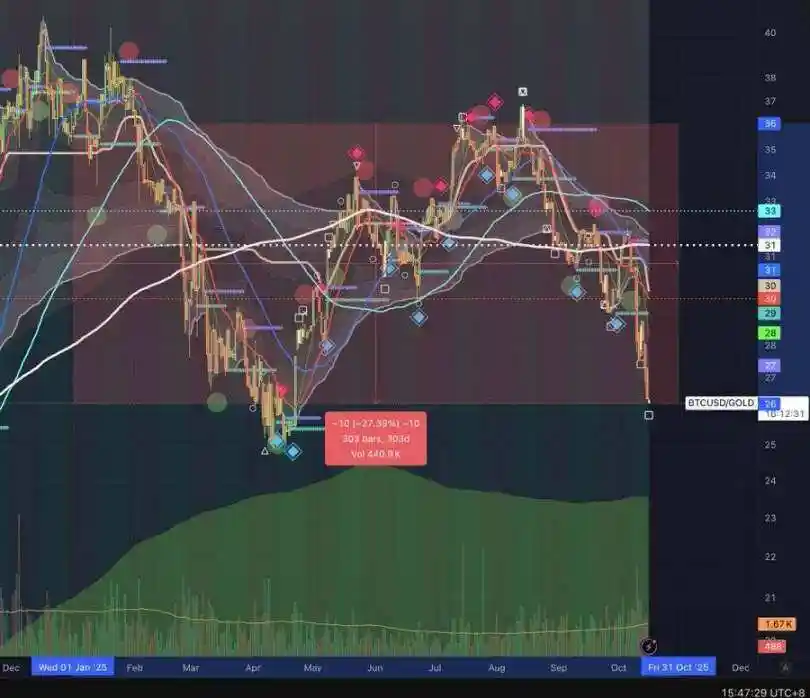

So far this year, the Bitcoin-to-Gold exchange rate has fallen by over 25%.

Original Article Title: Why gold is going to $5k

Original Article Author: Fishmarketacad, DeFi Researcher

Original Article Translation: Deep Tide TechFlow

Seeing the CT's attention on gold today, I have been following gold for a while, so I decided to share some quick thoughts (possibly wrong).

Why Does Gold Only Rise and Not Fall?

Since the 2020 era of unlimited quantitative easing (QE infinity) and fiat devaluation, I have been paying attention to precious metals as a non-market-correlated store of value.

The price of gold has already exceeded $4200, rising 25% in less than two months. Let's explore the reasons behind this phenomenon:

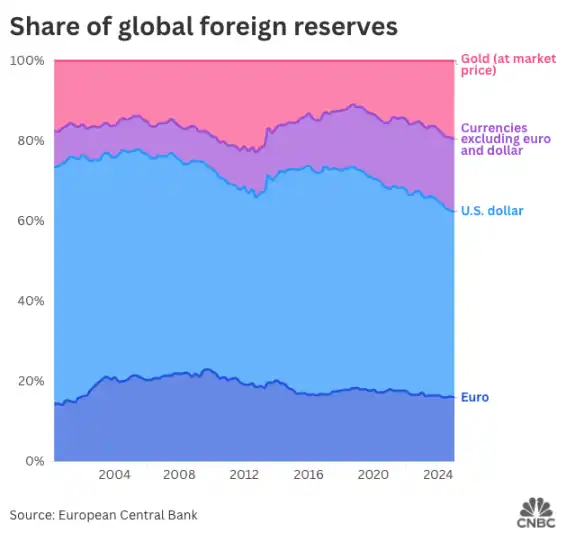

1. De-Dollarization / Central Bank Gold Buying

Central banks, especially China, are crazily buying gold. As far as I know, they are expected to purchase over 1000 tons of gold for the fourth consecutive year, and surveys show that they plan to continue buying.

Why? The U.S. national debt is expected to reach $37.5 trillion this year, with interest alone exceeding $1 trillion (tax revenue is about $4-5 trillion). There are only two ways to deal with such massive debt: default or devaluation, and the U.S. never needs to default because they can devalue the debt by printing more money.

2. Stablecoins as a Debt Socialization Tool

The U.S. devalues its debt through currency inflation, essentially printing more money to decrease the value of each dollar, thereby reducing the real value of the debt. This situation has been ongoing for decades, and you should be familiar with it.

The new twist is that if the U.S. shifts part of this debt to the crypto field, such as stablecoins, it could get very interesting because cryptocurrency is more easily accessible worldwide.

Stablecoins are increasingly backed by loans. Stablecoins pegged to the dollar, such as USDT and USDC, are currently mostly backed by U.S. treasuries. Originally purely 1:1 tools have gradually evolved to over 90% backed by U.S. treasuries.

Therefore, whenever people from other countries hold a stablecoin, they are indirectly buying U.S. debt. This process globalizes the U.S. 'inflation tax'. The more widely adopted the U.S. stablecoin is globally — a figure we know is in the trillions — the more the U.S. can export its debt and hand off its 'losses' to the world outside the U.S.

If this is indeed part of the plan, it ties back to the previously mentioned demand for de-dollarization, where gold as a safe store of value becomes crucial.

3. Physical Gold Shortage

Another key point is that this gold rally is not solely driven by paper gold or derivatives. If you're familiar with the potential short squeeze when open interest (OI) exceeds token liquidity in the perpetuals market, this is a similar idea.

In 2025, for example, the open interest in COMEX gold futures typically runs into hundreds of thousands of contracts (each representing 100 troy ounces of gold), whereas the total physical gold available for delivery is only a small fraction of this.

This means that the demand for physical gold at any point far exceeds the deliverable amount. This is also why the gold delivery time has extended from days to weeks. It indicates genuine physical demand (akin to spot demand), often not coming from short-term investors, thus forming a structural price floor.

4. Overall Uncertainty

Gold has once again affirmed its safe-haven status during uncertain times. Current factors such as U.S.-China competition, trade war concerns, domestic U.S. turmoil, Fed rate cuts, U.S. economy dependent on AI infrastructure support, economic uncertainties, etc., have led to global de-dollarization and investment in gold.

In my view, the main circumstances for gold to see a significant decline are when there is no need for a safe haven. The following conditions need to be met, but are not expected to happen in the short term:

· High employment rate: Poor U.S. economic prospects

· Funds flowing into risk assets: Stocks not being cheap (although not cheap right now)

· Political stability: U.S. needing to be friendly towards China

· Rising interest rates, i.e., increased cost of funds: Current situation is a complete opposite

Due to Trump's unpredictability, these conditions could also change rapidly (or at least the market perception around them), so caution is advised.

What Does This Mean for BTC?

Believe it or not, Bitcoin has fallen more than 25% against gold year-to-date.

I still believe that Bitcoin is not yet ready to become "digital gold." Although it shares many similarities with gold, it is gradually approaching gold each year (except for the unclear solution to the quantum computing issue).

However, if you try to buy gold, you will find that the premium for physical gold is very high, making it more suitable for buying and holding long term, which is not as fun. Therefore, I think retail investors may choose to buy Bitcoin instead of gold, but the purchasing power of retail investors is relatively lower compared to central banks.

Bitcoin is highly associated with U.S. politics today, which in turn hinders other central banks from buying Bitcoin to achieve their de-dollarization goals. As far as I know, U.S. miners now account for approximately 38% of Bitcoin's hashrate, and U.S. entities (ETFs, publicly traded companies, trusts, and the government) control about 15% of the total Bitcoin supply, with this percentage possibly increasing further.

So, I am uncertain about what will happen between Bitcoin and gold, but I believe that in the short term (until the end of this year), Bitcoin will continue to weaken against gold.

What Am I Doing?

Going long on Bitcoin dominance (BTC DOM): I believe de-dollarization has a larger impact on Bitcoin compared to other altcoins. With the recent "Black Friday" crash, it is evident that Bitcoin is the only asset with true order book liquidity and buying interest, and the Bitcoin dominance rate currently appears to be in an uptrend. If I see altcoins performing well, I may exit this trade, but usually, this is after Bitcoin hits a new all-time high, which should further boost Bitcoin dominance.

Going long on gold: Essentially, this involves buying paper gold, selling put options, or buying call options. However, the principle of "not your keys, not your coins" also applies here. I may just be holding a useless piece of paper, but I currently have no opinion on this.

Final Thoughts

In summary, I believe that due to the aforementioned structural changes, gold remains a solid choice. However, I would not be surprised by a short-term 20-30% pullback, which could be a good long-term buying opportunity, provided that the mentioned uncertainties have not dissipated.

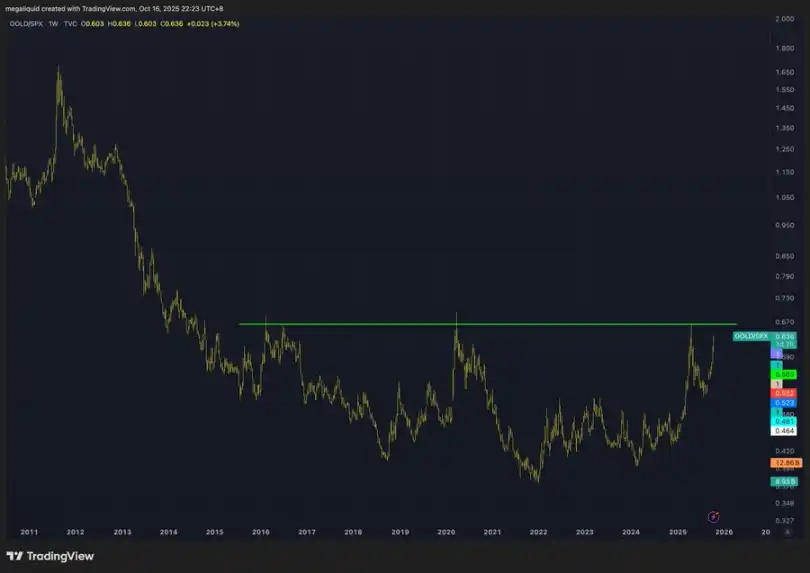

Additionally, gold is about to reach its resistance point relative to the S&P 500 index (SPX) and is approaching a market cap of $30 trillion. Therefore, these two factors could be potential local tops, and you may need to wait for a while before entering a FOMO state.

Finally, this is my another take on gold, as a quick conclusion, I still see gold having room to go up:

· If the US economy or global stability is uncertain, gold goes up

· If the US economy or global stability is more uncertain, gold goes up

· If the US economy or global stability is more stable, gold goes down

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi Faces a Trust Challenge: Balancer Recovers $8 Million Following $128 Million Hack

- Balancer proposes $8M repayment plan after $128M exploit, returning funds to liquidity providers via pro-rata in-kind distribution. - Whitehat actors receive 10% bounties in rescued tokens; non-socialized model ensures pool-specific funds go only to affected LPs. - Exploit exposed systemic risks in DeFi's composable pools, with attackers exploiting rounding errors despite 11 prior audits by four firms. - Governance vote will finalize distribution framework, with claim interface enabling 90-180 day token

AI-driven SaaS Revolution: PetVivo Reduces Expenses by 50-90%, C3.ai Collaborates with Microsoft

- PetVivo.ai cuts veterinary client acquisition costs by 50-90% using AI agents, achieving $42.53 per client vs. $80-$400 industry norms. - C3.ai's Microsoft partnership boosts stock 35% as Azure integration enables enterprise AI scalability through unified data operations. - AI-driven SaaS models like PetVivo's $3/lead platform and C3.ai's 19-27% revenue growth highlight AI's disruptive potential in traditional industries. - Both companies face challenges scaling beta results and converting pilots to long

Ethereum News Today: "Turbulence or Trust? $15 Billion in Crypto Options Set Market Dynamics Against Institutional Hopefulness"

- Bitcoin and Ethereum face $15B options expiry on October 31, 2025, risking amplified volatility amid sharp price declines. - Institutional confidence grows as Bitcoin/ETH ETFs see $217.5M inflows, contrasting crypto's 33-45% drawdowns vs. stable tech stocks. - Tom Lee's firm BMNR boosts ETH holdings to 2.9% of supply, betting on $5,500 mid-2025 and $60K+ 2030 targets. - Deribit data shows Bitcoin's bullish positioning (put-call ratio 0.54) vs. Ethereum's balanced approach, with max pain levels at $100K a

VIPBitget VIP Weekly Research Insights

This year's market has been driven primarily by the growth of DATs, ETFs, and stablecoins. Strong institutional inflows indicate that mainstream U.S. capital is now entering the crypto market. However, after the October 11 black swan event, the market underwent a significant correction due to deleveraging. Even so, several indicators now suggest that a bottom may be forming. Our recommended assets are BTC, ETH, SOL, XRP, and DOGE.