Can Bitcoin withstand the sell-off as $1.8 billion in profit-taking funds enter the market?

Momentum is gradually fading, with large amounts of capital flowing into exit channels.

Momentum is gradually fading, and a large amount of capital is flowing into exit channels.

Written by: cryptoslate

Translated by: Blockchain Knight

Bitcoin is showing signs of fatigue, a condition that usually appears before significant directional volatility.

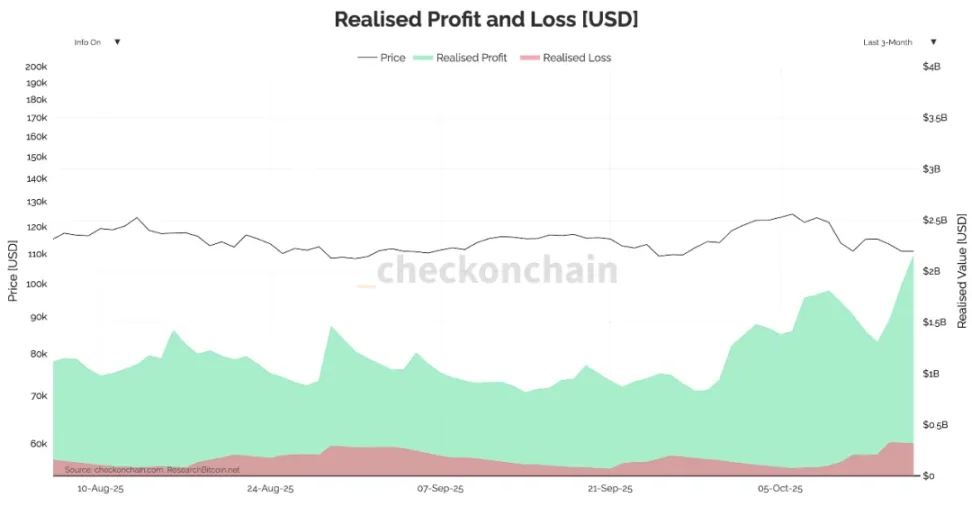

On October 15, traders realized $1.8 billions in profits, making it one of the largest profit-taking days since early summer this year.

On the same day, the market also saw $430 millions in realized losses.

This data confirms the general sentiment in the market since the weekend's plunge: momentum is gradually fading, and a large amount of capital is flowing into exit channels.

At the time of writing, the price of Bitcoin is below $110,000, having dropped more than 10% since early October.

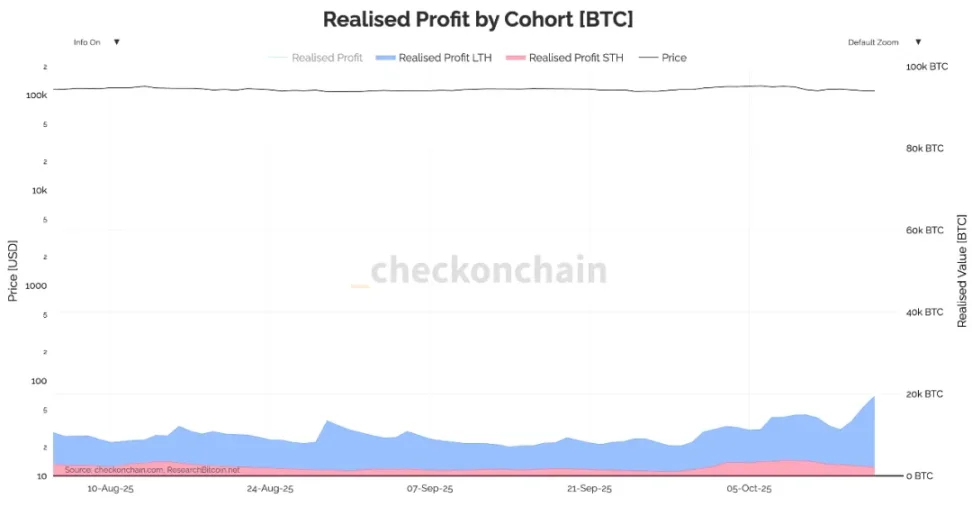

This portion of the decline was not a slow dip, but rather the result of investors who entered at the beginning of 2025 and have held until now quickly closing their positions.

Long-term holders (i.e., investors holding for more than three months) are the main force behind this sell-off, with the scale of their realized profits being more than six times that of short-term holders.

Even during last week's plunge, long-term holders remained in deep profit, so it can be concluded that they are not panic selling.

They are engaging in de-risking operations: choosing to take profits as the market weakens, rather than waiting for a rebound.

After market consolidation, a certain degree of profit-taking is routine, and hundreds of millions of dollars in daily profit-taking can be interpreted as healthy capital rotation.

But as observed since early October, when this outflow of capital becomes a sustained trend, its nature shifts from "dispersed selling" to showing signs of "market exhaustion."

The scale of realized losses is also rising. Although losses are currently within a "controllable" range, they have climbed in tandem with the scale of profit-taking.

If realized losses continue to grow in sync with profit-taking, it may indicate that de-risking operations are spreading from short-term holders to the entire market.

This spread may be highly contagious, as currently half of Bitcoin's short-term holders are in an unrealized loss position.

According to on-chain data analysis platform Checkonchain, unrealized losses currently account for about 2% of market capitalization. Although the scale is not large, the growth rate is quite fast.

If the price of Bitcoin falls below $100,000, this proportion could rise to 5%, a level sufficient to turn the current market's "unease" into full-blown panic.

Historically, only during complete bear market phases does more than 30% of circulating supply fall into a loss position, and the current market is dangerously close to this threshold.

If buyers can successfully hold the $100,000 level, Bitcoin may be able to reset its short-term cost basis and restore bullish momentum.

If it falls below $100,000, the cost basis for a new round of buyers will collapse, and all short-term circulating supply will be in a loss position.

This does not necessarily mean the end of the current cycle, but it could further expand the correction to $80,000, a drawdown of about 35% from the all-time high (ATH).

Given the scale of current selling pressure, Bitcoin's present stability remains remarkable, but the signals transmitted on-chain are unmistakable: market confidence is steadily weakening.

Bulls are still holding the line, but with every downward candlestick, it becomes harder for outsiders to judge whether they are "buying the dip" or "catching a falling knife."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BNY Mellon Empowers Crypto Ecosystem with Robust Infrastructure

In Brief BNY Mellon enhances its crypto ecosystem role through infrastructure services, not its own coin. The bank supports stablecoin projects instead of launching an altcoin amid positive market conditions. BNY Mellon prioritizes infrastructure over token issuance, promoting collaboration and ecosystem strength.

Crypto Surge Revives Investor Optimism

In Brief The crypto market exhibits signs of recovery post-major liquidations. Ethereum, Dogecoin, Cardano, and XRP have shown significant gains. Technological innovations and ETF expectations contribute to market optimism.

Bitcoin ETFs Lose $366 Million While Ethereum ETFs Shed $232 Million in Major Market Outflow

Dogecoin Tests Crucial Support Zone, Charts Indicate Possible Upside Toward $0.86