JPMorgan says crypto native investors likely behind recent market correction

Quick Take JPMorgan analysts say last week’s crypto market correction was likely driven by crypto native investors using perpetual futures, not by CME futures or crypto ETF users. Bitcoin and Ethereum ETFs saw modest outflows, indicating limited liquidations from traditional investors, they said.

The severe correction in crypto markets last week, which involved massive liquidations, was likely driven by crypto native investors rather than institutional or retail ETF holders, according to JPMorgan analysts.

The analysts, led by managing director Nikolaos Panigirtzoglou, said in a Thursday report that there was "little evidence" of significant liquidation in spot bitcoin exchange-traded funds, which are generally favored by traditional retail investors.

Between Oct. 10 and Oct. 14, bitcoin ETFs saw modest cumulative outflows of $220 million, or 0.14% of total assets under management, while Ethereum ETFs recorded a larger $370 million outflow, or 1.23% of AUM, the analysts noted.

Similarly, CME bitcoin futures — a key gauge of institutional positioning — showed few liquidations, while CME Ethereum futures saw heavier deleveraging, likely reflecting "greater de-risking" by momentum traders such as commodity trading advisors and quant funds, according to the analysts.

By contrast, perpetual futures , a product typically favored by crypto native traders, both retail and institutional, experienced sharp deleveraging. Open interest in bitcoin and Ethereum perpetual contracts fell by about 40% in dollar terms — a decline exceeding the price drops of both assets. That pattern, the analysts said, indicates that crypto native investors were the primary drivers of last week’s correction, while non-crypto native investors (who are more likely to use CME futures or crypto ETFs) remained largely on the sidelines.

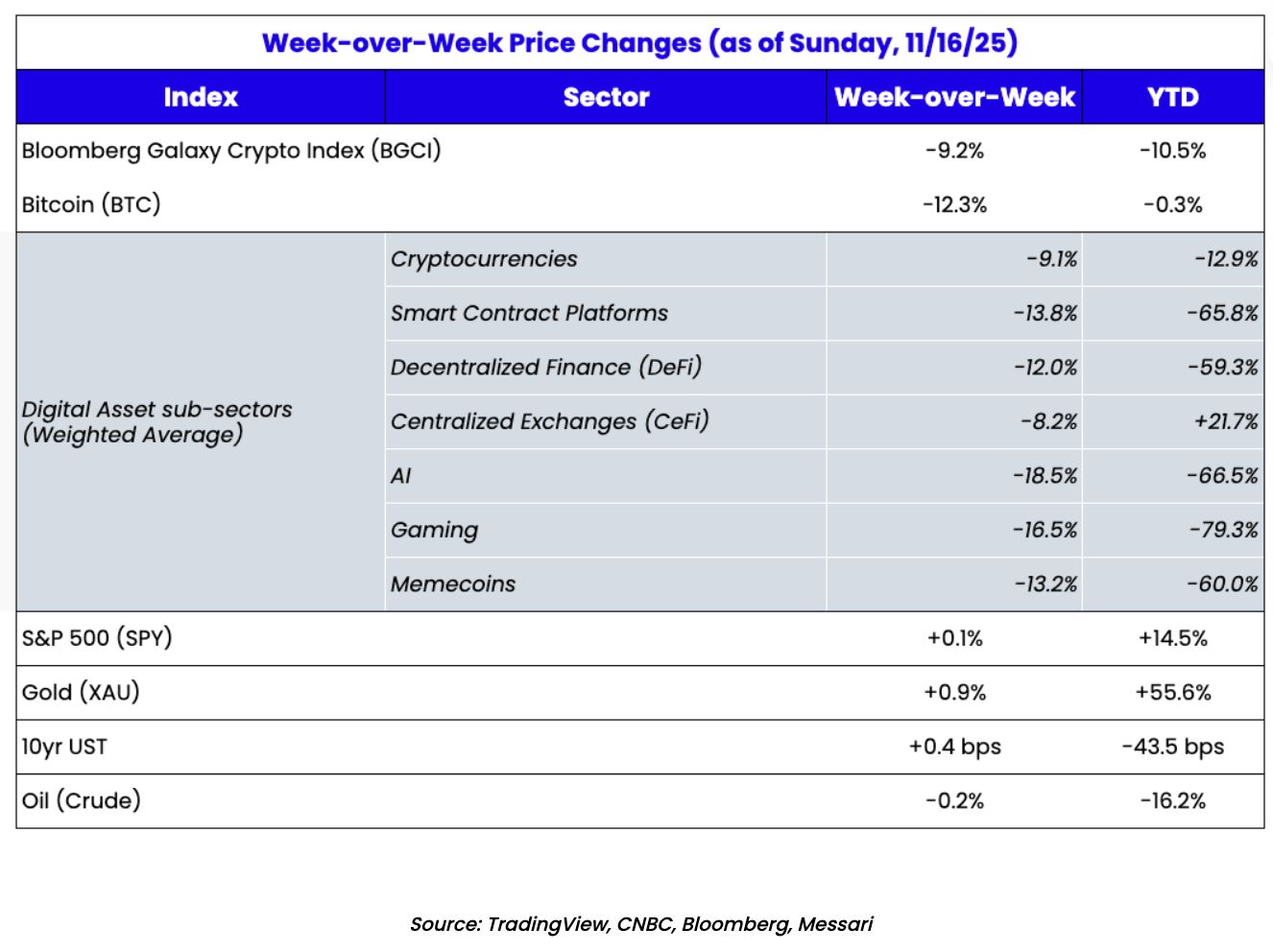

Crypto markets were hit by the largest liquidation event in history last Friday, triggered in part by the latest round of tariff headlines from U.S. President Donald Trump. More than $20 billion in leveraged positions were wiped out, affecting over 1.5 million traders. Bitcoin, ether, and altcoins all saw steep declines. While prices have since stabilized somewhat, sentiment remains cautious.

Bitcoin is currently trading around $108,500, down about 2.5% in the past 24 hours, according to The Block’s bitcoin price page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Atlantic: How Will Cryptocurrency Trigger the Next Financial Crisis?

Bitcoin fell below $90,000, and the cryptocurrency market lost $1.2 trillions in six weeks. Stablecoins, criticized for disguising risks as safety, have been identified as potential triggers for a financial crisis, and the GENIUS Act could increase these risks. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Bitcoin Surrenders Early as Market Awaits Nvidia’s Earnings Report Tomorrow

Global risk assets have experienced a significant decline recently, with both the US stock market and the cryptocurrency market plunging simultaneously. This is mainly due to investor fears of an AI bubble and uncertainty surrounding the Federal Reserve's monetary policy. Concerns over the AI sector intensified ahead of Nvidia's earnings report, while uncertainty in macroeconomic data further increased market volatility. The correlation between Bitcoin and tech stocks has strengthened, leading to split market sentiment, with some investors choosing to wait and see or buy the dip. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively improved.

Recent Market Analysis: Bitcoin Falls Below Key Support Level, Market on High Alert, Preparing for a No Rate Cut Scenario

Due to the uncertainty surrounding the Federal Reserve’s decision in December, it may be wiser to act cautiously and control positions rather than attempting to predict a short-term bottom.

If HYPE and PUMP were stocks, they would both be undervalued.

If these were stocks, their trading prices would be at least 10 times higher, if not more.