Ocean Protocol’s Sudden Exit from ASI Alliance Triggers Legal Action

Fetch.ai’s Humayun Sheikh is funding a class action following Ocean Protocol’s sudden ASI Alliance exit, a move that sent FET plunging and reignited debate over governance, trust, and token unity in decentralized AI.

Fetch.ai CEO Humayun Sheikh has announced plans to personally fund a class action lawsuit following Ocean Protocol’s sudden withdrawal from the Artificial Superintelligence Alliance (ASI).

The Ocean Protocol decided to exit the decentralized AI coalition that once united Fetch.ai, SingularityNET, and Ocean Protocol under a shared token vision.

Fetch.ai CEO Humayun Sheikh Plans Class Action After Ocean Protocol’s ASI Alliance Exit

In a post on X (Twitter), Sheikh urged affected FET holders to prepare evidence of financial losses linked to Ocean’s exit. He committed to funding a class action in three or possibly more jurisdictions, with a dedicated channel planned for users to submit claims.

If you are or were a holder of $fet and have lost money during this Ocean action be ready with your evidence. I am personally funding a class action in 3 or possibly more jurisdictions. I will be setting up a channel for all to submit your claims. Hold tight and be ready!

— Humayun (@HMsheikh4) October 16, 2025

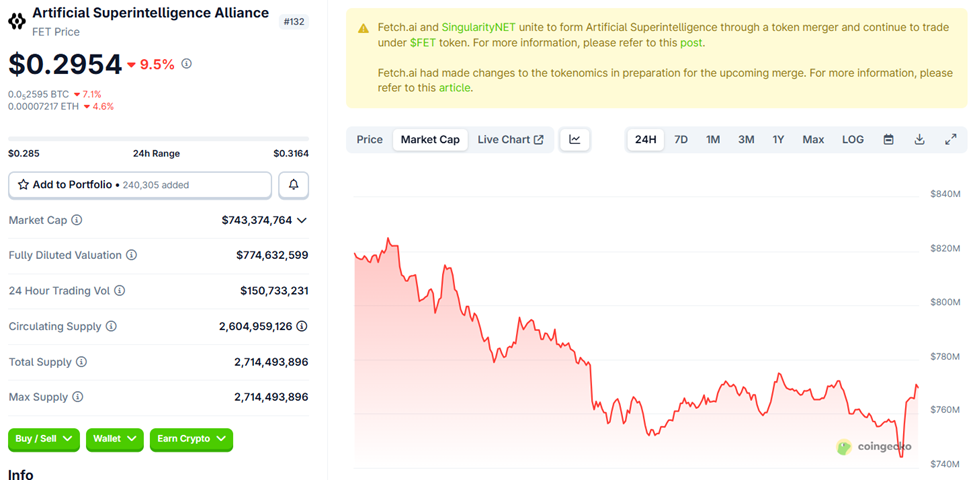

The statement comes as the FET price dropped almost 10% in 24 hours, trading at $0.2954 on CoinGecko at the time of writing.

FET Price Performance. Source:

CoinGecko

FET Price Performance. Source:

CoinGecko

The sell-off has been ongoing, exacerbated by Ocean Protocol Foundation’s decision to withdraw all its directors and membership positions from the ASI Alliance.

The decision effectively ends its participation in the coalition formed earlier this year to build a unified AI and Web3 ecosystem.

Against this backdrop, Binance announced plans to cease support for deposits of Ocean Protocol via the Ethereum network starting October 20 at 03:00 UTC.

“After this time, any OCEAN deposits sent via ERC20 will not be credited to users’ accounts and may lead to asset loss,” Binance articulated.

BeInCrypto first reported on October 9 that the Ocean Protocol Foundation’s exit raised serious questions about the long-term alignment and trust among ASI’s founding members.

Diverging Visions and Community Backlash

While Ocean did not cite specific reasons for its withdrawal, community discussions point to internal rifts and diverging visions over the future of AI tokenization and data ownership.

Ocean officially joined the ASI Alliance in March 2024, with around 81% of its total OCEAN supply swapped for FET by July. However, roughly 270 million OCEAN tokens, held by more than 37,000 wallets, remained unconverted.

This suggested significant resistance from community members who preferred to retain the original token and governance model.

This resistance may have influenced Ocean’s decision to withdraw, as the foundation refocuses on its decentralized data infrastructure mission, rather than merging into the broader AGI-driven economy championed by Fetch.ai and SingularityNET.

Critics within the ASI community have accused Ocean of exploiting the alliance for visibility while contributing little to the unified ecosystem. Others described the move as a “Trojan horse” act that disrupted months of cooperative development.

In my opinion, the Ocean protocol is like a Trojan horse agent that has infiltrated the ASI_Alliance. We will not forget the damage you have caused to this major project. History shows that traitors meet their end! pic.twitter.com/HHZlwbY2xI

— Black__1 (@Black146901146) October 9, 2025

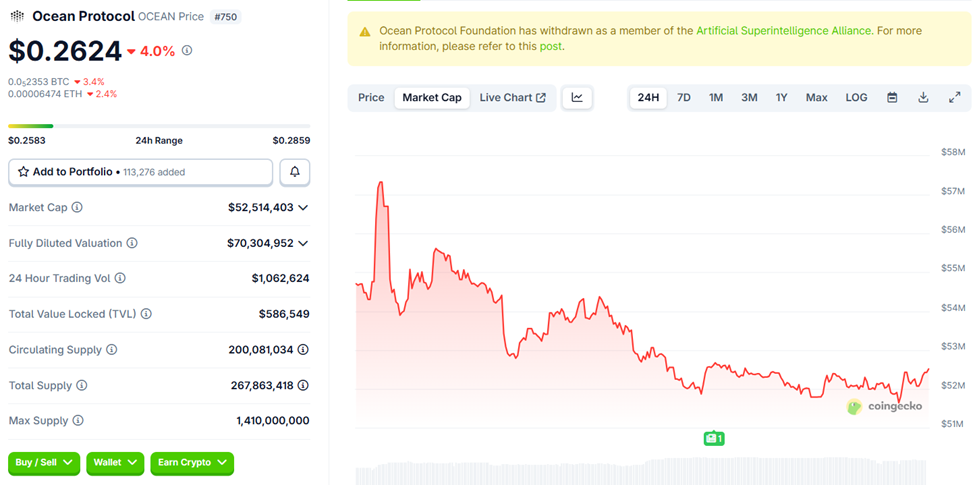

Since the split, OCEAN’s price has plunged from a March 2024 peak above $1.00 to roughly $0.2625, while the foundation announced plans to buy back and burn OCEAN tokens using project profits. This measure is aimed at supporting long-term value.

Ocean Protocol (OCEAN) Price Performance. Source:

CoinGecko

Ocean Protocol (OCEAN) Price Performance. Source:

CoinGecko

The network also called upon exchanges to consider relisting OCEAN afresh.

“Any exchange that has de-listed $OCEAN may assess whether they would like to re-list the $OCEAN token. Acquirors can currently exchange for $OCEAN on Coinbase, Kraken, UpBit, Binance US, Uniswap and SushiSwap,” the protocol stated.

Meanwhile, Sheikh’s planned class action could mark a new chapter in legal and reputational uncertainty for the decentralized AI sector. It also discusses how alliances and token mergers should be governed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?

Bitcoin rejects at key $93.5K as Fed rate-cut bets meet 'strong' bear case

Bitcoin price action, investor sentiment point to bullish December

Ether outpaces Bitcoin’s trend change: Is ETH on track for a 20% rally?