EIGEN Large Unlocking Event Approaching: Monthly 10% Market Cap Dilution, Smart Money Exiting Early

There will be more unlocks on November 1st, and the details will be revealed then.

Original Author: Cryptor, On-chain Analyst

Original Translator: DeepTech TechFlow

On October 10, the entire crypto market experienced a sharp decline due to tariff news, with $EIGEN plunging by as much as 53% within the day, dropping from $1.82 to $0.86. At first glance, this seemed to be another victim of a market flash crash, but the reality is far more complex.

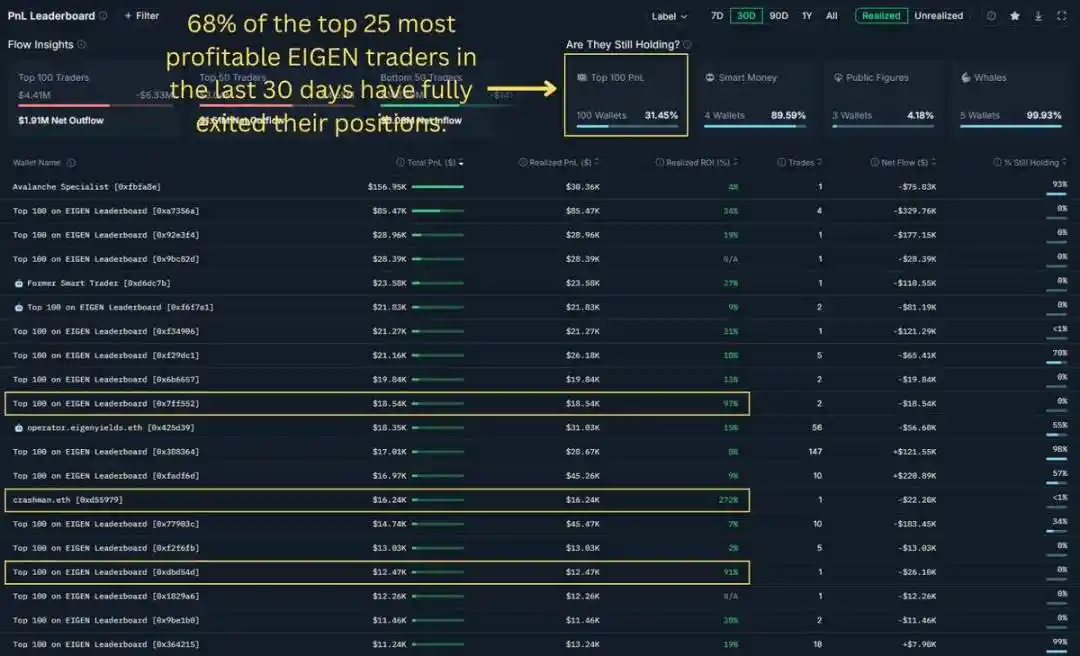

Over the past 30 days, 68% of the top-earning $EIGEN traders have exited the market. They did not panic sell due to the tariff crash on October 10, but rather they pre-positioned themselves to mitigate the upcoming 24-month supply shock — the first unlock of which occurred on October 1.

I specifically looked into on-chain data because my timeline was filled with overly optimistic headlines that did not align with the price action.

In fact, EigenCloud's development momentum is strong: it has partnered with Google, the Total Value Locked (TVL) has increased from $12 billion in August to $17.5 billion, Coinbase AgentKit integration has gone live, and EigenDA V2 and cross-chain expansions are actively in progress.

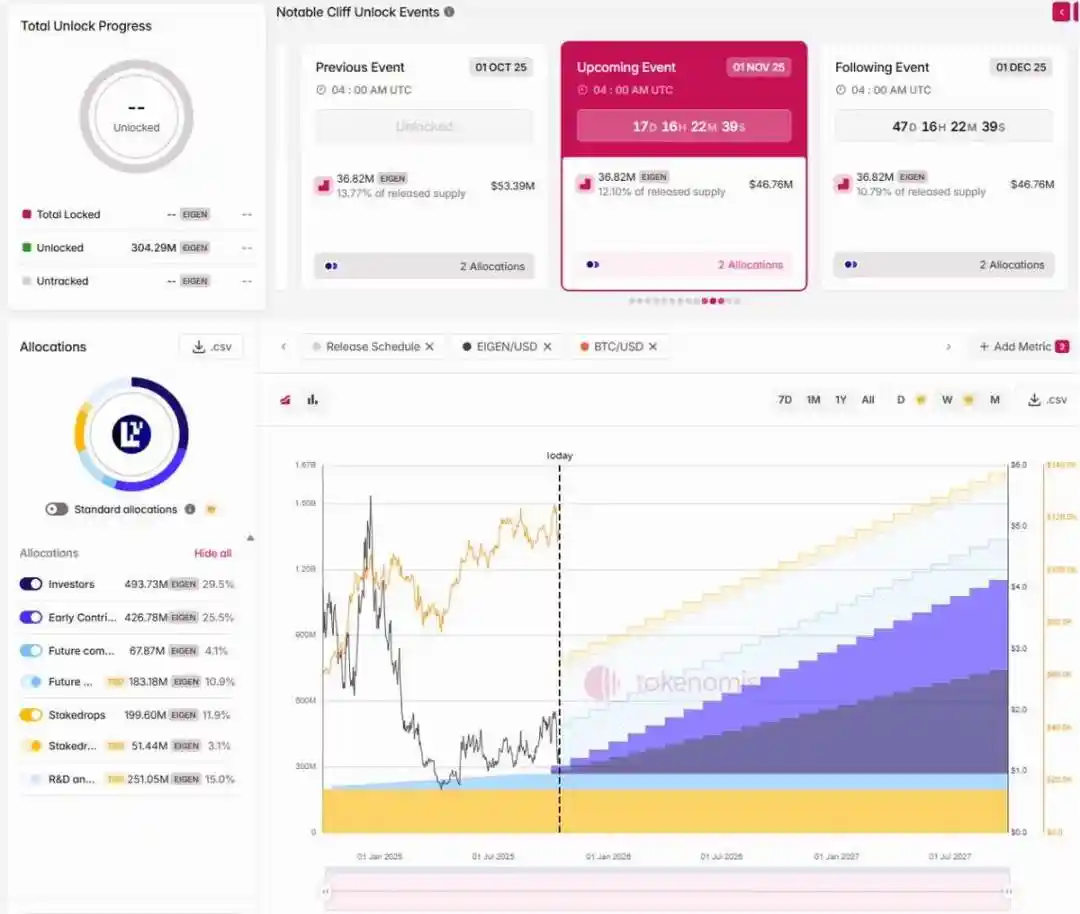

However, the issue lies in the fact that starting from November 1, approximately $47 million worth of $EIGEN tokens will unlock monthly over the next two years, flooding into the market. In other words, this is equivalent to 13% of the current market cap entering circulation every 30 days.

The top-earning traders have long foreseen this and exited the market early. Looking back at the past 30 days, it can be seen that smart money bought some dip chips after the flash crash, but it was mainly driven by a single whale investor, who, according to @nansen_ai data, is currently silent. Meanwhile, about $12.2 million flowed into exchanges last week.

The market crash on October 10 was just noise and distraction. The real signal lies in timing: who exited before October 1, who bought during the flash crash, and who is silent now.

Exit Pattern: September 2025 to October 2025

Most notably, in the past 30 days, among the top 25 highest-earning $EIGEN traders, 68% have completely liquidated their positions. They did not take partial profits but rather fully exited.

The top-performing trader "crashman.eth" achieved a 272% return on investment (ROI) and is now no longer holding any tokens. The second-place trader exited after a 97% return, and the third-place trader left after a 91% return. This pattern continued throughout the leaderboard.

Of the top 25 traders, only 8 still hold $EIGEN, with an average "holding ratio" of only 30%. Even these remaining holders have reduced their peak positions by 70%.

This data is more meaningful than the investment ROI. High returns with low holding ratios indicate that early confidence has gradually turned cautious. These exits began in mid-September, weeks before the market crash on October 10th, when the price was still above $2.

These traders clearly saw the unlock schedule and exited early.

Token Flow

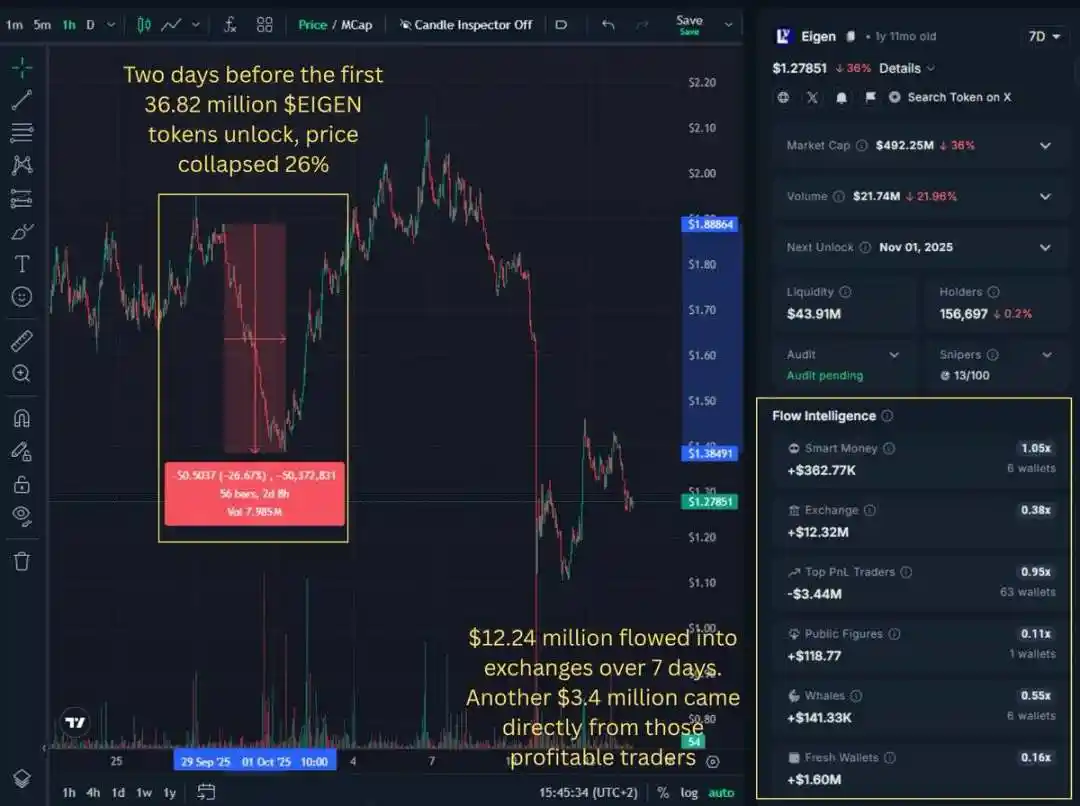

The timeline aligns with the initial unlock event on October 1st when $EIGEN became tradable after months of restriction. Two days before the first batch of 36.82 million $EIGEN was unlocked, the price had already plummeted by 26%.

Top traders took action before this event, selling tokens to exchanges. While it may seem like the market was accumulating chips, it was actually systematic distribution. At least from on-chain data, I think this is a reasonable interpretation.

Data on fund flows over the past 7 days shows that approximately $12.32 million worth of $EIGEN has flowed into exchanges, including $3.44 million from these top-profit traders.

Contradiction: A Smart Money Whale Buys the Dip

Smart money holdings increased by 68% last month, from 1.4 million to 2.36 million tokens. However, the turning point is that over half of the increment came from a single wallet currently holding 1.23 million $EIGEN.

This whale kept buying in September, sold near the low point unlocked on October 1st, then bought back at higher prices and added positions again after the market crash on October 10th.

While the staggered buying pattern is somewhat peculiar, the more critical point is that this is not a broad smart money consensus. The total holdings of other smart money are distributed among several wallets, totaling about 1.2 million $EIGEN, which is not convincing to me. Smart money holds only 0.13% of the total supply.

Furthermore, in the past 24 hours, Smart Money has been inactive with no significant fund inflows. Even the whale has remained silent.

Meanwhile, as more Top PnL wallets have taken profits and transferred tokens to exchanges, the price of $EIGEN continues to decline. This trend can be seen in the column on the right of the screenshot above.

There are two interpretations for this silence:

· Bullish View: Confidence. Choose to hold, ride out the volatility, and wait for the fundamentals to catch up.

· Bearish View: Uncertainty. Even at a lower price, there isn't enough confidence to continue adding to positions.

November 1st will reveal the outcome.

The $47 Million Monthly Conundrum

Because come November 1st, the next challenge is around the corner: more unlocks.

The unlock schedule is public information; this is no secret. But it seems few have truly paid attention to its actual implications or placed it in a meaningful context for understanding.

The October 1, 2024 unlock lifted transfer restrictions and initiated a one-year lock-up cliff.

On October 1, 2025, the initial batch of 36.82 million $EIGEN unlocked. Starting from November 1, 2025, 36.82 million tokens will unlock every month for about 23 months until September 2027.

At the current price, approximately $47 million worth of tokens will enter the circulating supply every 30 days. Based on the current market cap (at the time of writing, $490 million), these monthly unlocked tokens equate to about a 10% dilution rate. That's significant pressure.

Currently, only 23% of the tokens are in circulation, giving a Fully Diluted Valuation (FDV) to Market Cap ratio of 4.5x, indicating that 77% of the tokens are still locked up.

The top ten holding addresses control 50% of the token supply, most of which are held in protocol wallets, exchange reserves, and VC allocations, all subject to the same unlock schedule.

This means that there will be continued selling pressure over the next two years, rather than a one-time event.

Those who exited in September did so not due to a particular price trend, but to preempt a known supply shock date.

Protocol and Token: Why Both Can Stand Alone

Ironically, as a protocol, EigenCloud has actually performed well.

The Total Value Locked (TVL) reached $17.5 billion (up from around $12 billion in August). Collaborated with Google Cloud for AI payment validation. Coinbase AgentKit integration added support for verifiable blockchain agents. Slashing mechanism went live in April. EigenDA V2 was launched in July. Cross-chain extensions are also actively in progress.

Development is real, adoption is growing, and the logic of the infrastructure is coming to fruition.

But strong fundamentals cannot erase poor tokenomics. These are two separate issues. While the token is part of a project, it doesn't mean they will progress in sync.

$EIGEN's growth narrative is now colliding head-on with a heavy, multi-year unlocking schedule that has yet to fully start. This is why I always separate product analysis from token analysis, as they rarely sync up, especially during the vesting period.

Token success requires that the protocol can generate enough real demand to absorb $47 million in new supply each month.

Even for a project like EigenCloud with genuine appeal and scale, this is a high bar.

November 1: A True Stress Test

I'm not sure who will come out on top in this showdown: protocol growth or supply pressure.

But what I do know is that the data is telling us some facts. Once again, my timeline is littered with (scarce) bullish news about $EIGEN. Does this situation sound familiar to us? Those following me should know which cases I'm referring to.

For $EIGEN, profit-taking traders exited in the weeks leading up to the initial unlock, with the most successful ones leaving when the price was still above $2. A savvy whale of funds bought heavily during the dip but then fell completely silent. Exchange inflows continued to rise in the lead-up to the next unlock window.

The October 10th market crash driven by tariffs captured everyone's attention, but the real story revolves around the wallet distribution of the 24-month unlock schedule, which will officially accelerate on November 1st.

Insights from pattern recognition:

When the "Still Holding %" of top performers drops below 30%, when exchange inflows surge relative to market cap, and when a major cyclical unlock is approaching, this is usually not your entry signal.

November 1st marks the next monthly test of this supply cycle. We will see whether whale confidence pays off or early sellers were right in their judgment.

Watch these metrics:

· Position changes of smart money and whether more wallets are increasing their holdings.

· Whether other groups (such as top 100 holders, top profit accounts, whales, and funds) are accumulating.

· Exchange flow velocity (will the weekly $12 million inflow rate accelerate?).

· Number of active wallets (are there new participants entering, or is it just existing holders rotating?).

This framework applies to any token with an unlock schedule. The methodology here is more critical than a single trade.

On-chain data provides you with the same information that institutions and funds have. The difference is whether you know where to look before the market does.

If you do? Then you've already outdone 99% of crypto Twitter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Stalls at $119K, Market Speculates on Next Rally

Brevis Launches Multi-GPU zkVM for Ethereum Proving

Bitcoin Enters Speculative Phase Amid Institutional Inflows

Base co-founder discusses token issuance again—what does the launch of the livestreaming feature on Zora signify at this moment?

The article points out that as expectations rise for the launch of the native token on Coinbase's L2 network Base (expected in Q4 2025), Zora, as a leading application within its ecosystem, has become the focus of market attention. Investors see Zora as a key pathway to gaining potential Base token airdrops, and its recent strong performance and strategic developments have further reinforced these expectations.