First US Crypto Bank Gets the Green Light — Backed by Thiel, Luckey, and Lonsdale

Erebor became the first US bank to receive conditional approval for digital-asset operations, marking a milestone in federally regulated crypto banking.

The US Office of the Comptroller of the Currency has granted preliminary, conditional approval for Erebor Bank’s national charter, opening the door for a tech- and crypto-focused lender backed by Palmer Luckey, Joe Lonsdale, and Peter Thiel.

The decision came just four months after Erebor’s application and followed Washington’s rollout of the GENIUS Act, which set new standards for stablecoin issuance. The bank plans digital-only operations from Columbus and New York, supported by $275 million in capital and a conservative risk framework.

OCC Greenlights Erebor’s $275M Charter

The Office of the Comptroller of the Currency (OCC), the federal agency overseeing national banks, granted Erebor preliminary and conditional authority to form a federally chartered bank on Wednesday. It is the first such approval under Comptroller Jonathan Gould since his July appointment, underscoring a shift toward a more innovation-friendly regulatory posture.

This status lets founders raise deposits, hire staff, and build infrastructure while regulators vet their systems. Erebor must complete cybersecurity, capital, and anti-money-laundering audits before opening.

“The OCC remains committed to a diverse banking system that supports responsible innovation,” Gould said in a statement. “Today’s decision is an early step, not the finish line.”

The OCC granted preliminary conditional approval to Erebor Bank after thorough review of its application. In granting this charter, the OCC applied the same rigorous review and standards applied to all charter applications.

— OCC (@USOCC) October 15, 2025

Once fully licensed, Erebor’s charter will permit lending, custody, and payments using digital-asset rails. Headquartered in Ohio with a secondary office in New York, Erebor will operate primarily through mobile and web platforms. Backers include Founders Fund, 8VC, and Haun Ventures—all active in crypto and fintech.

Before launching, Erebor must also obtain Federal Deposit Insurance Corporation (FDIC) approval, which typically takes nine to ten months. Analysts note that dual OCC-FDIC oversight could set a new compliance bar for digital-asset banking.

Silicon Valley Money and Trump-Era Links

Erebor’s founding network is deeply intertwined with influential Silicon Valley and political figures. Co-founder Palmer Luckey, also the founder of defense-tech company Anduril, and Joe Lonsdale, co-founder of Palantir and head of 8VC, have been notable supporters of President Donald Trump and Vice President J.D. Vance. Both donated heavily to Republican campaigns during the 2024 election cycle.

Another early backer, Peter Thiel, remains one of the most prominent conservative venture investors and an ally of the Trump family. Erebor’s formation aligns with the current administration’s efforts to loosen regulatory barriers for banks engaging in digital-asset activities.

The company’s leadership, including CEO Owen Rapaport and President Mike Hagedorn, maintains operational independence from its politically connected investors. However, the presence of high-profile financiers such as Founders Fund, 8VC, and Haun Ventures has raised questions about the speed of regulatory approval. Critics argue the bank benefited from favorable access to federal agencies, while supporters claim the rapid process reflects Erebor’s strong compliance design and deep capital reserves.

$312B Stablecoin Market Poised for Change

The charter could reshape US crypto banking by linking insured-bank infrastructure with blockchain finance. Under the GENIUS Act, banks issuing stablecoins must maintain 100 percent reserves and publish monthly disclosures. The framework could accelerate institutional adoption and payments testing.

If Erebor secures final licenses, it may compete with Anchorage Digital for stablecoin issuance and custody services. Its plans to lend against crypto or AI hardware could expand liquidity for miners, market makers, and infrastructure firms.

Critics, however, warn of favoritism and potential risk concentration. Senator Elizabeth Warren called the approval a “risky venture.” Still, regulators portray the move as a measure toward integrating digital assets under strict supervision.

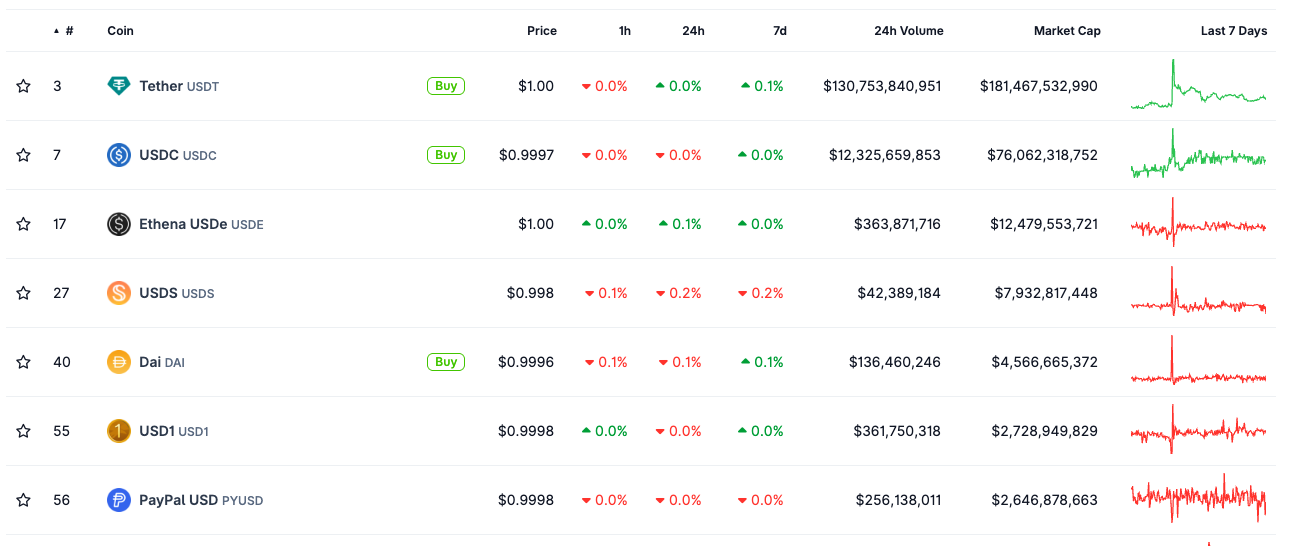

Top 7 Stablecoins by Market Capitalization / Source:

CoinGecko

Top 7 Stablecoins by Market Capitalization / Source:

CoinGecko

According to data from CoinMetrics, the stablecoin market has grown by nearly 18 percent in 2025, reaching a capitalization of roughly $312 billion. Analysts at Galaxy Research forecast that regulated banks could capture up to 25 percent of this market by late 2026 as compliance frameworks mature.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HYPE Trader Targets $50 After Fresh Entry Setup at $37 Range

Dogecoin Holds Above $0.1973 Support as Weekly Triangle Pattern Persists

Sui Consolidates Near $2.74 Amid Tight Support and Resistance Range