Institutional Exodus from Ethereum Funds

Ethereum’s market recovery appears to be stalling as institutional investors pull back significantly. The data shows something quite concerning – Ethereum-backed exchange-traded funds recorded massive outflows totaling $428.52 million on Monday alone. That’s the largest single-day capital exit from these funds since early August.

BlackRock’s iShares Ethereum Trust led this exodus with $310.13 million in redemptions, which is pretty substantial when you think about it. Grayscale’s Ethereum Trust and Fidelity’s Ethereum Fund followed with $20.99 million and $19.12 million respectively. The smaller players like Bitwise and VanEck saw more modest declines, but the overall picture is clear: institutional confidence has taken a hit.

This institutional pullback comes at a time when Ethereum is already struggling to maintain its footing. The coin is currently trading around $3,986, well below the critical $4,000 level that many traders were watching. I think this combination of institutional selling and technical weakness creates a challenging environment for any meaningful recovery in the short term.

Technical Indicators Paint Bearish Picture

Looking at the charts, Ethereum finds itself in a tricky position. The ETH/USD pair is trading below its Super Trend indicator, which currently sits at $4,561 as dynamic resistance. That’s quite a gap from where we are now.

The Super Trend indicator works by placing a line above or below the price based on volatility. When an asset trades above this line, it typically signals bullish momentum. But right now, Ethereum is clearly below it, suggesting the bears have control.

Traders usually interpret this positioning as a warning that downward pressure could continue. It’s not necessarily a guarantee of further declines, but it does make any recovery attempt more difficult. The market seems to be waiting for some catalyst to change this dynamic.

Potential Price Scenarios Ahead

If the current bearish sentiment persists, we might see Ethereum break below that crucial $4,000 level. The next significant support appears to be around $3,626. Should that level fail to hold, there’s potential for a deeper decline toward $3,215.

However, it’s important to remember that markets can turn quickly. A sudden surge in demand could invalidate this bearish outlook. In that scenario, Ethereum might climb back toward $4,211. The question is what would trigger such a reversal.

Perhaps we’re seeing a temporary pause rather than a definitive breakdown. The broader crypto market has shown some gradual improvement recently, though Ethereum seems to be lagging behind. Spot market participants have also been trimming their holdings, which adds to the selling pressure.

Market Sentiment and Recovery Prospects

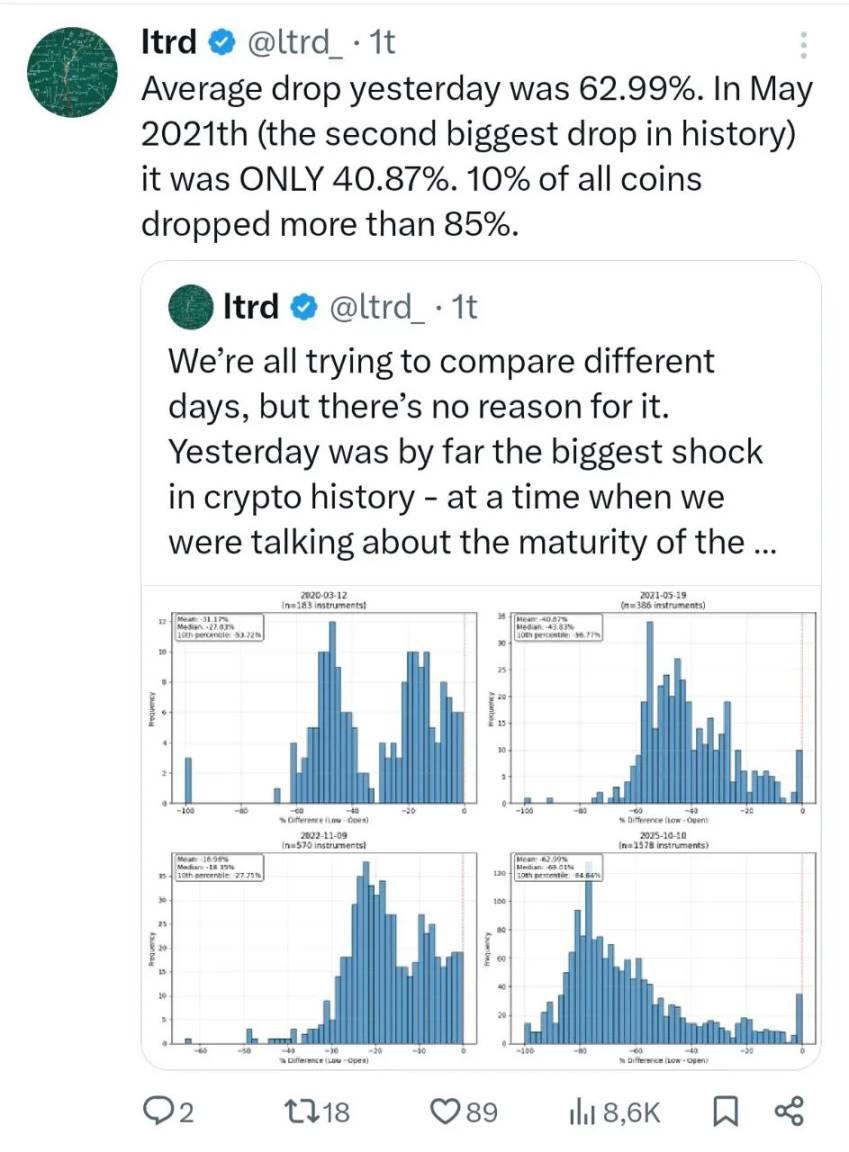

What strikes me about this situation is how quickly sentiment can shift. Last Friday’s market-wide liquidation event clearly spooked institutional investors, and we’re seeing the aftermath play out in these ETF flows. The record outflows suggest that professional money managers are taking a more cautious approach.

This institutional retreat could have longer-term implications for Ethereum’s price action. Without that institutional support, retail traders might find it harder to push prices higher. Then again, crypto markets have surprised us before with sudden reversals.

The key level to watch remains $4,000. If Ethereum can reclaim and hold above that level, it might signal that the worst is over. But for now, the technical indicators and institutional flows both point to continued challenges ahead. It’s one of those moments where patience might be the best strategy for traders.