Dash to $100 in October? 4 Key Drivers Behind the Privacy Coin’s Breakout Potential

Dash (DASH) is gaining traction as privacy coins rebound, with whales accumulating and a key technical breakout signaling potential for a surge toward $100.

As privacy concerns surge in October, Dash (DASH) emerges as a strong contender for a major breakout alongside Zcash (ZEC), the leading privacy coin.

Many analysts believe DASH could soon return to the $100 mark, or even go higher. What supports this prediction? The following analysis explores four main drivers behind this potential move.

1. Rising Interest in Privacy Coins

According to a recent report from Milkroad, only two sectors remained profitable over the past month: exchange tokens and privacy coins. The report highlights Zcash, Dash, and Monero as key representatives of the privacy coin resurgence.

Only 2 crypto sectors made money this month.Privacy Coins and Exchange Tokens, everything else bled out.That tells you a lot about where capital hides when markets turn risk off.If you’re building a portfolio for the next leg, don’t just chase hype sectors. pic.twitter.com/UZ60jXane1

— Milk Road (@MilkRoadDaily) October 14, 2025

The growing public interest in privacy has become the first major catalyst behind Dash’s rebound. Analysts note that privacy coins have been the best-performing group in the market, posting an average gain of more than 60%.

Search interest and media coverage for privacy-focused cryptocurrencies have also reached their highest levels since 2017, suggesting that the “privacy culture” within blockchain is awakening once again.

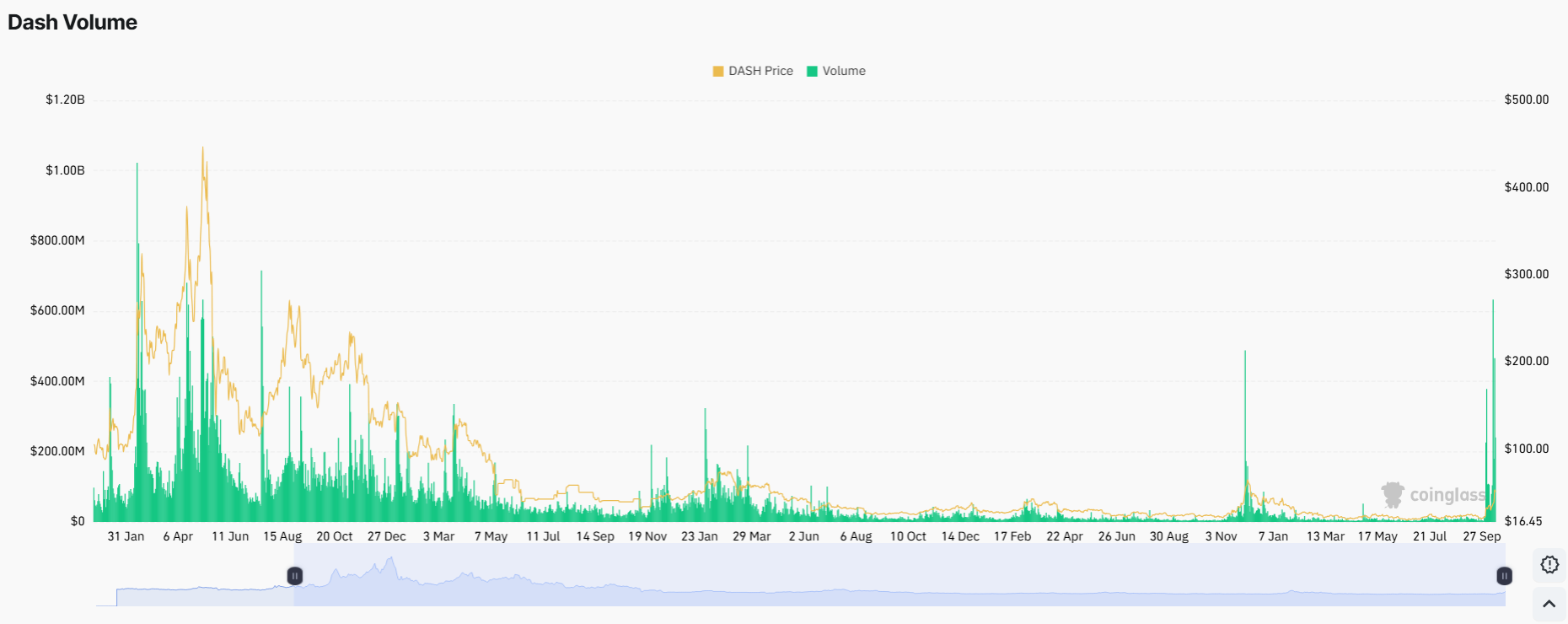

2. Explosive Trading Volume

Dash’s daily trading volume in October reached a record high of over $600 million. Data from CoinGecko shows that the current daily volume remains in the $200–$300 million range, 10 times higher than at the beginning of the month.

Dash Volume. Source:

Coinglass

Dash Volume. Source:

Coinglass

The last time DASH saw such strong volume was in early 2021, when the surge in activity fueled a rally to $400.

This renewed trading activity signals growing investor confidence in the altcoin and could provide the foundation for another bullish move, potentially mirroring the rally seen in 2021.

3. Whale Accumulation

Another bullish sign comes from the accumulation pattern among top DASH wallets.

Data from BitInfoCharts shows that the top 100 addresses have increased their DASH holdings from 25% of the total supply in early 2025 to more than 36%, marking a 10-year high.

TOP 100 DASH Richest Addresses. Source:

BitInfoCharts

TOP 100 DASH Richest Addresses. Source:

BitInfoCharts

The concentration of supply among large holders has not decreased, even after DASH rose over 100% in October. This stability indicates that whales are not taking profits yet, suggesting continued confidence and readiness for another leg up.

4. Technical Breakout

From a technical perspective, DASH has confirmed a breakout from a multi-year descending wedge pattern during October’s volatile price action.

This breakout is a classic bullish signal that often precedes major upward momentum. Analysts believe it could propel DASH to $100 or beyond in the coming weeks.

$DASH is trying to escape this (almost) 3000 days long falling wedge. If #DASH closes this week above (approx) $40 and then next week as well, this thing could shoot for a breakout target of $1K (ish) After that we can reach all the way up to the extensions from 2017 highs at… pic.twitter.com/GhoFGBOxTG

— Vuori Trading (@VuoriTrading) October 12, 2025

“Dash may soon reach $100, and if things heat up, it could jump past $200,” Joao Wedson, Founder & CEO ofAlphractal, predicted.

Despite these positive signs, these catalysts are short-term in nature. If market interest cools, trading volume declines, or whales begin distributing their holdings, DASH’s ability to sustain its growth will depend on how widely it achieves real-world adoption.

Ultimately, lasting growth for DASH will require more than market excitement—it will depend on whether the coin can demonstrate genuine utility and continued demand in the broader crypto ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: With the Fed Loosening Policy, Optimists Eye $150K Bitcoin as Critics Highlight Vulnerabilities

- Fed's October rate cut to 3.75%-4.00% triggered $550M crypto liquidations, with Bitcoin near $111,000 amid range-bound trading. - Institutional bulls like Saylor predict $150K BTC by 2025, citing regulatory progress and tokenized securities adoption. - France proposes 2% BTC strategic reserve while California fines Coinhub $675K, highlighting regulatory scrutiny of crypto infrastructure. - Trump ally Lummis suggests Fed sell gold to buy 1M BTC, contrasting with critics like Schiff who question Bitcoin's

Bitcoin News Today: Bitcoin Faces Quantum Countdown: Immediate Measures Needed or Face Potential Extinction?

- HRF reports 6.51M BTC ($188B) at risk from quantum attacks, including dormant Satoshi-era coins. - Experts warn quantum computers could break Bitcoin’s encryption within 5–10 years, urging urgent solutions. - Quantum algorithms like Shor’s threaten Bitcoin’s security, but current post-quantum solutions exclude major blockchains. - U.S. and firms like IBM/Google advance quantum tech, intensifying urgency for Bitcoin-specific upgrades. - Bitcoin community debates action plans, with no consensus on mitigati

Crypto hacking losses fall by 85.7% as improvements in security surpass ongoing trust issues

- PeckShield reported 85.7% drop in October 2025 crypto hacking losses to $18.18M, attributed to improved security measures and threat response. - Smaller-scale attacks dominated, contrasting prior large DeFi breaches, while MEXC faced backlash for freezing $3M from crypto whale "The White Whale." - Crypto VC funding surged to $5.11B in October, with AI, prediction markets, and RWAs attracting most capital led by Coinbase Ventures and Binance Alpha. - Orama Labs surpassed $3.6M TVL after security audits, s

Tether’s $10 Billion Growth: Digital Bank’s Holdings Surpass Conventional Competitors

- Tether reported $10B net profit in Q1-Q3 2025, driven by $181.2B in reserves including $135B in U.S. Treasuries and $12.9B in gold. - XAUT gold-backed token reached $2.1B market cap as gold prices surged to $4,379/ounce amid global uncertainties. - USDT now serves 500M users globally, dominating emerging markets with its $1 peg and 34% market cap growth since January. - Tether plans USAT token launch and investment fund license in El Salvador while facing intensified regulatory scrutiny worldwide.